Opioid misuse is a public health crisis that has resulted in debilitation, deaths, and significant social and economic impact. The epidemic has been fueled by widespread abuse of prescription opioids and a dramatic increase in the availability of illicit opioids such as heroin. In this article, we examine some steps to overcoming this issue and improving the way we treat pain.

This article was authored by Rishabh Chawla from V-Bio Ventures.

The magnitude of the opioid epidemic is startling: in the US, about 4% of the population misuses licit or illicit opioids. In 2018, a full 70% of the 67,000 fatal drug overdoses in the US involved a prescription or illicit opioid. And this is far from just a US problem: according to the World Health Organization, in 2016 an estimated 27 million people around the globe suffered from opioid use disorders.

The origin of the opioid crisis can be traced back to 1995, prior to which many physicians felt concerns regarding the undermanagement of pain symptoms. To properly evaluate and manage pain, the American Pain Society elevated pain from merely a symptom to the fifth vital sign of the human body (in addition to body temperature, pulse, respiratory rate and blood pressure). This decision resulted in clinicians conducting routine pain assessments and prompted increased prescriptions for pain medication.

Studies have found that as many as 80% percent of people who use heroin first misused prescription opioids.

Around the same time, a sustained release formulation of Oxycodone was approved: OxyContinR, developed by Purdue Pharma. The addictive nature of the drug, combined with aggressive marketing by Purdue Pharma, caused the annual sales of OxyContin to soar from $48 million in 1996 (the first year after approval) to $1.1 billion by 2000, and a peak at $3.1 billion in 2010. Sales have since dropped and, with the company plagued by lawsuits related to the opioid crisis, Purdue Pharma filed for bankruptcy in 2019. It was by no means the only company profiting from prescription opioids, however, with others continuing to this day.

The high prescription rates of legal painkillers are important, as studies have found that as many as 80% percent of people who use heroin first misused prescription opioids. Many international drug cartels have taken advantage of the fraught situation by distributing illicit opioids across the world, adding further fuel to the fire.

Alternatives to opioids

Considering the widespread prescription of opioids, it may be surprising to hear that the medication is not actually very efficacious. The Number Need to Treat (NNT) is a metric that indicates the average number of patients who need to be treated to prevent one bad outcome (in this case, to prevent pain in just one individual). The NNT for current pain drugs ranges from approximately 3.5 (for opioids) to 15, reflecting the poor efficacy of most pain killers and, particularly, of non-opioid pain drugs. Millions of patients worldwide are suffering from either acute or chronic pain. To truly fight this epidemic, it’s therefore not enough to just improve our control over prescriptions; we also need to develop safe and effective alternatives to opioids.

Millions of patients worldwide are suffering from either acute or chronic pain. To truly fight this epidemic, it’s therefore not enough to just improve our control over prescriptions; we also need to develop safe and effective alternatives to opioids.

This is no simple task. Pain, like cancer, is not a unitary phenomenon and cannot be treated with a single universally effective drug class. To move forward, we need to recognize the complexity of pain. There are several distinct types of pain driven by different mechanisms, such as physical tissue damage, somatosensory nerve damage, or inflammation, and each of these require appropriate therapeutic interventions.

While pain remains a complex challenge, many novel therapeutic targets have been identified in the last two decades. Methods like genomics, proteomics, epigenetics, lipidomics and single-cell RNA sequencing have been used to identify biochemical pathways involved in pain signal generation, transmission and perception.

Using these strategies, several targets have been identified, including: Angiotensin Type 2 Receptor (AT2R); Neurotensin Receptor1(NTSR1); Matrix metalloproteinases 9/2 (MMPs 9/2); fms like tyrosine kinase 3 (FLT-3); Metabotropic Glutamate Receptor 7 (mGluR7); and ion channels such as Nav1.7 and transient receptor potential (TRP) channels. Unfortunately, many drugs directed against these recently identified targets have failed in clinical trials, often due to inadequate preclinical models, inadequate biomarkers, or toxicity.

Better models for pain

Innovation in preclinical models and biomarkers will be essential to improving the success rate of pain drug development. There has been little progress in preclinical mouse pain models in the past decades, with most still based on reflex responses as they are relatively easy to measure. These assays offer poor translation to clinical success and don’t represent pain within the complete physiological context. Better models and alternatives to spontaneous pain responses are being explored in different labs worldwide, to better address the range of pain phenotypes in need of treatment.

Another critical factor in evaluating novel pain drugs is the need for more objective pain assessments during clinical trials. Pain is subjective and depends on individual differences in a person’s physiological, emotional and cognitive state. Currently, most clinical trials for pain use a subjective 10-point scale that does not provide an objective readout, which is potentially contributing to trial failures.

In light of the progress so far, we at V-Bio remain hopeful that new and improved pain drugs will successfully advance through clinical development in the near future.

One possible solution is the use of imaging biomarkers, such as functional and pharmacological MRI, in pain assessment. This could be of great value in studying drug-effects and dosing based on pharmacokinetic/pharmacodynamic data. It could facilitate more reliable and objective pain readouts than the 10-point pain scale and thereby enhance the quality and accuracy of information obtained in clinical trials.

Digital biomarkers also hold promise for migraine prevention, acute migraine treatment, osteoarthritis pain and chronic back pain. This was exemplified by a recent study in chronic lower-back pain, where step counting was used to measure movement after treatment. Movement increased by five-fold in the treated patient group compared to the control group, despite the patients being unaware of the improvements. This implies that digital biomarkers could be another important objective tool in assessing the effectiveness of new pain treatments.

Combating the crisis

A rise in awareness of the global opioid crisis has led to an increase in pain treatment innovation. These efforts have been supported by increased governmental funding, particularly in the past decade. In light of the progress so far, we at V-Bio remain hopeful that new and improved pain drugs will successfully advance through clinical development in the near future. Such safe and efficacious alternatives to opioids would provide a welcome relief to the millions of people in pain world-wide.

In a recent article, we discussed how the most prescribed drugs are usually indicated for common noncommunicable diseases. These include chronic conditions like diabetes, heart disease, GERD and mental health issues. Regarding treatment innovation, these prevalent diseases are often underserved when compared to less common, but more profitable, orphan diseases. In this article, we look at some of the underlying factors causing these noncommunicable diseases and what could be done to prevent them.

This article was authored by Ward Capoen from V-Bio Ventures.

According to the World Health Organization (WHO), the top 10 causes of death in high income countries are almost exclusively noncommunicable diseases. Many of them are cardiovascular and metabolic diseases, with cardiovascular diseases along being responsible for 31% of deaths worldwide.

