Over the past few decades, pharma has gradually shifted its target patient focus for newly launched drugs from large to niche populations. What has caused this trend, and is the pendulum of drug development swinging back again?

In the year 2000, every one of the world’s top-10 best-selling drugs was a compound targeting a common and chronic indication – treatments such as statins for high cholesterol, proton pump inhibitors for stomach ulcers, and selective serotonin reuptake inhibitors for depression. Two decades later, that same top-10 chart looks very different, with several of the drugs having started their commercial lives as orphan drugs (including Keytruda, Opdivo, Revlimid and Imbruvica). Although these drugs in the top-10 are all technically ‘partial orphan drugs’ (having expanded beyond orphan diseases since receiving their first market authorization), their target patient groups are still very narrow compared to the average 20th century drug.

New oncology drugs typically cost more than $100,000 per year of treatment, meaning it only takes 10,000 patients to push them over the billion-dollar sales bar.

This evolution towards narrower indications has been the result of several converging forces. Firstly, government incentives have made the orphan route more attractive for pharma by lowering requirements for the clinical data package, shortening approval times, and providing time-limited market exclusivity for new drugs. Secondly, smaller patient groups with common underlying pathologies increase the odds of clinical trial success and obtaining regulatory approval. Thirdly, the lifesaving nature of some of these drugs currently on the best-seller list allows them to command high enough prices to compensate for the small patient populations. New oncology drugs typically cost more than $100,000 per year of treatment, meaning it only takes 10,000 patients to push them over the billion-dollar sales bar.

The oncology model for blockbuster drugs

It’s no coincidence that the ‘orphan’ blockbuster drugs in the bestseller list are all cancer drugs: the oncology drug market presents a prime example of this ‘small patient group’ strategy at work. Advances in our understanding of the molecular basis of cancer, and corresponding expansion of sequencing-based diagnostic toolkits, have allowed us to dissect cancer into dozens of smaller sub-indications that share the same causative mutations and molecular drivers of tumorigenesis. Consequently, there is now an extensive armamentarium of cancer drugs that selectively target oncogenes (such as BRAF, BRCA1/2, EGFR, and RET). Some of these drugs were granted approval based on the molecular targets they modulate, irrespective of the organ in which the cancer occurs. All of them command high prices for the companies that developed them.

With fewer patients and lower product prices, how will biotech companies be able to obtain a return on their investment in drug development?

Many pharma and biotech players are currently hard at work replicating this ‘oncology model’ in other indications, including in neurodegeneration, heart failure, diabetes, and arthritis. As our understanding evolves, it is becoming increasingly clear that these diseases are in fact mosaics of sub-indications lumped together based on common symptoms, each of them having very diverse genetic and molecular causes. To move beyond mere symptom alleviation, therapies need to act on the underlying mechanisms, which tend to vary from patient to patient. As we’ve seen in oncology, the synergy between high-precision patient diagnosis and deployment of mechanistically targeted drugs leads to better disease-modifying therapies. Though the patient groups are smaller, they are also more homogeneous, enabling more effective targeted therapies.

There is however an important caveat to replicating the oncology model in these other large indications: the per-patient drug prices will have to drop significantly. Unlike cancer therapies, treatments for many of these chronic diseases need to be given over a longer period of time. Additionally, many of these indications are not imminently life-threatening, which translates to lower QALY (Quality-Adjusted Life-Year) benchmark scores – the measure commonly used to determine the cost and reimbursement policies for new drugs. And last but not least, some of these indications are so large that they threaten to economically sink healthcare systems if their price tags are not adjusted to the volume of need. While oncology can serve as an excellent model for future therapies in chronic indications, the drug pricing will need to be dramatically different.

Obstacles still in the way

This conclusion beggars the question: with fewer patients and lower product prices, how will biotech companies be able to obtain a return on their investment in drug development?

One solution is to drastically cut the cost of drug development, which can be done at three levels: drug discovery and candidate development, drug manufacturing, and clinical trials. Drug discovery is already being sped up and having its failure rate lowered thanks to the increased availability of information on protein structures, combined with AI-aided virtual drug design. Lowering the costs of preclinical and clinical drug manufacturing is a more serious challenge, particularly for antibodies, nucleic acids and cell- and gene therapies, though progress is also being made in this space. By far the biggest challenge in the coming decades will be lowering the cost of clinical trials. Even here though, solutions may be found through a combination of improved trials designs, better stratification, further digitalization of read-outs, and the use of AI guidance.

If these hurdles are overcome, then we will likely see drug development trends return to what they were at the start of the century, with pharma and biotech again focused on broad impact, common indications.

Ghent, Belgium, 31 March 2022 – V-Bio Ventures announced the final closing of its second fund, V-Bio Fund 2, having raised EUR 110 million euro and exceeding its target of EUR 100 million.

Together with their first fund, V-Bio Fund 1, V-Bio Ventures will have over EUR 185 million under management, putting it in a very good position to fund promising innovative companies. Almost all limited partners of their first fund are participating in this second fund, as are multiple new investors. V-Bio Ventures is a venture capital company that focuses specifically on the segment of young pioneering biotech companies and its strategy to invest in transformational companies in the medical and agricultural sector will remain unchanged in this second fund. V-Bio Fund 2 will also maintain its fruitful relationship with VIB, Europe’s leading life sciences institute, to access deals from the renowned research center that has spun out multiple successful biotech companies such as Ablynx.

