Ghent, Belgium, 7 September 2023 – Corteria Pharmaceuticals, a V-Bio Ventures portfolio company, is a biopharmaceutical company specialized in the development of transformative therapies for unaddressed heart failure subpopulations. Corteria today announced an oversubscribed EUR 65 million Series A co-led by US investment firm OrbiMed and EU-based leading investment firm Jeito Capital, with the participation of all existing seed investors (V-Bio Ventures, Kurma Partners, Fountain Healthcare Partners, Invivo Capital, and Omnes Capital). The funding will be used to advance Corteria’s cardiovascular pipeline into the clinic.

Heart failure is a serious disease with a prevalence of more than 60 million patients globally and still growing. Corteria’s innovative approach consists of selecting therapeutic targets involved in the worsening and acute forms of human heart failure, as well as a stratification strategy to identify specific subgroups that are most likely to benefit from the treatments. These forms of heart failure are widespread, life-threatening, and not directly addressed by the current standards of care.

Corteria was founded in 2021 by Sanofi’s former head of cardiovascular research, Philip Janiak, and Marie-Laure Ozoux, former cardiovascular project leader at Sanofi, around two cardiovascular programs in-licensed from Sanofi[1].

Since then, Corteria’s pipeline has expanded rapidly and today comprises three first-in-class therapies that are highly differentiated as they produce multi-organ benefits, acting on the kidneys, the vessels, and the heart:

The lead asset for Worsening Heart Failure is expected to enter the clinic in early 2024.

[1] CRF2 peptide agonist and AVP neutralizing monoclonal antibody programs

[2] Corticotropin-releasing hormone receptor 2

V-Bio Ventures is an independent venture capital firm specialized in building and financing young, innovative life sciences companies. V-Bio Ventures was established in 2015 and works closely with Belgium-based VIB, one of the world’s premier life science institutes. The fund invests throughout Europe in start-up and early-stage companies with high growth potential focusing on technologies that provide transformational improvements in the biopharmaceutical, pharmaceutical, diagnostics and agricultural sectors.

Founded in 2021, Corteria Pharmaceuticals is a privately held biopharmaceutical company developing first-in-class drugs in heart failure subpopulations. Despite some improvements in the management of this serious disease, the prevalence of heart failure keeps increasing with more than 60 million patients worldwide. Corteria’s strategy implies innovative patient stratification and target selection based on human evidence and a better understanding of the disease biology in patients with a focus on worsening and acute heart failure and right heart failure.

disposed of as the feedstock for fermentation bioreactors, we could speed the transition to a circular, low-waste economy.

“Precision fermentation has the potential to revolutionize many industries, including through food and chemicals production.”

In the battle against the climate crisis, precision fermentation presents a hopeful aid. Using microbes to create valuable materials, we can help to transform the global economy and shift away from harmful agricultural and industrial practices. However, despite the support of industry and Venture Capital cash, this field still faces many challenges. Though promising, we need further investment in this innovative technology before it can fully deliver on its potential for sustainable solutions.

Precision fermentation is, at its core, an advanced form of brewing: using microbes to create specific substances. More specifically, this revolutionary technology fuses traditional fermentation and precision biology techniques, genetically reprogramming microorganisms such as yeasts and bacteria with instructions to produce select proteins, fats, and other vital molecules. These genetically engineered microorganisms serve as tiny but efficient cell factories, bypassing the conventional methods of manufacturing and production to yield high-value products in a sustainable manner.

One of the remarkable aspects of precision fermentation is its ability to convert waste materials – such as agricultural residues and industrial by-products – into high-value chemicals, nutritious foods, and clean-burning fuels, transforming trash into valuable commodities. Using biomass that would otherwise need to be disposed of as the feedstock for fermentation bioreactors, we could speed the transition to a circular, low-waste economy.

“Precision fermentation has the potential to revolutionize many industries, including through food and chemicals production.”