These diseases are not just a burden in their own right: they also predispose people to all sorts of other maladies, including autoimmune diseases, cancer and infections. This vulnerability for infectious diseases has become particularly obvious in the current pandemic, where it has been shown that obesity, hypertension and diabetes are major risk factors for bad patient outcomes. The link between cardiovascular/metabolic diseases and infections is of course not unique to COVID-19. A deranged metabolism is not an asset when battling any disease, be it cancer or the flu.

Changed diets have altered our metabolisms

Whereas there certainly are genetic predispositions that contribute to the development of cardiovascular and metabolic diseases, the main risk factors are lifestyle related. Unhealthy diets, physical inactivity, tobacco and alcohol use are what have led to such a large proportion of the world’s population being diseased. This was not the case less than a century ago.

There are several key metabolic changes that increase the risk of noncommunicable diseases: raised blood pressure, obesity, high blood sugar and/or insulin, elevated blood lipids and low-grade inflammation. Which pathways cause all these symptoms is not entirely understood, but there are hints to be found.

The evidence all points to the Western diet, rapidly spreading around the world with increased globalization and general affluence, as a major contributor to our deadliest diseases.

Plenty of research has shown that a diet high in processed foods, sugar and bad fats directly contributes to the development of cardiovascular and metabolic diseases. Specifically, excessive consumption of carbohydrates, like white flour and refined sugars, may play a major role in the onset of metabolic disorders. Supporting this, diets based on carbohydrate restriction (like ketogenic or paleo diets) and whole-foods, plant-based diets (with less processed foods and animal products) have both been reported to improve overall health. The evidence all points to the Western diet, rapidly spreading around the world with increased globalization and general affluence, as a major contributor to our deadliest diseases.

You are what you eat: unhealthy

What is most striking when considering the high incidence of cardiovascular and metabolic diseases, is that they are such a recent development. Sure, the average life expectancy was lower in the past, but this was largely caused by high infant mortality and death from trauma or infectious diseases. Historically, if you avoided these mortality causes, you were likely to live to a ripe old age free of many of the noncommunicable diseases we suffer from today.

Many of today’s most common diseases are relatively new to the scene, including diabetes, autoimmune diseases and even cancer. Currently, individual auto-immune disorders have a prevalence of about 1-3% of the population, cancer will affect about 30% of people and more than 60% of us will suffer from some form of metabolic disease. Even accounting for longer life expectancies, this is not how it should be, nor how it was in the past.

While there will always be a need for medicines to treat cardiovascular and metabolic diseases, they should only be needed in a minority of people. The high incidence of these diseases is not a given that we simply need to accept: lifestyle changes can make a difference.

In his seminal 1939 book ‘Nutrition and Physical Degeneration’, Weston Price reported on 10 years of research into the diet and health of different populations. He found that people living on their traditional diet were often strong, healthy and athletic. Primarily a dental researcher, his work showed that caries and dental arch deformities occurred in less than 1% of people relying on indigenous foods, whereas villagers that ate a western diet had crippling dental decay due in part to the prolific use of sugar and flour. He also noted a link with mental health issues, even describing crippling arthritis in children with bad teeth.

Since then, the increased prevalence of toothpaste has removed some of the damage done by sugar that Price observed. However, the link between dental and microbial health and noncommunicable diseases like arthritis, Alzheimer’s and autoimmune diseases is under renewed investigation.

The rise in preventable diseases

Reading through ‘The Diet Delusion’ by Gary Taubes, it is clear that Price was not alone in linking diet and diseases. William Osler, the godfather of modern medicine in the US, only found 17 diabetics in 35,000 patients treated at Johns Hopkins in 1892. In 2020, that number would be 3,500. Elliott Joslin, the original diabetologist, collated almost 100 years’ worth of inpatient data at Massachusetts General Hospital in Boston. He found 175 diabetics in 50,000 patients (18 were under 20, so likely type 1 diabetic). Nowadays you can expect 500 type 1 and up to 5,000 type 2 diabetics in such a dataset.

Colonial physicians told similar stories. Albert Schweitzer spent years in Africa and treated many thousands of patients in a remote area. It took him 41 years to encounter his first appendicitis patient and he apparently had a hard time remembering seeing anyone with cancer. In 1902, Samuel Hutton, who treated thousands of Inuit and settlers in Labrador, found no evidence of cancer, asthma, appendicitis or other diseases common today. Scurvy and cancer were only seen in people living on a settler’s diet, heavy in flour, canned goods and sugar. The entirely carnivorous Inuit had no such issues.

While there will always be a need for medicines to treat cardiovascular and metabolic diseases, they should only be needed in a minority of people. The high incidence of these diseases is not a given that we simply need to accept: lifestyle changes can make a difference. If we reduce the number of patients that need to be treated for preventable issues, perhaps we could then focus our resources on creating appropriately priced therapies for the patients who need it the most. And have a healthy and happy population to boot.

Recent activities in the cell therapy field have prompted many investment funds to pour fresh and increasing capital into this space. In this review, we share some observations and highlight a few of the questions that arise when new modalities cross the bridge from bench to bed.

This article was authored by Christina Takke from V-Bio Ventures.

New genetic and cellular modalities hold the promise of not only ameliorating but potentially even curing some, until now, untreatable diseases. In December 2019, Coherent Market Insights published a staggering global market estimate for cell therapy, which they valued at over USD 7 billion in 2018. They predicted an annual growth rate of 21.1% over the next few years, in which case the market will surpass USD 40 billion by 2027.

However, one needs to keep in mind that cell therapies have been around for many years. Bone marrow transplants were pioneered by a team at Fred Hutchinson Cancer Research Centre, led by the Nobel Prize winner E. Donnall Thomas, between the 1950s to 1970s. Today, bone marrow transplants are commonly used to treat patients with certain forms a blood cancer, as well as congenital blood disorders. These therapies can consist of autologous cells (the patient’s own cells) or allogenic cells (cells coming from a donor).

Over the past several decades, scientists have worked hard to increase the efficacy of these therapies in eliminating the patient’s cancer cells. They have also worked hard on the logistical challenges associated with a treatment that has yet to be made into an “off the shelf” therapy.

CAR T cell therapy

CAR T cell therapy is a type of treatment in which a patient’s T cells are changed in the laboratory so they will attack cancer cells. In practice: T cells are taken from a patient’s blood, then the gene for a specific receptor (called a chimeric antigen receptor (CAR)) is added in the laboratory, so that the T cells will bind to a surface protein on the patient’s cancer cells. The T cells are then multiplied and given back to the patient.