V-Bio Ventures is expanding their team from seven to nine experienced investment professionals with a scientific background and a wealth of experience from biotech companies and investment funds. Shelley Margetson joined the fund as Managing Partner, bringing her expertise as senior executive in multiple European biotechnology companies, including Nasdaq-listed Merus (MRUS). In addition to expanding the team, Ward Capoen, who has been with V-Bio Ventures since the start of the first fund, is being promoted to Partner.

Recent portfolio successes of V-Bio Ventures include Syndesi Therapeutics, which was acquired earlier this year by AbbVie for up to $1bn, as well as Agomab and Precirix having raised EUR 63m and 80m respectively from international investment syndicates. Since its inception in 2015 V-Bio Ventures has invested in nineteen companies, has co-created seven of them, and has helped to advance eight therapies into clinical development and closer to patients.

Christina Takke and Willem Broekaert, Founding Managing Partners of V-Bio Ventures: “We are extremely pleased to have received the confidence of both existing and new investors and look forward to continuing our proven strategy to invest early in new or young ventures based on outstanding science and to support their management teams through the initial value creating milestones.”

V-Bio Ventures (www.v-bio.ventures) is an independent venture capital firm, specialized in developing and financing young, innovative life sciences companies. V-Bio Ventures was founded in 2015 and works closely with Belgium-based VIB, one of the world’s leading research institutes in the life sciences. The fund invests across Europe in high growth potential start-ups targeting transformational innovations in the biotech, pharmaceutical and agricultural sectors.

Antimicrobial Resistance has become an enormous challenge for global health, yet remains largely ignored by companies. As this deadly race worsens, we urgently need to address the huge mismatch between the need and incentive for developing new antimicrobial drugs.

It´s nearly 100 years since the discovery of penicillin by Sir Alexander Fleming. Since then, antibiotics have transformed modern medicine and saved millions of lives. But as we’ve observed in real time with COVID-19, the fight against infectious agents like viruses, bacteria, and fungi is a continual one – as soon as a potent medicine has been developed, it´s only a question of time until new resistant variants develop, and the race starts all over again.

For quite some time now, we’ve been successful in competing with microorganisms. But the situation is becoming frightening. A global survey published in The Lancet in January 2022 showed that in 2019 1.27 million global deaths were the direct result of Antimicrobial Resistance (AMR). To put that in perspective, this means AMR infections killed more people in a single year than HIV/AIDS (864,000 deaths) or malaria (643,000 deaths). A United Nations Interagency Coordination Group on AMR estimates that this number could swell to 10 million per year by 2050 if we don’t take more action.

How has the situation become so dire, so quickly? And why, despite the huge unmet medical need, are hardly any pharma or biotech companies developing new drugs to counter AMR?

A costly evolutionary arms race

All infectious pathogens naturally develop AMR as a means to stay alive, a process which represents a major challenge to the treatment of infectious diseases. In 2019, more than 2.8 million drug-resistant infections occurred in the U.S. alone, and resistant bugs killed more than 35,000 people. Similar numbers are reported for Europe.

The names of the worst killers are known: S. aureus and Enterococcus species, Clostridium difficile, Enterobacteriaceae (mostly E.coli and Klebsiella pneumoniae), Pseudomonas aeruginosa, Acinetobacter, and Candida auris (a fungus). The most worrisome seem to be the Gram-negative pathogens, which are fast becoming resistant to nearly all the antibiotic drug options available, creating situations reminiscent of the pre-antibiotic era where a simple wound or operation has the potential to be life threatening.

In addition to the burden on patients and their families, the cost of AMR to the economy is significant. Along with mortality and morbidity, prolonged illness results in longer hospital stays, use of more expensive medicines, and greater financial challenges for those impacted. It is estimated that AMR already costs the EU €1.5 billion per year in healthcare costs and productivity losses, a figure which is only likely to rise dramatically.

How did it come to this?

There are several factors that clearly facilitated the rapid development of these dangerously resistant strains. In the past decades, we have dramatically and carelessly overused antibiotics. They have been inappropriately prescribed for wrong indications (e.g. viral infections), or used incorrectly (e.g. by patients not finishing a full course of treatment). Antibiotics have also been used extensively as growth supplements in the livestock industry, leading to resistance either due to direct consumption of animal products or indirectly through the use of livestock excrement as fertilizer in agriculture.

These issues have been gaining recognition over the last years, and an increasing number of countries are implementing programs to limit irresponsible use of antibiotics in medicine as well as agriculture. However, these measures can only slow our spiraling descent into danger, not deal with the resistance that has already arisen.

Why, despite the huge unmet medical need, are hardly any pharma or biotech companies developing new drugs to counter AMR?

To tackle the building crisis, we desperately need more tools to combat resistant microbes. But despite the huge unmet need for more and novel antimicrobial agents, such drugs have not been forthcoming. In fact, less and less new antibiotics are reaching the market – the last truly novel class of antibiotic was discovered in the late 1980s.