Precision fermentation has the potential to revolutionize many industries, including through food and chemicals production. Using vats of microbes to produce high-quality proteins, fats, and other essential vitamins offers an alternative to resource-intensive livestock farming and environmentally taxing chemical methods. By tapping into these resources, precision fermentation holds the promise of mitigating deforestation linked to agricultural use, and reducing the reliance on animal husbandry and petrochemicals, thereby alleviating the strain on land and biodiversity.

Furthermore, the complex machinery inside the cell can facilitate challenging chemical transformations without the use of organic solvents or precious metal catalysts. Within the last decade, these metabolic technologies have even developed the potential to utilize carbon dioxide – a greenhouse gas responsible for climate change – as a feedstock to produce essential compounds. Thus, precision fermentation offers a pathway to minimize our dependence on expensive catalysts and petroleum. Replacing traditional methods of fuel production enables the generation of clean-burning fuels from renewable feedstocks. This would not only reduce greenhouse gas emissions but can also contribute to the diversification of our energy sources, fostering a more sustainable and resilient energy landscape.

From fragrances to biofuels

Myriad companies already exemplify the versatility and transformative impact of precision fermentation. Ginkgo Bioworks – now a giant in the biomanufacturing industry – employs microbiology to produce sustainable fragrances, flavor compounds, and cosmetic ingredients. Their approach – generating low-volume, high-margin compounds – is perhaps the most logical current means to capture value with precision fermentation, as it presents a scenario where microbial production can legitimately outcompete chemical synthesis.

Plenty of other companies also use precision fermentation for a range of substances. Perfect Day creates animal-free dairy products by fermenting microorganisms that produce authentic dairy proteins. Mycorena and Mush Labs use fermentation to produce mycoproteins for meat alternative products, while Clara Foods produces egg proteins for use in baking and mock omelets. Impossible Foods employs precision fermentation to produce heme protein, which gives their soy protein patties a meat-like appearance and taste. In the renewable energy sector, LanzaTech converts industrial waste gases into sustainable biofuels using precision fermentation.

“VC funding for precision fermentation in Europe peaked in 2022 with over EUR 350 million invested.”

These companies demonstrate the broad applications of precision fermentation across various sectors. With such enormous promise, investors have been getting onboard: VC funding for precision fermentation in Europe peaked in 2022 with over EUR 350 million invested. However, if the general trends of 2023 continue, we can expect to see a decrease in funding, with only a little over EUR 200 million invested. This is worrying to see, as early funding for further innovation is sorely needed, because the field still faces many challenges.

Hurdles on the path to true sustainability

The allure surrounding the future of fermentation is undeniably captivating. However, there are important considerations we need to address as we look to transform our production methods. At this point, the cost of precision fermentation compared to conventional techniques often results in higher-priced products, hindering widespread adoption and accessibility for consumers. One major hurdle is scaling up production to match or surpass the output of traditional methods. Currently we would require entire city blocks dedicated to fermentation facilities to meet the demand of even a small niche market. This casts doubt on the practicality of applications such as substituting cow meat with heterologous protein substrates in our burgers. The true solution might lie in reducing our consumption of meat instead.

“On all fronts, we need to ensure we are not simply trading one problem for another.”

Complicating things further, the energy requirements of precision fermentation pose a significant barrier, particularly for startups and small businesses. Bioreactor operation relies primarily on electricity, often produced using fossil fuels, as renewable alternatives can’t yet keep up with the high energy demands. Although this doesn’t negate the superior sustainability afforded by precision fermentation, it does mean that life cycle analyses are crucial if we are to accurately demonstrate environmental impact. Proclaimed valorization of agricultural side streams and waste must also be scrutinized, as they may drive up costs and rely on enzyme/substrate processing technologies that are not yet developed. On all fronts, we need to ensure we are not simply trading one problem for another.

A beacon of hope

Precision fermentation emerges as a powerful beacon of hope, poised to combat the ongoing climate crisis and mitigating the environmental impact of food, fuel, and chemical production. Positioned at the forefront of the circular bioeconomy, it spearheads the transition from linear to circular systems, harnessing the wisdom of nature itself.