“At V-Bio Ventures, we feel that a company developing new therapeutic modalities needs to own or control the entire manufacturing process, enabling it to be master of its own destiny.”

Two engineered CAR T cell therapy products are on the market today: Yescarta, a treatment for large B-cell lymphoma (BCL) from Gilead/Kite Pharma; and Kymriah, for B-cell acute lymphoblastic leukaemia (ALL), from Novartis.

The approval of these two treatments has unlocked a real wave of new investments into early stage cell therapy companies. It has also prompted more pharma/biotech acquisitions, including Astellas which acquired both Xyphos biosciences and Universal Cells at a pre-clinical IND stage. Two further M&A deals that are yet to be put into effect include: Kite Pharma (a subsidiary of Gilead), which has a research partnership with, and an option to acquire, Gadeta; and Takeda Oncology, which has a research partnership with, and option to acquire, GammaDelta Therapeutics.

Additional product launches in the coming years will, in our view, further heat up the market and contribute to boosting the demand for CAR T cell therapies.

What comes after CAR T?

The first cell therapy programs were all immunotherapies aimed at fighting cancer. This was a logical first step for the industry, as safety aspects are less of a concern for cancer indications as compared to the chronic treatment of (relatively healthier) autoimmune patients.

Recently, though, the T cell therapy scope has been broadening to include these more chronic diseases. Scientists are expanding their horizons and are looking at other cell populations, such as B cells, NK cells and regulatory T cells. Mechanistically, regulatory T cells have the opposite effect of CAR T cells and can therefore suppress, rather than enhance, the body’s immune response.

This new expansion of the field is already attracting the interests of investors. Since January 2020, BioCentury has published the launch of two new companies in this space: Sonoma Biotech and Kyverna Therapeutics. Both are T cell therapy companies targeting autoimmune diseases, and launched with a Series A round of USD 40 million and USD 25 million, respectively.

“Not only innovative research and human talent is required to maintain a successful biotech hub; ancillary supporting structures, such as access to lab space or adequate manufacturing capacities, are also essential to anchor the next generation of biotech companies.”

The technical challenges that lie ahead

Science is paving the way, but for cell therapies to become real game changes, many challenges still remain. We feel that both interdisciplinary and international approaches are needed, if the industry is to solve several scientific, manufacturing and patient selection questions.

Technical challenges, in a nutshell:

The other big hurdle: Manufacturing and Quality Control

Production has always been a challenge for new drug modalities. Besides the cost-effective production of the biological material, the companies need to prove the homogeneity of their product and define the exact threshold for potential deviations and impurities.

This is particularly true for cell therapy products, given their living nature and complexity. This difficult task has been widely recognised, with several cell therapy companies building out their own manufacturing capabilities, or accessing proprietary slots with service organisations, as well as investing in advanced analytical cell typing methodologies.

Venture Capital (VC) investors are willing to fund new developments generating (pre-) clinical data to substantiate the potential of the invention. However, putting VC money in bricks and mortar, or in this case in steel tanks and expensive pieces of hardware, is a recurring dilemma and to date less attractive for financially driven VCs.

“The product is the process and the process is the product” still holds true for all new treatment modalities beyond protein drugs and small chemical molecules.

At V-Bio Ventures, we feel that a company developing new therapeutic modalities needs to own or control the entire manufacturing process, enabling it to be master of its own destiny. Constant access to production modules is required to be able to run the various iterations of process improvement in a timely manner.

How to finance this expensive development?

Taking the above into account, a crucial question remains for young companies: how to finance this expensive testing, manufacturing and quality control? Only creative financing solutions will allow innovative start-up companies to quickly advance their new treatment modalities into clinical trials and to eventually reach the patients who need them.

Looking at this from another perspective: enabling manufacturing expertise and production capacity in a cluster can also boost the local biotech ecosystem in a broader sense. It will anchor innovative research and development companies to the area and enable further growth of the cluster. Christina Takke, Managing Partner of V-Bio Ventures, concluded:

“Not only innovative research and human talent is required to maintain a successful biotech hub; ancillary supporting structures, such as access to lab space or adequate manufacturing capacities, are also essential to anchor the next generation of biotech companies.”

Over the past few months, every news headline has focused on COVID-19. The industry is accelerating its own in-house research to match the pace of the pandemic. The business development market is wide open, as large and mid-sized pharma companies are interested in partnering with early stage initiatives to advance investigational COVID-19 programs (in addition to pursuing their own in-house activities).

This article was authored by Christina Takke from V-Bio Ventures

Many different approaches are being developed: repurposing of existing anti-viral drugs; vaccine approaches, by companies whose share price has rocketed following the announcement of a new development program; and biologics approaches (including monoclonal and polyclonal antibody products) aiming to find an immediate answer for patients weakened by uncontrolled viral replications.

This area of the biotech industry is receiving enormous attention at the moment. New funding initiatives are being set up by multiple governments, as well as by large charity organisations such as the Bill and Melinda Gates foundation. The pharma and biotech industries are deploying accelerated development schemes, and regulatory agencies are pragmatically exploring how the clinical development path for new drugs can be shortened while maintaining safety standards.

In addition to these scientific and clinical efforts, public policies are also being implemented to try and break the chain of transmission. We’re seeing more and more countries issuing tougher lockdowns to ensure social distancing.

How far will the ripples reach?

It goes without saying that all these immediate measures are crucial to quickly finding solutions to this human crisis. It is crucially important to fight the direct impact this viral infection is having on patients’ lives and on over-stretched healthcare systems.

However, we also need to be aware of the far-reaching impacts of the current measures. While clinical trials for COVID-19 programs are ongoing, with many more to come later this year, clinical developments for other indications will sadly be delayed and halted until further notice.

Travel restrictions for patients and bottlenecks in hospital systems are the major drivers for clinical delays in non-COVID-19 clinical trials. Companies with pre-clinical development programs will also face some delays, although these will be less prominent than for their clinical counterparts. Social distancing requires labs to work in shifts ensuring less people at the benches and a reprioritisation of the pipeline programs.

For young biotech companies, this broad range of unforeseen delays will generally not be factored into their business plans; many of them will be forced to revisit their short-term financing needs.

Entrepreneurs might have to turn to their investors

At V-Bio Ventures, we have reviewed the impact of the COVID-19 pandemic on our portfolio companies, with a priority on the safety and health of the people involved. Careful analysis and contingency planning will help to guide the small biotech companies through this period. As it is hard to predict the duration of this crisis, funds might need to allocate additional resources to deal with the situation. A strong and diverse investor base will be crucial for young biotech companies’ abilities to cope during this period and emerge even stronger thereafter.