The key reason is that discovering and bringing antibiotics to the market is no longer profitable for pharmaceutical companies. A 2017 estimate puts the cost of developing an antibiotic at around $1.5 billion. In contrast, industry analysts estimate that the average revenues generated from an antibiotic’s sale is roughly $46 million per year.

Given the limited supply of new antimicrobials and increasing rates of AMR, doctors are rightfully being encouraged to prescribe new antibiotics only after exhausting all other options. While it makes sense to keep the new drug as a last resort for those patients with no other options, for the pharma company that developed the drug it results in marginal revenues that hardly justify the risk, time, and costs for developing the new agent. As a result, there is currently an enormous mismatch between need and incentive for developing new antimicrobial drugs.

How to fix a broken market

Over the past years, there have been a few attempts to fix this problem. For example, in 2018 NoVo Holdings launched the $165 million REPAIR Initiative (Replenishing and Enabling the Pipeline for Anti-Infective Resistance). The aim is to help biotech companies developing new antibiotics to generate first clinical data, which might enable them to strike deals with pharma companies for further development.

A similar program called CARB-X was established in 2016 with funding from government agencies in the US, Germany, and the United Kingdom, as well as foundations and charities like the Wellcome Trust and the Bill & Melinda Gates Foundation. Unfortunately, both programs have run into the same problems: most pharma companies have moved away from antibiotics and have no interest in taking up new programs, even when developed and largely paid for by others.

To overcome this issue, other initiatives have been launched to instead explore new business models. The subscription model is already being pursued in the UK and has now also been proposed in the US (The PASTEUR Act). The subscription model functions by annually paying contractually agreed-upon amounts to companies developing new antimicrobials, based on the clinical need and novelty of the drug, irrespective of the actual volume of antimicrobials used.

In addition, the AMR Action Fund has been set up through a concerted action from the pharmaceutical industry, global philanthropies, and development banks to bring 2-4 new antibiotics to patients by 2030. Of course, while these initiatives are a step in the right direction, much more remains to be done.

Uniting against a common enemy

Developing new drugs is a risky business. Without a lucrative potential return, pharma companies will remain reluctant to dedicate substantial resources to the difficult and chancy development of new antimicrobials. Young biotech companies – ever more the drivers of innovation for the pharma industry – will also struggle to obtain VC funding due to the investors’ perceived lack of an attractive exit.

What we desperately need is a joint global initiative – by stakeholders including governments, pharma industry, VCs, biotechs, and key agencies and foundations – to develop attractive new models for antimicrobial drug development and provide global access to new antibiotics. We know that this kind of worldwide mobilization is possible – we have seen it in the fight against COVID-19. That same zeal now needs to be applied to the hidden pandemic of AMR.

Ghent, Belgium, 16 March 2022 – V-Bio Ventures today announced the completion of a EUR 80 million Series B round of its portfolio Company Precirix NV led by new investors INKEF Capital, Jeito Capital and Forbion as co-leads.

“We are delighted to announce this major milestone and are grateful for the strong investor support. The addition of Inkef, Jeito and Forbion, three leading VC funds in the healthcare sector, significantly reinforces our international shareholder base”, said Ruth Devenyns, CEO of Precirix. “The investment will allow Precirix to accelerate its growth trajectory and to further validate and broaden the technology platform.”

Precirix’s platform brings together several unique features and facilitates the development of radiolabelled single-domain antibodies (sdAbs) for multiple targets, in combination with different isotopes and applicability in various settings. The company’s lead product candidate, CAM-H2, is currently in a Phase I/II study for the treatment of HER2-positive metastatic breast and gastric cancer. The study allows inclusion of patients with brain metastases, a population in urgent need of effective therapies. Initial imaging data provide confidence in the potential of CAM-H2 to address the unmet medical need in this population. Patients are now being enrolled in the second cohort of the dose-escalation phase, following the absence of any dose-limiting toxicities in the first cohort and a positive review from the Safety Review Committee.

The proceeds of this financing round will fund the development and expansion of Precirix’s pipeline. More specifically, the company will advance CAM-H2 through its ongoing Phase I/II study and plans to bring additional novel radiopharmaceuticals to the clinic. Precirix will also focus on further strengthening the platform, using its potential to generate new product candidates, linkers, and CMC processes.

Simone Botti, Partner at INKEF Capital, Sabine Dandiguian, Managing Partner at Jeito and Jasper Bos, General Partner at Forbion Growth will join Precirix’s Board of Directors.

The company’s existing shareholders Gimv, HealthCap, Novo Holdings, Pontifax Venture Capital, V-Bio Ventures, BioMed Partners, as well as the seed investors, continue to support the company, having all participated in the round.

Christina Takke, Managing Partner at V-Bio Ventures, commented: “Today’s financing is a recognition of the company’s achievements over the past years. We are excited to be part of this journey since co-leading the Series A round in November 2018. We are privileged to have secured the financing from such a highly reputed international syndicate. This allows the company to advance highly needed therapeutics closer to patients in need.”