However, in a relatively young industry with the tendency to greenwash and oversell, it is key for investors to discriminate projects early on that make little economic or energetic sense from those that hold potential. Recognition of the inherent shortcomings of this burgeoning field will push us forward to rise above the challenges. Cheaper substrate can lower initial costs for commodity production, but true transformation of industry requires improvements in processing, engineering, and purification technologies to make the whole life cycle greener. It behooves us to push ahead, pursuing a journey of discovery, as we unlock the potential to reshape industries and cultivate a sustainable future that benefits both humanity and the planet.

The recent approval of the obesity and diabetes drugs Wegovy, Ozempic, and Mounjaro has brought about big headlines, but are these treatments also leading to a shift in our perception of obesity? Obesity has long been seen as a failure of individual willpower, but it is becoming increasingly apparent that losing and keeping off the kilos is a more complex, biological challenge. These new drugs offer a first, rather simplistic solution to a complicated problem, yet perhaps they will lead to a much-needed revolution in how obesity is viewed and treated.

According to figures from the World Health Organization (WHO), obesity has reached epidemic proportions globally. The majority of people on earth now live in regions where overweight and obesity kill more people than hunger. In 2016, more than 1.9 billion adults were overweight, of which over 650 million were obese, corresponding to 39% and 13% of the world’s population. Overweight and obesity affects almost 60% of adults in Europe and over 70% in the US, with both proportions on the rise. Worryingly, this upward trend also applies to children, with the WHO labeling childhood obesity is one of the most serious public health challenges of the 21st century.

Upwards of 4 million people die each year as a result of being overweight or obese, but obesity is also related to many other diseases. Associated health consequences – well documented across myriad independent studies – include cardiovascular diseases (the world’s leading cause of death), type 2 diabetes, musculoskeletal disorders (including osteoarthritis), as well as sleep disorders and mental health issues. Moreover, being overweight or obese is linked with a higher risk of at least thirteen different types of cancers, including ovarian, breast, prostate, liver, kidney, and colon cancer. It all paints a rather large, bleak picture of the future if this epidemic isn’t addressed.

New drugs approved

Obesity is a chronic biological disease. This simple fact has long been accepted by scientists, but is only now finally becoming more widely acknowledged among the public and policymakers. For a long time, overweight people have been burdened with the stigma that they simply lack the willpower to eat less and exercise more. However, study after study have shown that it’s not simply about willpower: genetics contribute to obesity, and people’s metabolism and hormones often work against them as they try to lose weight. Unfortunately, changes in diet and exercise alone aren’t enough to achieve substantial and sustained weight loss.

Pharmaceutical companies have seen the growing demand for weight loss solutions and begun developing an arsenal of drugs. In particular, three recent FDA approvals have been gaining copious amount of attention: Wegovy (approved for weight loss, Novo Nordisk), Ozempic and Mounjaro (approved for type 2 diabetes, Novo Nordisk and Eli Lilly). The demand for these new drugs has been so high that off-label use of Ozempic and Mounjaro as weight-loss aides caused shortages for diabetes patients in early 2023 (worsened by viral celebrity endorsement).

“By reducing a patient’s desire to eat, incretin-mimetic drugs can lead to a startling amount of weight loss: 15-20% of the patient’s body weight, in clinical trials.”

Wegovy, Ozempic, and Mounjaro all belong to a drug class called incretin mimetics, which emulate the effects of the hormone GLP-1 (in Wegovy and Ozempic), or both GLP-1 and GIP (in Mounjaro). Incretin peptides like GLP-1 and GIP dampen appetite and increase satiety. By reducing a patient’s desire to eat, incretin-mimetic drugs can lead to a startling amount of weight loss: 15-20% of the patient’s body weight, in clinical trials. Proponents argue that these newly approved drugs offer a much-needed alternative to bariatric surgery, but the approval of these drugs has the potential for a much wider impact if they also help bring about a revolution in how we view and treat obesity.