The current situation makes us recall the financial crisis of 2007-08, which also shook up society in an unexpected way. In 2007-08, the banks had been at the basis of the crisis, while the underlying developments within the pharma and biotech industries were initially not directly impacted. Of course, the period of funding drought had its impact on the years 2009-10 following the crisis.

The current situation is different. During the recent years, the financial institutions have reinforced their capital buffers. Now, the financial sector can hopefully be part of the solution to keep the nascent European biotech ecosystem in business. This is especially relevant for the ancillary businesses crucial for a growing ecosystem, such as contract research organisations, contract manufacturing organisations and tools providers (ect.).

A prerequisite for the knowledge industry will be that venture capital funds are still able to raise capital and close new funds. If VCs are able to continue investing in a future-proof industry, they can potentially provide a solution for the crisis we are currently going through.

Augustine Therapeutics is one of VIB’s latest spinoffs, developing a first-in-class drug for Charcot-Marie-Tooth disease. The company recently announced a seed-funding […]

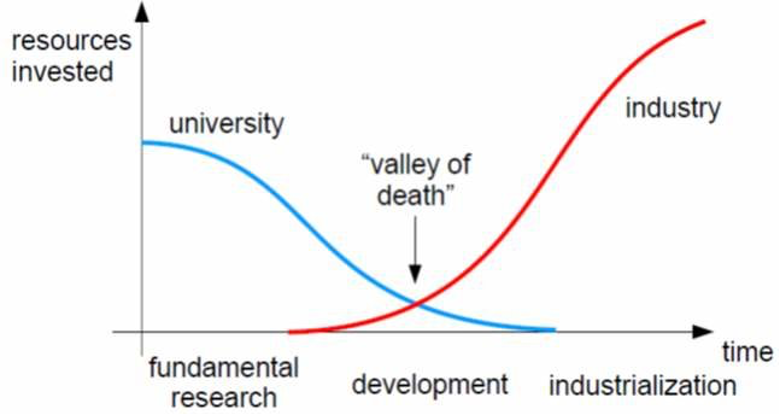

Augustine Therapeutics is one of VIB’s latest spinoffs, developing a first-in-class drug for Charcot-Marie-Tooth disease. The company recently announced a seed-funding round of €4.2 million, led by V-Bio Ventures. We spoke to several of the key persons in Augustine about how the startup is tackling the “Valley of Death”: the no-man’s-land between academia and industry where many potential therapies often fail.

By Amy LeBlanc

From academic theory to patient therapy

Augustine’s mission is to develop the first treatment for Charcot-Marie-Tooth disease (CMT). Although considered an orphan disease, CMT is nevertheless one of the world’s most common hereditary neurological disorders. It isn’t deadly, but severely affects a patient’s quality of life as the progressive degeneration of peripheral nerves results in a range of issues. Current treatment options are limited to supportive care, such as physiotherapy and pain killers.

The company was founded based on multiple breakthroughs in the labs of Ludo Van Den Bosch, Joris De Wit and Bart De Strooper (VIB – KU Leuven). Van Den Bosch has been studying neurodegenerative disorders, such as ALS and CMT, for decades. While trying to gain insights into the underlying genetic mutations and mechanisms of CMT, his lab identified a biological pathway that can potentially be targeted to treat the disease. Van Den Bosch told us:

“I was convinced from the beginning that this pathway represents an interesting therapeutic strategy, not only for CMT but also for ALS and other neurodegenerative diseases. But since we’ve discovered that it is clearly a driving factor for CMT, and as there are no other treatments available to patients suffering from this disease, we are aiming for that first.”

Having raised a seed-round of 4.2 million euro, Augustine is now working on identifying molecules that can target this specific pathway. Drug development presents a daunting task for such an early-stage startup, but things have been progressing rapidly with several leads already identified. This is because Augustine wasn’t founded in a typical manner: the company is being supported by VIB Discovery Sciences.

How to hit the ground running with drug development

Augustine is a very early-stage startup: the company is in the process of establishing a management team and, although it has a well validated target, it is working on the early stages of proprietary chemistry. A company this young would ordinarily have a hard time attracting the necessary capital and know-how to initiate drug development. So how has Augustine done it?

The aim of VIB Discovery Sciences is to bridge the Valley of Death, as they call it: the critical initial phase of a drug discovery, where it still teeters between academia and industry. – Jérôme Van Biervliet, VIB

The answer lies in the Flemish life sciences institute VIB’s extraordinary support for spin-offs. Jérôme Van Biervliet, head of VIB Discovery Sciences, explained:

“At VIB, we have a very active strategy of taking academic inventions by the hand towards startup creation. To conduct this process of valorization, we added another tool to the box in 2015: VIB Discovery Sciences. The aim of VIB Discovery Sciences is to bridge the Valley of Death, as they call it: the critical initial phase of a drug discovery, where it still teeters between academia and industry.

We have an operational, scientific team, led by people with experience in the biotech or pharma industry, who help to initiate the drug discovery process for targets that emerge from the research being conducted at VIB. Then we try to find investors and business partners for the company to set up seed funding or other investments.”

The Valley of Death, where less resources are invested by both academia and industry, is a phase where a lot of startups fail.

“In this industry,” Van Biervliet continued, “there is still significant risk involved in early-stage projects. We see it as our task to de-risk as much as possible; both financially, by co-investing, but also by supporting the company’s initial activities. This allows investors to take on projects which might otherwise have been too early in development for them.

Because we work in close collaboration with our academic founders, who have been working on these targets for many years and know their field well, it makes for a win/win situation: we can get the critical activities for the drug discovery organized in a professional and industry-like manner, yet retain the creativity and insights from the academic labs.

This has been exactly the case for Augustine Therapeutics: with the Discovery Sciences team, we started the drug discovery process in 2018 and were quickly able to attract the interest of V-Bio Ventures and other investors.”

The next step of the journey

With its seed fund secure and chemistry underway, Augustine is set to “graduate” from VIB Discovery Sciences later this year. Currently, the operational tasks that would normally be undertaken by the CSO and COO are being managed by the VIB Discovery Sciences team. V-Bio Ventures also has a role to play, looking after the work typically assigned to the CEO and CFO. Augustine is now building towards internalizing these skills and building a solid management team.

Augustine Therapeutics is a good example of the interplay between VIB, V-Bio and other investors in the space. A couple of years ago, this was way too early to even think about founding a company… Now, instead, we are able to move the project along into that translational space. – Ward Capoen, V-Bio Ventures

It may seem like an odd set-up, but Ward Capoen, Principal at V-Bio Ventures, says it’s not unheard of:

“As investors, we’re starting to see this happening more and more, where you have this start-up incubation period supported by initiatives like VIB Discovery Sciences. In the US, you have Flagship Ventures, Y Combinator and Atlas Venture, all doing a similar thing.