Precirix is a private, clinical-stage biopharmaceutical company founded in 2014 as a spin-off from the VUB, dedicated to extending and improving the lives of cancer patients by designing and developing precision radiopharmaceuticals, using camelid single-domain antibodies labelled with radioisotopes. The company has a broad pipeline with one product candidate in a Phase I/II clinical trial and two in advanced preclinical stage. Research on multiple isotopes, linker technology and combination therapies further expand the platform. Precirix’s technology also allows for a theranostic approach, where patients can be selected using a low dose/imaging version of the product, followed by a therapeutic dose for treatment. https://www.precirix.com/

V-Bio Ventures is an independent venture capital firm specialized in building and financing young, innovative life science companies. V-Bio Ventures was established in 2015 and works closely with Belgium-based VIB, one of the world’s premier life science institutes. The fund invests throughout Europe in start-up and early-stage companies with high growth potential focusing on technologies that provide transformational improvements in the biopharmaceutical, pharmaceutical, diagnostics and agricultural sectors. www.v-bio.ventures

Ghent, Belgium, 1 March 2022 – V-Bio Ventures today announced the completion of the acquisition of its portfolio company Syndesi Therapeutics SA by AbbVie (NYSE: ABBV), which will help to expand AbbVie’s neuroscience portfolio. This acquisition gives AbbVie access to Syndesi’s portfolio of novel modulators of the synaptic vesicle protein 2A (SV2A), including its lead molecule SDI-118. The mechanism is currently being evaluated for the potential treatment of cognitive impairment and other symptoms associated with a range of neuropsychiatric and neurodegenerative disorders, such as Alzheimer’s disease and major depressive disorder.

“There is a major unmet need for new therapies that can help improve cognitive function in patients suffering from difficult-to-treat neurologic diseases,” said Tom Hudson, M.D., senior vice president, R&D, chief scientific officer, AbbVie. “With AbbVie’s acquisition of Syndesi, we aim to advance the research of a novel, first-in-class asset for the potential treatment of cognitive impairment associated with neuropsychiatric and neurodegenerative disorders.”

The lead molecule, SDI-118, is a small molecule currently in Phase 1b studies, which is being evaluated to target nerve terminals to enhance synaptic efficiency. Synaptic dysfunction is believed to underlie the cognitive impairment seen in multiple neuropsychiatric and neurodegenerative disorders.

“We have been impressed with the vision of AbbVie’s neuroscience R&D team, who share our view on the therapeutic potential of SDI-118 in a range of neurologic diseases,” said Jonathan Savidge, chief executive officer, Syndesi Therapeutics. “I am delighted with the closing of this deal. It has been a pleasure to partner with our investors to investigate the potential of SDI-118 in early clinical studies. Now, as part of AbbVie, the program is well positioned to move into later stages of clinical development.”

Christina Takke, Managing Partner at V-Bio Ventures, commented: ”This transaction strongly validates V-Bio’s strategy to invest early in newly formed ventures based on outstanding science and to support their management teams through the initial value creating milestones. We are extremely pleased with this acquisition by Abbvie, whom we regard as an ideal partner to further develop this program.”

Under the terms of the agreement, AbbVie will pay Syndesi shareholders a $130 million upfront payment with the potential for Syndesi shareholders to receive additional contingent payments of up to $870 million based on the achievement of certain predetermined milestones.

Founded in December 2017 and based in Belgium, Syndesi is a clinical stage biotechnology company pioneering the development of novel therapeutics that modulate synaptic function to relieve the symptoms of cognitive impairment. Syndesi’s unique molecules act pre-synaptically to enhance synaptic efficiency by positively modulating the function of synaptic vesicle protein 2A (SV2A), which plays a central role in regulating neurotransmission.

Syndesi was created through a partnership between UCB Biopharma SRL and a syndicate of Belgian and international investors to further develop novel SV2A modulators that had been originally discovered by UCB. Syndesi’s Series A financing was co-led by Novo Holdings together with Fountain Healthcare Partners, with participation from Johnson & Johnson Innovation – JJDC, Inc., SRIW (Société Régionale d’Investissement de Wallonie), V-Bio Ventures and Vives Fund, along with UCB Ventures. The company has also benefited from support from the Walloon Region. The lead molecule, SDI-118, was discovered by UCB before being out-licensed to Syndesi as of 2018.

Many argue that young companies have little need for a Chief Financial Officer (CFO). They would say that CFOs are unnecessary and costly add-ons early on when a business’ financial needs can be satisfied through outsourcing or by a more junior member of staff. However a CFO brings a deeper and more strategic financial perspective which can help a company outgrow the competition. So, is delaying CFO recruitment a sensible budgetary decision or an expensive mistake?