Limitations and concerns

Obesity is a complex, heterogenous, and multifactorial disease. But surprisingly – and despite the epidemic gripping the world – the diagnosis, biological understanding, and healthcare management of obesity is still in its infancy. Critics of these newly approved drugs worry that their availability may tempt physicians to opt for an ‘easy’ treatment route, simply prescribing these new medicines without further analysis into the root causes of each patient’s weight gain. Unfortunately, we know that these underlying drivers are numerous and often overlapping, including an excess of insulin secretion, stress, sugar addiction, genetics and epigenetics, and early life experiences. These drivers also intersect and develop over time in response to environmental factors.

“These drugs are not curative… once patients cease taking the medication they regain, on average, two-thirds of previously lost weight within one year.”

Another issue is that the prescription of these drugs is currently based on a rather arbitrary qualification method: the patient’s Body Mass Index (BMI). This is a measure of a person’s body fat based on height and weight; a BMI over 25 is considered overweight, and over 30 is obese. While convenient and easy to measure, the BMI has several limitations when it comes to acting as a gatekeeper metric for treatment eligibility, including the fact that not everyone with a high BMI will necessarily develop metabolic disease, while some with a low BMI will.

More importantly, despite their efficaciousness in driving weight loss, these drugs are not curative – they do not address the underlying cause of patient’s obesity. Clinical studies showed that once patients cease taking the medication they regain, on average, two-thirds of previously lost weight within one year. Similarly, many of the improvements seen while on the medication (e.g. improved blood glucose and blood pressure), revert to baseline levels, leaving the patient hardly better off than when they started. Experts have already flagged that patients may have to keep taking these drugs for a lifetime to maintain their effects. However, there are as-of-yet no data on how the drugs affect people when taken over decades. This is especially concerning with Wegovy having been approved for the treatment of adolescents.

Another consideration is the cost. With the extremely high prevalence of overweight, the diabetes and obesity market could easily top the blockbuster sales of statins in the coming years – Pfizer CEO Albert Bourla estimates that the market will grow to staggering $90 billion by 2028. Prescribing these drugs to patients (simply based on their BMI) – with an annual price tag in the US of $13.000 – could soon lead to a significant strain on healthcare systems.

You say you want a revolution?

Despite their limitations, these recently approved obesity drugs are a first step in the right direction for patients’ health. They are helping to shine the spotlight on obesity as a highly relevant indication and a global public health concern. Competition is now mounting across the pharmaceutical industry, with several new incretin-like drugs in development in various company pipelines. The investment space is also wide open for more differentiated drugs that better address the root causes of obesity, help patients lose fat while maintaining muscle mass, and provide more affordable, sustainable, and curative solutions.

Potentially the most impactful thing these new drugs can do for us is to help shift the perspectives of the public, industry, and healthcare systems towards viewing obesity as a complex biological disease, rather than an individual issue of poor lifestyle choices and weak will.

Silicon Valley investment gurus have long promoted the idea that startups should ‘fake it till you make it’ to become successful. The infamous fall of Theranos is a perfect showcase of how this attitude can turn into a disaster. We take a closer look at this philosophy of exaggeration and weigh up the merits of ‘fact vs. fiction’ when life sciences entrepreneurs are dealing with potential investors.

Startup companies often face a ‘chicken or the egg’ problem: they need funding to develop product prototypes, but they need product prototypes to attract funding. ‘Fake it till you make it’ is a tempting proposition as it offers an enticing shortcut: by exaggerating, embellishing, or even fabricating proof-of-concept data, startups are able to get on the radar of investors. The aim is to set a positive cycle in motion: funding facilitates talent recruitment; talent enables the development of prototypes; prototypes are needed to raise additional financing – at which point the initial exaggeration/embellishment/fabrication that got the ball rolling is (hopefully) forgiven and forgotten.

A fallen unicorn

In the heyday of social media startups, ‘fake it till you make it’ was common advice doled out to new startups. Entrepreneurs were told they would be at a disadvantage if they didn’t deploy this tactic (as their competitors surely would). There is evidence that several current tech giants (including Uber) veered far from the truth and even flouted the law in their aggressive path to growth. But to date, no one has taken this tactic to more of an extreme than the fallen unicorn Theranos.