Augustine Therapeutics is a good example of the interplay between VIB, V-Bio and other investors in the space. A couple of years ago, this was way too early to even think about founding a company. Projects like this would maybe have been licensed out to pharma or they may have just bumped around in the academic lab for a while.

Now, instead, we are able to move the project along into that translational space, where we can create a new therapy for patients who are currently without any treatment options.”

Header image: Ward Capoen (left) and Jérôme Van Biervliet (right) (courtesy of V-Bio Ventures).

Ghent (Belgium), 20th of January 2020 – Today V-Bio Ventures announces its investment in RootWave, a pioneer in electrical weed killing solutions. RootWave secured ca. EUR 6.5m in a Series A investment round led by V-Bio Ventures (Belgium) and Rabo Food & Agri Innovation Fund (Netherlands), and joined by impact fund Pymwymic (Netherlands) and existing shareholders including Yield Lab Ireland. The proceeds will enable RootWave to expand commercialisation of its RootWave Pro, a professional hand-weeder for spot weeding and treating invasive species, integrate its technology into automated agricultural weeders, and conduct further research into novel electricity-based weed killing applications.

RootWave’s technology uses electricity to kill weeds from the roots upwards. The $30bn herbicides industry is under pressure due to herbicide-resistant weeds and increasing regulation and litigation. RootWave’s technology is the leading solution for herbicide-free and effective weed control, contributing to more sustainable agriculture, a cleaner environment and a healthier food chain. The company is currently selling its RootWave Pro throughout Europe and is partnering with ag-machinery companies including Steketee/Lemken and SFM Technology.

In connection with the financing, Willem Broekaert of V-Bio Ventures, a representative of Rabo Food & Agri Innovation Fund, and Pieter Vis of Pymwymic will join the board of directors.

Andrew Diprose, CEO of RootWave, comments: “This fundraising reinforces the potential of RootWave’s technology and will allow the company to grow its revenues and commercialise its next generation products. We are grateful for the support from our existing board and shareholders and look forward to welcoming the new investor syndicate to our board. Together we will deliver innovative solutions that the market is urgently demanding.”

Willem Broekaert, Managing Partner from V-Bio Ventures, adds: “We have been impressed by the determination and vision of RootWave’s management team, and by the deep innovation pipeline of the company. We strongly believe in the transformation RootWave can bring about in the weed control market and are excited to be part of this journey.”

Richard O’Gorman, Director of Rabobank’s Food & Agri Innovation Fund, comments: “We at Rabobank recognize the need for greater sustainable food production and technologies that not only support increase yields, but also safeguard the environment for future generations. We are very proud to invest in RootWave and our partnership is testament to our mission to support truly innovative emerging technologies that can make a true difference in how we produce food in a future-proof manner.”

Pieter Vis, Investment Manager of Pymwymic, says: “We are proud to join RootWave on their mission to develop and commercialise electrical vegetation control technologies and products that improve communities and the environment by offering a scalable and sustainable alternative to chemical herbicides.”

About RootWave

RootWave (www.rootwave.com) uses electricity to kill weeds as a sustainable and scalable alternative to herbicides. The technology is organic, sustainable, no-till and cost-effective.

RootWave was launched in 2012 and is currently selling an award-winning professional hand weeder designed for growers, gardeners and groundskeepers to spot weed and treat invasive species; it is used across the world by contractors, municipalities, heritage sites, estates, football clubs, and farmers.

RootWave has won several EU and UK grants to adopt its technology for agriculture and is working with several ag-machinery companies to develop automated solutions for specialty and broadacre crops.

RootWave zaps weeds with zero chemicals and is improving the environment by offering a sustainable alternative to herbicides.

About V-Bio Ventures

V-Bio Ventures (www.v-bio.ventures) is an independent venture capital firm specialized in building and financing young, innovative life science companies. V-Bio Ventures was established in 2015 and works closely with Belgium-based VIB, one of the world’s premier life science institutes. The fund invests throughout Europe in start-up and early-stage companies with high growth potential focusing on technologies that provide transformational improvements in the biopharmaceutical, pharmaceutical, diagnostics and agricultural sectors.

About Rabo Food & Agri Innovation Fund

Rabo Food & Agri Innovation Fund “RFAIF” (www.rfaif.com) is a captive venture capital fund of Rabobank, a global leader in providing international finance to the food and agriculture (F&A) sector. RFAIF leverages Rabobank’s extensive global network and sector knowledge to support the growth and success of start-up companies leading innovation across the food and agri supply chain.

About Pymwymic

Pymwymic (www.pymwymic.com) is an investment cooperative of private investors who invest in impact driven enterprises through Sustainable Development Goal themed sub-funds, leveraging a peer-to-peer network and exchange of knowledge and expertise. The Pymwymic Healthy Ecosystems Impact Fund invests in early to growth stage companies that have measurable impact and seek to conserve and restore our ecosystems while generating an attractive financial return.

For more information, please contact:

V-Bio Ventures

Willem Broekaert

Willem.broekaert@v-bio.ventures

A large proportion of new treatments and life sciences breakthroughs can often be traced back to humble beginnings in a start-up venture. Why is it that these smaller companies seem so adept at developing innovative products? What have they got that larger companies are lacking? V-Bio Ventures takes a look at some of the factors making start-ups hotbeds for innovation.

This article was authored by Willem Broekaert from V-Bio Ventures.

Today’s successful drugs are, more often than not, rooted in start-up companies. An increasing share of blockbuster drugs, although marketed by large pharmaceutical and biotech companies, originated in start-ups and were internalized through licensing deals or M&A. To name just a few examples: AbbVie’s Humira, the world’s best-selling drug in 2019, was originally developed in the laboratories of Cambridge Antibody Technology, and the pioneering immuno-oncology drug Opdivo, sold by Bristol Myers Squibb, hatched out of Medarex.

Research at V-Bio Ventures shows that 70% of the $82 billion revenues from the top 10 selling drugs in 2018 came from externally discovered drugs. This begs the question: what makes these start-ups better nurseries for innovation than established companies?

Close to the source

Revolutionary ideas rarely spring up within the start-up companies themselves. To get to the root of innovation, we have to look beyond both the pharmaceutical companies and the start-ups. Most impactful new products are based on many different academic discoveries, resulting from untargeted open-ended exploratory research. Start-ups often excel when linking up with academic originators of great ideas; translating these ideas into products or product prototypes is in many cases the gist of their business model.