A Hierarchy of Needs

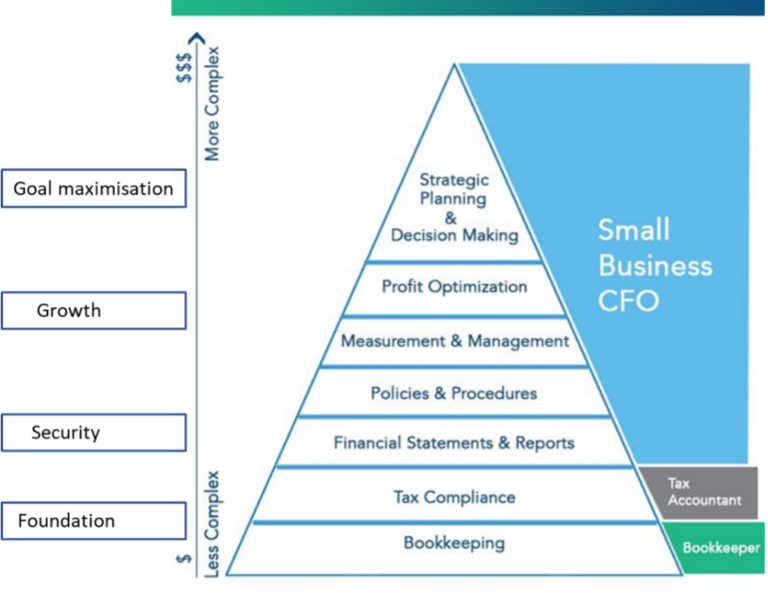

The financial requirements of a company will inevitably change over time and throughout the lifecycle of the business. We’re going to borrow the concept of Maslow’s Hierarchy of Needs to model how these requirements evolve. First published in 1943, Maslow’s Hierarchy of Needs is a motivational theory in psychology comprising a five-tier model of human needs, often depicted as hierarchical levels within a pyramid. Needs lower down in the hierarchy must be satisfied before the needs higher up the pyramid can be attended to.

A similarly structured Hierarchy of Needs could be used to examine the financial management of a business, with the different stages of a business’ development divided into four main categories (Foundation, Security, Growth, and Goal Maximization), as displayed in the figure below:

Figure: Hierarchy of Needs pyramid for the financial management needs of a business.

Foundation

The more basic the needs, the more basic the skills required to perform them. In financial terms, the fundamental needs of a business are administrative and can be met with a bit of technical training. Invoices need to be processed and paid, and bookkeeping taken care of. Generally speaking, businesses that are at this level in the Hierarchy of Needs can manage well without a CFO, by outsourcing to a firm or relying on a junior staff member to take care of the essentials.

Security

As a business grows, its needs also evolve in complexity. Once a company starts requiring things like financial statements and reports, the presence of a CFO becomes more useful. Financial and cash planning is particularly essential for a biotech start-up, and is best done in-house so that forecasts can be quickly and accurately amended as the business evolves. A meaningful rolling forecast requires the skills of somebody who not only understands financial modelling but also understands the underlying business. At this stage a full-time CFO may exceed the requirements of a company, so many biotechs compromise by opting for a part-time CFO who divides their time between several companies, obtaining the required expertise without the outlay for a full-time CFO.

Growth

To support growth, it’s essential for a business to have a person onboard who can accurately measure financials and understand the nuances of its performance, adapting the company’s course of action accordingly. In a biotech company, this means having a firm grasp not only on how much is being spent where, but also on market analyses, the cost/benefit analysis of spending more to accelerate progress, and knowing when to discontinue projects or programs that no longer make economic sense. At this stage, finances become more than just a measuring device – they’re a tool enabling company management. It’s now essential for a company to have a qualified CFO onboard who can make use of tools like key performance indicators (KPIs) to help guide the business and ensure that the right strategies are in place to achieve crucial goals.

Goal Maximization

Once a business reaches the top of the pyramid, the CFO starts providing their CEO with more than just financial expertise – the CFO now acts more as a counterpart in decision making, providing counsel and support. The CFO can provide strategic insights based on the plans, forecasts, and tools that have been developed and customized for the business. Their views are invaluable when considering important questions like: “Should we partner a program?”; “How much funding should we raise and how?”; or “How do we plan for an exit?”. The CFO will help ensure everything is in place to facilitate successful due diligence, whether for funding, M&A activity, or for an IPO. Because building fruitful relationships with potential partners, bankers, and investors takes time, it is imperative that a CFO is onboard and well-integrated into the company before tackling any of these long-term goals.

Moving up the pyramid

Before hiring a CFO, the CEO and the Board need to ask themselves whether they would like to have a CFO present to aid in the company’s journey up the pyramid, or if it’s best to wait until the need arises for a CFO’s particular skillset. As Maslow’s original theory argued, needs lower down the pyramid must be satisfied before you can progress to the next level. Hiring above your needs, by bringing a CFO on board earlier than strictly necessary, may result in more effective and smooth business development. Biotech companies are always in a race, aiming to achieve scientific and clinical results as quickly as possible. An experienced CFO will help to ensure that the company is in the best possible position to get ahead in this race.

Ghent, Belgium, 27 January 2022 – V-Bio Ventures, a venture capital company that focuses specifically on the segment of young pioneering biotech companies, has increased the capital of its second fund V-Bio Fund 2 to 96 million euros. The fundraising will continue for several months, and the fund managers expect the target of EUR 100 million will be achieved.