Founded in 2003 by then 19-year-old Elisabeth Holmes, health startup Theranos raised over $700 million from investors on the promise of a revolutionary blood-analysis technology capable of producing rapid and accurate results from a simple finger-prick sample. By 2014, the company had reached a staggering peak valuation of $10 billion. Alas, this value was built on false claims: the system shown to investors had been faked in the hope that the company’s R&D team would be able to turn it into reality later on. Theranos could never deliver the dreamed-up technology, and information from whistleblowers eventually lead to the demise of the company, and a fraud conviction for Elisabeth Holmes in 2022.

“Where exactly is the line separating acceptable hype from lies and fabrication?” – Willem Broekaert

Many consider Theranos to be an extreme outlier – an example of ‘fake it till you make it’ being taken far too far through an exceptional combination of charisma, dishonesty, and immorality. But can we prevent similar cases from cropping up, and where exactly is the line separating acceptable hype from lies and fabrication?

A fine line

The life sciences industry is regarded as fact-based and data-driven – due diligence from investors is notoriously thorough when examining startups with new technology ideas. However, when entire datasets are skillfully fabricated, it is not so easy to detect deception without access to insider information. This is why some investors request key proof-of-concept data to be generated or repeated by independent players, such as other academic laboratories or contract research organizations.

Of course, startups based on new ideas also need to be able to sell their story to grab the attention of investors. The investor pitch will typically contain both current information (such as underlying principles of the technology, supported by data and prototypes), as well as forward looking information about future versions of the technology, potential applications, and market prospects.

Fact vs. Fiction

When it comes to the current information, we advocate zero tolerance for any shade of ‘faking’. At this point, the line is the truth: any data shown should be real and presented in full transparency so as to be verifiable and repeatable. If entrepreneurs want investors to back their company, they need to engage with each other in a long-term relationship which requires mutual trust, respect, and sustained transparency. Presenting incorrect or misleading information is a very bad start, bound to derail that much-needed trust sooner or later. The life of a startup is full of roadblocks and setbacks, and trust is the glue that keeps the stakeholders together to navigate the difficult periods ahead.

That being said, we believe there is some room for artistic license when entrepreneurs are painting a rosy picture in their forward-looking information. Since no one can predict how the future will play out, there is no way to tell whether the promises will come true. The technology as it stands might very well evolve into future incarnations that allow for applications beyond what is currently possible.

It is natural – even desirable – that entrepreneurs are passionate and optimistic about the future of their company. They need to walk a fine line between selling their long-term vision with confidence and conviction, while not overselling it to the point where investors turn cynical and disengage. Our key recommendation is to clearly separate fact from fiction, and plainly point out all underlying assumptions being made. In this way, investors can verify future projections in the business plan and make up their own mind about how realistic they are. Then, if there is a match, they can confidently engage in a long-term trust-based relationship with the startup to help realize the entrepreneur’s vision.

Ghent, Belgium, 15 May 2023 – Dualyx NV, a Ghent based biotech developing next generation immune modulators, today announces that it has completed a €40 million ($44 million) Series A financing. The fundraise has been co-led by Fountain Healthcare Partners, Forbion and Andera Partners, with support from existing investors V-Bio Ventures, BGV, PMV, VIB, HTGF, and GFF. The funds raised will enable Dualyx to progress its lead autoimmune program DT- 001, as well as its pipeline of Treg candidates. Ena Prosser, Partner at Fountain Healthcare Partners, Juliette Audet, Partner at Forbion, and Aneta Sottil, Director at Andera Partners will join Dualyx’s Board as non-executive directors.

Dualyx’s lead program DT-001 targets the highly attractive TNF receptor 2 (TNFR2), widely regarded as a master control switch in immune modulation. Through state-of-the-art antibody development, Dualyx has developed an agonist to the receptor which shows highly selective activation of regulatory T cells (Tregs).