So, why are academic leaders more inclined to entrust their revolutionary ideas to a cash-constrained start-up rather than to a resourceful large organisation? Firstly, academic culture is highly person-centric: the names of individual experts often function as a brand of their own, with laboratory units named after their leading principal investigator (PI). This fits well with the people-oriented culture of start-ups, which are built around a handful of visionary leaders. They are usually open to accommodating a PI, either as part of the founding team or as a privileged advisor. In a start-up setting, a PI can experience a great sense of involvement and direct impact; more than they would in a collaboration with a large corporate organisation, where they would be competing for attention with dozens of others. Secondly, members of the start-up culture have an appetite for early, risky ideas; a good match with the academic culture of pursuing high-minded yet uncertain goals.

Startups are biotech hotbeds because they are irresistibly attractive to the best people with the most innovative ideas. – Willem Broekaert, V-Bio Ventures

However, a symbiotic relationship with academia can only explain a part of the competitive advantage of start-ups. Indeed, there are many successful start-ups, like Argenx and Galapagos, whose roots did not lie in academia. So, what are some other key factors at play?

Laser-like focus on the goal

By their very nature as a fledgling entity, start-ups need to have a laser-sharp focus on a well-defined goal. The main advantage of a narrow focus is that the technological and business roadmaps, however complex, often fit in the mind of a single person or is contained to a very small team. Execution of the business plan can, therefore, be clearly laid out and tasks can be allocated in a straightforward manner. This contrasts with large organisations where task allocation is complicated by the multiple intertwined and sometimes competing goals. Overall, this focus makes start-ups more efficient in nurturing innovation than their larger counterparts.

A tribal affair

A start-up’s social organisation can be compared to that of an ancient tribal group: in the face of fierce external competition and limited resources, achieving team objectives within the shortest possible timeframe is directly linked to the group’s survival. For a start-up not to go under, every member has to maintain a zealous conviction in the company’s central thesis, be devoted to the company’s central goals and work to the best of their abilities at all times. This do-or-die spirit and strong group identity makes for extraordinarily good team motivation. Furthermore, the short chain-of-command in start-ups adds to the feeling of personal impact and ownership at all levels of the organisation.

Custom-built teams

Another key factor for the successful start-ups is that these companies are strong magnets for talented people willing to dive headlong into adventure. In tech or software start-ups, management teams are typically formed bottom-up by friends with similar backgrounds; people who coincidently met at school or at work. In biotech, by contrast, management teams are usually formed through a well thought out process. A top calibre management team is purposefully brought together, a task often performed by the founding entrepreneur or the leading venture capitalist.

Given the slow and multidisciplinary nature of the biotech R&D process, it takes several years and dedicated specialisation to obtain a managerial level proficiency. Management teams of biotech start-ups are brought together not only because each member is exceptionally well suited for the job, but also because they all have complementary skills. The result is a diverse group of people with different traits, experiences and professional backgrounds. If all team members have a mutual compatibility and strong dedication to the company, freshly assembled teams can result in synergistic and energetic team performance.

The razor-sharp focus of start-ups, combined with an experienced and dedicated top management, means that every key aspect of the company receives ample attention and strategic reflection. On top of that, the board of directors adds another tier of experienced people to ensure that the company stays in tune with the agreed business objective.

Willem Broekaert, managing partner at V-Bio Ventures, concludes: “Startups are biotech hotbeds because they are irresistibly attractive to the best people with the most innovative ideas. The attraction of start-ups lies in providing people with the opportunity to directly impact the success of the company, giving them the satisfaction of winning a gamble against the odds.”

This article was authored by Ward Capoen from V-Bio Ventures.

With the soaring cost of drugs for rare indications, many biotech and pharmaceutical companies are focusing R&D efforts on orphan diseases. Will the pendulum swing back towards more common maladies? When will the price of drugs start to fall? In this month’s VC views, V-Bio Ventures examines the current business model for rare diseases.

Belgians were recently introduced to baby Pia, whose parents crowdfunded over 2 million euro to pay for a course of Zolgensma, a Novartis-owned gene therapy to treat spinal muscular atrophy. Just last month, Alnylam Pharmaceuticals got approval for Givlaari, an RNAi-based treatment for acute hepatic porphyria. The annual price for Givlaari has been set at $454,000. It seems like not a day goes by without news of a new drug for a rare disease with a jaw-dropping price tag.

You don’t need to be a baby boomer to remember that such high prices for medicines didn’t use to be a thing; they’re a recent development. A new book provides an insight into this: in the biography, the author details how visionary Dutch entrepreneur Henri Termeer founded the biotech Genzyme. His idea was that, to treat patients with rare diseases, we would have to charge hundreds of thousands of dollars per year in order to make up for the low patient numbers.

It seems like not a day goes by without news of a new drug for a rare disease with a jaw-dropping price tag.

Termeer figured that society would agree to these costs for two important reasons. Firstly, even at such high prices, the total cost to society would be low, as the diseases are rare. Secondly, once the patent lapses, the treatments would be cheap and forever available to society at a low cost. Many agreed: Termeer’s business model for rare diseases has been adopted by a lot of major players in the biotech industry.

A business shift towards rare diseases

Given that this pricing-pact between industry and government has held since the 1990s, developing drugs for rare diseases has become all the rage. As there is often no standard of care to provide a benchmark, any first drug showing some improvement over the placebo will often be approved at a high price.

Being the first to market in a rare disease with no treatment options is a coveted advantage. Once your therapy becomes the entrenched standard of care, the competition will have a hard time of it. To enrol participants in clinical trials, they need to convince the few patients out there to give up their current treatment for a new and unproven one. This also means that even large pharmaceutical companies, like Novartis, GSK and their peers, are increasingly focused on gene therapies, cell therapies and orphan diseases.

Every year, the best-selling drug lists are topped by cancer and auto-immune disease drugs… for diseases that, although devastating for the patient, often account for less than 1% of the population.

It almost makes you feel like nobody is working on the great diseases of mankind anymore; that heart disease, hypertension and diabetes were a thing of the nineties, no longer in the spotlight. Every year, the best-selling drug lists are topped by cancer and auto-immune disease drugs like Herceptin, Humira and Revlimid. These are all multi-billion-dollar franchises for diseases that, although devastating for the patient, often account for less than 1% of the population.

Conversely, when looking at what drugs are actually prescribed, a whole different picture emerges. An analysis from 2018, looking at the most prescribed drugs in the US, provides an insight into the most common diseases where innovation is possibly needed. The top indications, based on the number of prescriptions, are hypertension, hypothyroidism, diabetes, high cholesterol, heart disease, GERD, pain, depression and infectious diseases.