The investors who were already involved at the start-up of V-Bio Fund 2 in early 2021 are the European Investment Fund (EIF), ParticipatieMaatschappij Vlaanderen (PMV), the Federale Participatie- en Investeringsmaatschappij (FPIM), and BNP Paribas Fortis Private Equity, with in addition various family investment vehicles and university parties (VIB, KU Leuven, and Ghent University). EIF’s investment in V-Bio Fund 2 is backed by the European Fund for Strategic Investments (EFSI), the main pillar of the Investment Plan for Europe. Since then, additional investors have joined V-Bio Fund 2, including KBC Private Partners Life Sciences, Group Vanden Avenne Commodities, the family investment vehicles Korys (Colruyt family) and De Eik (Van Waeyenberge family) and the Dutch real estate and biotech investor Aat van Herk (known for investments in, among others, argenX). Fundraising will continue in the coming months and the total capital of V-Bio Fund 2 is expected to further increase to reach the target amount of EUR 100 million or beyond. In order to internationalize this fundraising, V-Bio Fund 2 was the very first venture capital fund in Belgium to obtain a EuVECA label. Together with their first fund, V-Bio Fund 1, V-Bio Ventures will have in total over EUR 175 million under management, making it one of the largest providers of equity capital to early-stage biotech companies.

V-Bio Ventures specializes in financing and co-creating young biotech companies, both from the medical sector and sustainable agriculture. V-Bio Ventures mainly focuses on projects that build on extraordinary scientific breakthroughs and therefore have the potential to grow into disruptive companies. The venture capitalist has a privileged partnership with VIB (Flemish Institute for Biotechnology), a Flemish research institution that is one of the world’s best in the life sciences and founded successful biotech companies such as Ablynx. In addition to the collaboration with the preferential partner VIB, V-Bio Ventures is looking for exceptional start-ups from other top academic institutes throughout Europe. In order to make the best choices among the most promising projects, V-Bio Ventures has a team of 7 experienced investment professionals with a scientific background and a wealth of experience from biotech companies and investment funds, and can also call on the expertise of more than 1800 scientists connected to VIB. V-Bio Ventures previously invested in the next generation of Belgian biotech star companies such as Confo, Orionis, Agomab, Aphea.Bio, Exevir, Precirix and Protealis, as well as in companies from other European countries, including Muna, Coave, Oxular and Corteria. With the additional financing, V-Bio Fund 2 will further expand its portfolio of exceptional growth companies.

V-Bio Ventures (www.v-bio.ventures) is an independent venture capital firm, specialized in developing and financing young, innovative life sciences companies. V-Bio Ventures was founded in 2015 and works closely with Belgium-based VIB, one of the world’s leading research institutes in the life sciences. The fund invests across Europe in high growth potential start-ups targeting transformational innovations in the biotech, pharmaceutical and agricultural sectors.

In recent public discussions on economic progress, people have been asking: is infinite growth really the best way to measure economic success? With a background in biology, having entered the investment world in the year 2000, Christina Takke found this an intriguing question best viewed through the metaphor of life in a test tube versus a real ecosystem.

Simon Smith Kuznets was an American economist and statistician who received the 1971 Nobel Memorial Prize in Economic Sciences for his “empirically founded interpretation of economic growth”. His work helped transform economics into an empirical science and resulted in the U.S. Department of Commerce standardizing the measurement of the US economy based on the gross domestic product (GDP).

To this day, the economic success of a country is measured by their GDP, essentially reducing all human activity into a single figure representing productivity. A country’s GDP determines how trustworthy it’s perceived to be and subsequently how much money it can borrow from lenders under which conditions.

The GDP is often used to define the prosperity of a country, but is this an adequate assessment? Simon Smith Kuznets himself disapproved the use of the GDP as a general indication of welfare, stating that “the welfare of a nation can scarcely be inferred from a measure of national income”.

The measure of a nation’s health lies in more than just wealth

In the first few decades following the Second World War, a rising GDP admittedly seemed to translate well into the increased wellbeing of a country’s citizens. A higher GDP corresponded to a growing middle class and improved standard of living, but (as Kuznets himself argued) that correlation may always have been an oversimplification.

GDP is a gross number representing the sum total of what we’ve produced over a given period. This total really encompasses everything: consumer goods, electronics, healthcare products and services, the food we consume; but also the waste we produce, profits from criminal activities, and even the plastics we discard that ultimately accumulate in the ocean.

“The welfare of a nation can scarcely be inferred from a measure of national income”. – Simon Smith Kuznets

Companies all over the world are similarly evaluated by various quantitative measures, such as the growth of their sales, profits, and anticipated future cashflows. By selling more products at higher prices with lower production costs, companies are rewarded with higher share prices in public markets. Many factors are excluded by these simplified representations of company success, including sustainability, ethical considerations, and employee wellbeing.

Investors are often quite vocal proponents of these measures of success, pushing companies towards restructuring and splitting activities to increase profits and accelerate growth, thereby driving up share prices. It’s all part of the system, of course, with investment funds (including VCs) having to generate returns for their own shareholders from which they ‘borrowed’ the money in the first place. But although the aim to return profits may be understandable, the question remains: can the system support sustainable growth?

Infinite growth using finite resources

Examples from biological systems can really help to illustrate the limits and possibilities of economic growth. To start with, let’s picture a bacterial culture in a test tube filled with a nutrient-rich broth. After a slow start, the bacteria start to multiply and grow exponentially, with the growth eventually reaching a peak plateau, followed by a rapid decline caused by a lack of available nutrients and an excess of accumulated waste products. It’s a bleak picture, and one which would seemingly bode ill for the idea of infinite growth.

However, real life doesn’t take place under test-tube conditions. Real growth is not monopolized by a single species with homogenous needs across the population – it is asynchronous and diverse.