To date, promising results have been observed from pre-clinical research with DT-001 and investigational new drug (IND)-enabling studies have begun. DT-001 holds promise to be a game-changing treatment option for a broad range of autoimmune diseases. The funds will be used to progress Dualyx’s DT-001 program into its early clinical proof-of-concept phase. The company has a pipeline of additional Treg focused programs in early-stage development.

Alongside the financing, Bernard Coulie, CEO of Pliant Therapeutics, joins the company as Independent Chairman with immediate effect. Bernard brings with him a wealth of experience in founding and leading successful biotech companies.

“It’s clear to me that TNFR2 is a validated and exciting target for autoimmune therapies, and I am confident that Dualyx has all the ingredients for success with its lead program. I’m therefore delighted to join the Board as Chairman while Dualyx heads towards the clinic,” commented Bernard Coulie, Independent Chairman of Dualyx. “I look forward to working closely with Wouter, Luc and the rest of the Dualyx management team over the coming years.”

“Attracting the expertise and support of top tier investors to Dualyx highlights the potential of the work to date in our DT-001 program and more importantly, completes our high-quality international investor base. We extend a warm welcome to Bernard as Chairman and I am confident that the combined support of our new board will enable progress with our highly promising TNFR2 program, and ultimately our goal of addressing hard-to-treat autoimmune diseases,” added Wouter Verhoeven, CEO of Dualyx.

Dualyx was founded two years ago by CSO Luc Van Rompaey, in a collaborative model with Wurzburg University, Argenx, VIB, Ghent University and KU Leuven. The company has been supported to date by a EUR 7 million seed round from V-Bio Ventures, BGV, PMV, VIB, HTGF, and GFF.

Dualyx is a Ghent-based biotech company dedicated to the development of novel Treg based therapies to address the needs of patients with difficult-to-treat autoimmune diseases. The company was founded in 2020 by Luc van Rompaey in a collaborative model with Wurzburg University, Argenx, VIB, Ghent University and KU Leuven. Dualyx has developed a pipeline of highly promising immune modulating programs including DT-001, an antibody agonist program targeting the TNF receptor 2 (TNFR2) which is currently in IND-enabling studies. TNFR2 is widely regarded as a master control switch in for immunosuppression, making it highly attractive for Treg therapies. Dualyx also has a pipeline of additional Treg programs in early development. Dualyx is backed by a group of well-respected investors including: Fountain Healthcare Partners, Forbion, Andera Partners, V-Bio Ventures, BGV, PMV, VIB, HTGF and GFF.

V-Bio Ventures is an independent venture capital firm specialised in building and financing young, innovative life science companies. V-Bio Ventures was established in 2015 and works closely with Belgium-based VIB, one of the world’s premier life science institutes. The fund invests throughout Europe in start-up and early-stage companies with high growth potential focusing on technologies that provide transformational improvements in the biopharmaceutical, pharmaceutical, diagnostics and agricultural sectors. V-Bio Ventures’ cornerstone investor is the European Investment Fund (EIF). EIF’s contribution is supported by InnovFin Equity, with the financial backing of the European Union under Horizon 2020 Financial Instruments and the European Fund for Strategic Investments (EFSI) set up under the Investment Plan for Europe.

Corteria Pharmaceuticals is developing transformative therapies for heart failure subpopulations most likely to benefit from the company’s novel cardiorenal treatments. The company was founded in 2021 by Sanofi’s former head of cardiovascular research, Philip Janiak, and Marie-Laure Ozoux, former cardiovascular project leader at Sanofi.

Our heart is one of the most resilient organs in our body. But despite this extraordinary fortitude, heart failure is on the rise, currently affecting more than 60 million patients worldwide. It is in fact the only category of cardiovascular disease which continues to grow, in spite of the best efforts to address the problem.

Corteria Pharmaceuticals is tackling specific forms of heart failure using a unique strategy and approach. The French company in-licensed from two Sanofi cardiovascular programs.