Very few innovative treatments have been developed for any of these diseases in recent years, and the medicines that do exist are usually symptom-reducing rather than curative. Though there are a lot of generic options available for these diseases, that in itself makes development of new and better treatments even harder. A semi-effective old drug is after all harder to beat in a clinical trial than a placebo, making trials larger, longer, more difficult and more expensive.

Will the pendulum swing back?

We tend to classify diseases by their outward appearance: their symptoms and clinical phenotype. But cancer and auto-immune diseases have taught us that, under the hood, these are not one disease: they are many different diseases that all look alike. This has led to the development of the targeted therapies that are currently transforming oncology and immunology.

This approach is now also starting to be applied to the “big” indications. Heart failure can be divided in subgroups depending on which pathway is affected; depression can emerge from many different imbalances in the brain or immune system; and pain is the result of the rewiring or dysfunction of any number of signalling pathways in nerve cells.

These new insights in the intricacies of different diseases will no doubt usher in a wave of new drug targets, and the pendulum will inevitably swing back from rare to prevalent diseases. But if we keep splitting these large diseases into a bunch of orphan indications, can we then charge rare disease prices for them? Will society bear the cost? This unsolved question will certainly become a hot topic in the years to come.

Scientific progress will go the way it always does: forward, to the benefit of many patients. As with Genzyme in the 1990s, and in the face of ever-increasing constraints on government budgets, new business models will emerge to adapt with the changing times.

Ghent, Belgium, December 16 2019 – Today V-Bio Ventures announces its investment in Augustine Therapeutics, a new venture developing innovative therapeutics for patients suffering from Charcot-Marie-Tooth disease. A spin-off of VIB and KU Leuven, Augustine raises a seed-round of 4.2 million euro with V-Bio Ventures, PMV, Advent France Biotechnology, Gemma Frisius Fund and VIB.

Augustine Therapeutics, a spin-off from VIB and KU Leuven, focuses on the discovery and development of innovative medicines to benefit patients suffering from Charcot-Marie-Tooth disease (CMT) and other neuromuscular diseases. CMT is one of the most common hereditary disorders of the peripheral nervous system, affecting approximately 10 to 30 in 100,000 people globally. The disease is characterized by a progressive denervation of muscles, resulting in a slow decline of the patient’s day-to-day functioning. The current therapeutics market for CMT is limited to supportive management of symptoms.

The newly formed company is rooted in the ground-breaking research of the VIB-KU Leuven labs of Ludo Van Den Bosch and from a collaboration between the labs of Joris de Wit and Bart De Strooper (both VIB-KU Leuven). According to Ludo Van Den Bosch: “We uncovered several biological pathways in peripheral neuropathies that represent promising therapeutic targets for CMT. The validation and in-depth study of the underlying biology of these targets now provides a first-rate foundation for the development of novel therapeutics.”

Augustine Therapeutics completes a seed financing round of 4.2 million euro. The company is the result of a collaborative effort of VIB, KU Leuven, V-Bio Ventures and PMV, joined by Advent France Biotechnology and Gemma Frisius Fund. Augustine Therapeutics is a great example of VIB’s approach to company co-creation with business partners and investors. In anticipation of attracting a dedicated management team for Augustine, the day-to day interim management of the company is assumed by Ward Capoen (V-Bio Ventures) and Jérôme Van Biervliet (VIB).

Ward Capoen, Principal at V-Bio Ventures: “We are proud to have built an international syndicate of renowned investors for Augustine Therapeutics together with VIB. We remain involved in the management of the company while we prepare Augustine for a bright future in search of novel treatment options that will benefit patients suffering from neuromuscular diseases.”

The VIB Discovery Sciences team is taking the lead in the preclinical development of Augustine’s new therapeutics. Jérôme Van Biervliet, head of VIB Discovery Sciences: “We launched Augustine Therapeutics to start the journey of bringing truly innovative products to patients suffering from serious neuropathies. The scientific discoveries of the VIB-KU Leuven scientists provide an ideal starting point for the pipeline of the new company. From here on, the senior, industry-trained team of VIB Discovery Sciences will bring the required deep expertise in drug discovery for early-stage drug development.”

About V-Bio Ventures

V-Bio Ventures is an independent venture capital firm specialized in building and financing young, innovative life science companies. V-Bio Ventures was established in 2015 and works closely with Belgium-based VIB, one of the world’s premier life science institutes. The fund invests throughout Europe in start-up and early-stage companies with high growth potential, focusing on technologies that provide transformational improvements in the biopharmaceutical, pharmaceutical, diagnostics and agricultural sectors. More information: www.v-bio.ventures.

About VIB

VIB is an excellence-based entrepreneurial research institute in life sciences that focuses on translating basic scientific results into pharmaceutical, agricultural and industrial applications. VIB’s Innovation & Business team currently has a portfolio of 230 patent families. This team conducts about 120 partnering agreements with innovative companies each year. VIB is also firmly rooted in a long-standing tradition of setting up start-up companies. Since its foundation in 1996, VIB has created more than 20 start-up companies. VIB is funded by the Flemish government and works in close partnership with five Flemish universities – Ghent University, KU Leuven, University of Antwerp, Vrije Universiteit Brussel and Hasselt University. More information: www.vib.be.

About KU Leuven

As the number one European university for innovation, KU Leuven actively invests in launching innovative technologies in the commercial market by creating spin-off companies, securing and licensing intellectual property, and collaborating with industry. KU Leuven supports researchers and students in transforming their innovative ideas and technologies into commercial products and services that impact people’s lives worldwide. As such, KU Leuven encourages young entrepreneurs to develop a solid business plan, to validate the market and build a coherent team. Since its creation in 1972, KU Leuven Research & Development has supported the creation and growth of 128 spin-off companies, directly employing more than 6,700 people. KU Leuven’s spin-off companies constitute a huge economic leverage for the Leuven region. In the period from 2005 to 2018, KU Leuven invested 12.5 million euro in its spin-off companies, and 1 billion euro of external capital was raised. 103 of KU Leuven’s spin-off companies, of which the first was established in 1979, are still active today. Many have an international leading position. Seven spin-off companies have had an Initial Public Offering (IPO) on the stock exchange. More information: https://lrd.kuleuven.be/en.

For more information, please contact:

V-Bio Ventures

Ward Capoen

ward.capoen@v-bio.ventures

This article was authored by Katja Rosenkranz from V-Bio Ventures.