“Real growth is not monopolized by a single species with homogenous needs across the population – it is asynchronous and diverse.”

For a better model of this messy real-world scenario, let’s instead consider the development of a rainforest. When a piece of cleared rainforest is reclaimed, the grassland initially gives way to a few small bushes, followed by saplings which eventually grow into mature trees. To begin with, the growth curve will mirror that of the bacteria in the tube: with enough trees, the canopy closes, cutting off sunlight to the understory below and limiting further growth.

But here is where the pattern between ecosystem and artificial monoculture differs: in a rainforest, the limited resource has led to an astonishing diversity of plant species. From epiphytes in the canopy to fern fronds on the ground, plants have evolved countless ways to cope with the limited sunlight available and still be able to flourish. The competition has led to a thriving understory which in turn is able to support all manner of life. And the biodiversity itself results in an ecosystem that is more sustainable and resistant to existential threats like climate change.

“Economic growth needs to nurture diversity and innovation in order to be futureproof.”

Without growth, there is no development and adaption. But as with the continual growth of a rainforest ecosystem, economic growth needs to nurture diversity and innovation in order to be futureproof.

How do we foster diversified growth?

It seems clear we need to focus less on growth for the sake of growth itself, and more on the resulting diversification and health of the whole system. Increased productivity is not necessarily the sign of a healthy society – what we need are the transformational changes brought about by a competitive landscape that fosters innovation. This adaptive growth is vital for solving the many urgent problems being faced around the globe today.

This flourishing landscape is also where VCs like V-Bio Ventures have an important role to play. VCs often differ from larger investors in backing early-stage companies, promoting the growth of the metaphorical understory of the ecosystem which is so vital for the long-term health of the whole.

By delving deep into academic research and working together with scientists, we facilitate the development of innovations that benefit society and solve real-world problems. Doing so requires more than predicting sales numbers and cost prices, evaluating market predictions, and discounting future cashflows – in short, it requires more than quantitative measures of growth. Real success is better measured by the diversity of a flourishing ecosystem and the wellbeing of those within it.

Long COVID is a less talked-about aspect of the COVID-19 pandemic, yet its impact on society is already profound. Although this problem is still largely flying under the radar of the life sciences industry, a couple of first movers have already initiated clinical programs to address the condition. If more companies move into this space, long COVID may prove a catalyst for R&D in other related and underserved indications, like chronic fatigue syndrome.

Long COVID – also known as post-COVID-19 condition or post-acute sequalae of COVID-19 (PASC) – is a condition where a person fails to return to their baseline health after the initial acute phase of COVID-19 has passed. The list of associated symptoms is long with as many as 200 symptoms reported, the three most common being shortness of breath, cognitive dysfunction (also referred to as ‘brain fog’), and fatigue (reported in more than 50% of cases). The condition can be debilitating, causing physical incapacity due to severe fatigue, cardiac or respiratory dysfunction, neurological impairment, and psychological impacts.

“It has been estimated that a full quarter of people who contract the SARS-CoV-2 virus develop long COVID.”

It has been estimated that a full quarter of people who contract the SARS-CoV-2 virus develop long COVID, equating to tens of millions of people affected worldwide. Strangely, long COVID doesn’t seem to be restricted to the populations deemed most at risk for COVID-19 itself. In addition to the elderly or immunocompromised, the condition also occurs in those who are otherwise healthy and young, including patients who only had mild or no symptoms during the acute phase of their infection. Although children have a lower chance of developing long COVID, it still seems to affect 5-10% of those who contracted the corona virus, with longer-term implications for their health currently unknown. Initial statistics show that the proportion of people who have not fully recovered after 6-9 months ranges between 26-39%, creating an additional layer of complexity to the current global healthcare crisis.

Time to act

There’s clearly an urgent need for long COVID research and interventions – considering the large market and long-lasting nature of the condition, you would expect the life sciences industry to be highly motivated to develop targeted long COVID therapeutics. In reality, companies in this space have yet to receive government grants or VC investments.

Despite the lack of funding, a few first movers have publicly announced their entry into the field using repurposed drugs. US-based biotech Axcella is launching a Phase 2a clinical trial to evaluate its experimental drug AXA1125 in long COVID. Originally developed for Nonalcoholic Steatohepatitis (NASH), the company is hoping that AXA1125’s broad restorative effects on mitochondrial function and energetic efficiency can help long COVID patients experiencing exertional fatigue.

Mercaptor Discoveries is advancing its small molecule MD-012 towards clinical trials, targeting a protein involved in neuroinflammation and platelet aggregation – two things currently considered possible causes of the ‘brain fog’ experienced by many long COVID patients. Cryostem is also preparing an application for clinical trials addressing neurological dysfunction in long COVID, but using a stem cell therapy which the company is also testing on Post-Concussion Syndrome (PCS) to promote tissue regeneration.

“Diseases that share similar symptoms could serve as guiding stars for researchers.”

It may seem like a short list, but there have been many developmental roadblocks contributing to the scarcity of companies in this field so far. The medical definition of the condition was only made official by the WHO in October 2021, and we still have an incomplete understanding of the underlying pathophysiology and mechanisms of the condition, as well as a lack of biomarkers for clinical studies.