More than 75 years after the initial discovery of lysergic acid diethylamide (LSD), psilocybin and other natural psychoactive drugs, and their initial exploitation by the western pharma industry, these substances have seen a recent revival in clinical research. Although banned in the notorious “War on Drugs” initiated by US President Nixon, the potential medicinal applications of these substances are finally being explored again, particularly for treating depressive disorders and other mental diseases. This article aims to shed light on a topic we highlighted before in this series – anti-science in biotech – to illustrate the consequences of research being abandoned, as well as the opportunities and additional challenges to making these substances finally available for patients in need.

According to the latest OECD report on European Health, the total costs of mental ill-health are estimated at more than 4% of the GDP of the 28 EU countries, over 600 billion EUR. According to the World Bank Group (WBG) and World Health Organization (WHO), mental disorders account for 30% of the non-fatal disease burden worldwide and 10% of overall disease burden, including death and disability with global cost expected to rise to $6 trillion by 2030.

In the last decade, pharmaceutical companies have been very reluctant to develop new drugs for depression and other mental illnesses, due to notorious failures in the development of new anti-depressants and other treatments. Maybe it’s the lack of effective medicines, combined with the overwhelming need for new treatment options, that has finally lifted the ban on research into some potent yet safe substances: LSD, psilocybin and their derivatives.

LSD and psilocybin are both derived from fungi; LSD is produced by ergot (a plant parasite) and psilocybin by over 200 species of so-called “magic mushrooms”. Their mind-altering effects, which include euphoria, hallucinations and changes in perception, are caused at least partially by alterations in the serotonin system.

Both substances were first isolated and synthesized by the Swiss scientist Albert Hofmann in the mid-1900s while he was employed at Sandoz Laboratories (now a subsidiary of Novartis). In the 1950s and 1960s, LSD was marketed and generously distributed by Sandoz under the name Delysid. The company also sold pure psilocybin to physicians and clinicians worldwide for use in psychedelic psychotherapy.

The “War on drugs” was … quite possibly a reaction to the counterculture movement that opposed the Vietnam War and supported civil rights.

Initial studies indicated that these substances had an astonishing effect on patients with depression, anxiety or addictive behaviors. However, experimentation wasn’t restricted to the scientists and clinicians; the drugs were also quickly embraced by the hippie and counterculture movement of the 1960s for their ability to promote “spiritual awakening” and sparking creativity. But research was shut down when President Richard Nixon launched his “War on Drugs”.

The War on Drugs

On June 18, 1971, Nixon declared that drug abuse was the USA’s “public enemy number one”. The “War on drugs” campaign (actually the Controlled Substance Act (CSA)), was officially initiated due to skyrocketing numbers of drug use, abuse and overdosing. However, it was also quite possibly a reaction to the counterculture movement that opposed the Vietnam War and supported civil rights.

This campaign is still ongoing, even though the results have been far from successful. Despite enormous spending, the CSA has largely failed to reduce drug abuse, instead resulting in thriving black markets for illegal drugs, mass imprisonment for non-violent crimes (the US has the world’s highest incarceration rate) and the opioid crisis.

This includes imprisonment for using psychedelics like LSD and psilocybin, which are both classified as Schedule I drugs by the United States Drug Enforcement Administration (DEA). In the five-tier drug scheduling system, Schedule I drugs are substances that have a high potential for abuse and addiction and currently have no accepted medical use. Although scientific research on Schedule I drugs is not completely banned under the CSA, the legal restrictions combined with public perception has severely limited psychedelic research in the past four decades.

The Schedule I classification has remained since the 1970s, despite the fact that many experts agree that neither LSD nor psilocybin are addictive (ironically, they might actually have the opposite effect, as seen in pilot studies with patients with alcohol abuse). In fact, the drugs are difficult to abuse as they do not produce psychoactive effects when used in succession. In addition, they also seem to be astonishingly safe. As Matthew Johnson, an associate professor of psychiatry and behavioral sciences at Johns Hopkins University, who studies psychedelics put it:

“There’s no dose with observable organ damage or neurotoxicity. That’s pretty freakish. You´d be hard-pressed to find anything sold over-the-counter that you could say this about, including caffeine and aspirin.”

That being said, psychedelic drugs like psilocybin do have the potential to exacerbate psychiatric illnesses like schizophrenia in a small percentage of the population. Further research still needs to be done to identify good and bad candidates for psychedelic therapy.

Mushrooms as medicine

Despite the chilling effect of the “War on drugs”, tentative studies have recently started emerging, focused on potential medical applications for psychedelics. With the desperate surge in need for new treatments, there seems to be a new openness to explore these “old” psychoactive substances (and non-hallucinogenic derivatives such Bol-148) in a more rigorous scientific manner. Indications under consideration include severe depression, PTSD, alcohol addiction and cluster (alias “suicide”) headaches. This research gives new hope to patients who have been illegally self-medicating for decades by growing their own magic mushrooms.

The lack of effective medicines, combined with the overwhelming need for new treatment options, has finally lifted the ban on research into some potent yet safe substances: LSD, psilocybin and their derivatives.

In addition to increased academic activities, renewed interest in the field has also resulted in the appearance of private investors and new VC funds. Investors like Silicon Valley billionaire Peter Thiel, Christian Angermaier (founder of ATAI Life Sciences) and Field Trip Ventures, supporting start-up companies dedicated to developing psychedelic-based therapies.

But despite this renewed interest, a lot of challenges still remain. On the one hand, these drugs are – at least in the US – still classified as Schedule I: even if the FDA evaluates them positively, the final decision to re-classify them and make them available as a therapy lies with the DEA. Additionally, it will be very difficult to find pharmaceutical companies willing to market them. Not only are these psychedelics often very complex, and therefore costly to produce, but they are also natural substances. The drugs have been widely used and tested, making any attempt to get a decent patent protection – key for having a relevant duration of market exclusivity – more or less a futile endeavor.

Finally, these drugs come with their own challenges. The mechanism of action is still not fully understood; often just one treatment is sufficient to elicit a long-term benefit, but significant variations between patients would require individual treatment schedules and pricing schemes. In addition, clinical trials and treatment of patients with psychedelic therapies are further complicated as the efficacy of the therapy does not only depend on the compound itself but also on what is called the “Set and Setting” (the context of the psychedelic experience), thereby very much complicating the performance of placebo controlled trials.

Despite all the enthusiasm and strong advocacy, far more research needs to be performed before the safety and efficacy of drugs like LSD and psilocybin can be established. However, considering the possible benefits of these substances, further research absolutely seems warranted. We need to step away from a historic bias against the “hippy drugs” of the 1960s and make sure that potentially valuable drugs are not being neglected just because they just don´t fit into our current point of view.