Progress is rapidly being made, however, with many research projects initiated this year to examine the disease mechanisms from different angles, including blood abnormality, immune dysregulation, and autoimmunity. The US government has provided the NIH with USD 1.15 billion in funding to study long COVID, and the UK’s NIHR has provided researchers with GBP 19.6 million to identify autoimmune antibodies, autoreactive T-cells, and biomarkers in long COVID patients. As these hurdles to progress are overcome, we expect more industry activity in this space.

Two birds with one stone

One of the crucial considerations in long COVID research and drug development is discriminating between true long COVID symptoms and those resulting from the acute disease itself. To crack the underlying mechanisms of the condition, we first need to exclude factors like long-term organ damage, the effects of an ICU-stay, and the mental distress brought on by the initial infection.

Diseases that share similar symptoms could serve as guiding stars for researchers. One example is chronic fatigue syndrome: also known as Myalgic Encephalomyelitis, this is a rare condition characterized by long-term, profound fatigue. As with long COVID, the cause of chronic fatigue syndrome is still unknown but is hypothesized to be triggered by a viral infection. Diagnosis and management of this syndrome may help determine the medical approach to long COVID.

Other areas under active investigation in relation to long COVID are immune dysregulation and autoimmunity. Notably, symptoms of autoimmune diseases such as multiple sclerosis also include neurological issues and fatigue. Acute infections with the mosquito-transmitted Chikungunya virus can also result in chronic autoimmune effects, including relapsing or persistent arthritis mimicking rheumatoid arthritis.

Long-term effects following acute viral infections – known as post-viral syndrome – have been documented in many other viruses, including the Epstein-Barr Virus (causing glandular fever, also known as mono), Cytomegalovirus, and even the original SARS-CoV. Altogether, there are many who may benefit from an influx of funding and innovation in the long COVID space, as new disease mechanisms and therapeutic avenues are uncovered which may be applicable in other conditions.

Opportunities for life sciences industry

With the end of COVID-19 nowhere in sight, and long COVID presenting a huge unmet medical need, we expect the few biotechs that have already entered the field to rapidly be joined by others. Progress in this space will not only affect long COVID, but also present opportunities for researchers and companies looking to tackle other conditions that share a common pathophysiology. Long COVID may serve as a catalyst to stimulate R&D and translational programs in fields such as chronic fatigue syndrome, providing new solutions for millions of patients.

Ghent, Belgium, 9 December 2021 – Corteria Pharmaceuticals, a French biotechnology company specialized in the development of interceptive therapies for heart failure subpopulations, today announced the successful completion of its Seed round, providing EUR 12 million to pursue the development of a series of programs in-licensed from Sanofi S.A. (Paris, France). The seed round was led by Kurma Partners and includes V-Bio Ventures, Omnes Capital, and InVivo Capital. As part of the financing, Thierry Laugel (Chair) and Peter Neubeck from Kurma Partners, Ward Capoen from V-Bio Ventures, Claire Poulard from Omnes Capital, and Luis Pareras from InVivo Capital Health will join the Board of Directors.

Despite current standard of care, heart failure continues to affect more than 60 million patients worldwide. Corteria’s R&D programs will address the full spectrum of heart failure deterioration and offer opportunities for developing transformative therapies for the treatment of worsening and acute decompensated heart failure.

Alexandre Mebazaa, Professor at Université de Paris (France): “Congestion is the main cause of repetitive hospitalization and poor quality of life in heart failure patients. Using a multi-parametric strategy, Corteria’s present development program will closely follow our patients to assess severity of congestion and benefits of these novel therapies in worsening heart failure.”

Ward Capoen, Principle at V-Bio Ventures: “Despite many advances, heart failure remains an immense burden on the health care system. We are delighted to join Corteria on its journey to bring new and highly effective solutions to the field.”

Philip Janiak, founder and CEO of Corteria, and former head of cardiovascular research at Sanofi: “We are proposing a new way for developing drugs in heart failure subpopulations, through an innovative patient stratification strategy and a better understanding of the human disease biology. In that respect, target selection has been based on human pharmacology and biomarkers to monitor target engagement in heart failure patients.”

Marie-Laure Ozoux, co-founder and CSO of Corteria, will be supporting the research effort toward drug candidate selection: “We are particularly excited to have nurtured Corteria in close working relationship with Philip and his team. Heart failure represents an incredible medical need that requires medical and pharmacological innovation as well as better patient stratification. We believe Corteria is very well equipped to address these challenges.”

V-Bio Ventures is an independent venture capital firm specialized in building and financing young, innovative life sciences companies. V-Bio Ventures was established in 2015 and works closely with Belgium-based VIB, one of the world’s premier life science institutes. The fund invests throughout Europe in start-up and early-stage companies with high growth potential focusing on technologies that provide transformational improvements in the biopharmaceutical, pharmaceutical, diagnostics and agricultural sectors. https://v-bio.ventures/

Founded in 2021, Corteria Pharmaceuticals is a privately held company developing first-in-class drugs in heart failure subpopulations. Our strategy implies innovative patient stratification and target selection based on human evidence and a better understanding of the disease biology in patients.

We are using cutting-edge methods to stratify the patients and identify those who will benefit the most from our treatments. Our focus is on worsening and acute heart failure. https://www.corteriapharma.