“At Corteria, we are developing drugs to address heart failure subpopulations,” Janiak explains. “We have three programs in development: the first is focusing on worsening heart failure; the second on acute heart failure with hyponatremia; and the third on right heart failure. For each of these indications, there are no treatments currently approved, despite the high unmet medical need and growing number of patients.”

A strategy of stratification

The cardiovascular field – and particularly heart failure – has developed a poor reputation in the pharmaceutical industry, with the failure of many complex and large Phase III clinical trials. Corteria is however using a novel strategy to improve its chances of success.

“We know that heterogeneity in heart failure populations and lack of understanding of human disease biology have been contributing factors to failures in past trials,” says Janiak. “Instead of targeting broad chronic heart failure populations, we are attempting to stratify the patient population – identifying and defining the specific subgroups that are most likely to benefit from our treatments. This is possible thanks in part to our Phase 0 observational study that was just completed in worsening heart failure.”

“Instead of targeting broad chronic heart failure populations, we are attempting to stratify the patient population – identifying and defining the specific subgroups that are most likely to benefit from our treatments.” – Philip Janiak

The company’s lead program is a long-acting peptide drug for worsening heart failure, a condition characterized by shortness of breath, fatigue, swelling, and rapid heartbeat. As the heart becomes too weak to pump blood properly, together with kidney dysfunction, fluid builds up in the patient’s organs including lungs and legs. The condition is currently managed by administering a loop diuretic via IV to reduce this congestive build-up of fluid.

“Worsening heart failure is a life-threatening condition, and the current standard of care doesn’t address the root cause of the problem. One third of patients treated with diuretics will be readmitted to hospital with recurrent congestion within six months. This patient group is the subpopulation we are hoping to serve.”

The company is conducting a Phase 0 observational study to improve the probability of success of its Phase II study, which is aimed to initiate in 2025. “We are performing a deep phenotyping of this patient population to identify the residual congestion signatures that will be used to select the trial participants, including a range of parameters such as biomarkers, echocardiography data, and quality of the life evaluations,” Janiak explains. “It’s quite a new approach in the field, and it would provide effective treatments to the patients.”

A whole-body approach

Corteria’s second drug candidate is another long-acting peptide, under preclinical investigation for the treatment of right heart failure, as well as chronic diseases such as obesity and sarcopenia. Unlike these first two candidates, the company’s third program is a monoclonal antibody, used to treat acute heart failure with hyponatremia. Hyponatremia is a condition where the sodium level in the blood is too low, caused by elevation of the hormone vasopressin.

Patients with hyponatremia have a very poor prognosis, but they are extremely difficult to treat because the standard heart failure drugs – diuretics – may aggravate the hyponatremia. Doctors are forced to limit the patient’s water intake to deal with the issue. By neutralizing vasopressin, Corteria’s drug will normalize sodium levels while also reducing congestion. It is a unique approach: a first-in-class disease modifier.”

“The beauty of our products, and what sets them apart, is that they induce multi-organ benefits, acting on the kidneys, the vessels, and the heart.” – Philip Janiak

What unites these three different programs is that they are all employing multi-organ, broad approaches to tackling heart failure. The issue with many current heart failure drugs is that they are often quite organ selective. They are either cardiac-, renal-, or vascular-centric, and therefore fail to address complex conditions like worsening heart failure, which is a multiorgan failure syndrome. The probability of successfully treating such a cardiovascular situation will be low if you don’t target all of the organs affected by the disease. “The beauty of our products, and what sets them apart,” Janiak states, “is that they induce multi-organ benefits, acting on the kidneys, the vessels, and the heart.”

Funding for the future

When Corteria was founded in 2021, it raised a seed round of €15 million, complemented by a further €2 million in non-dilutive funding. The company is now in the process of raising a Series A, explains CFO Stéphane Durant des Aulnois:

“Our aim is to continue developing our three main programs, to bring our lead asset to the completion of Phase II, and our other two assets to the completion of Phase I, all by the end of 2025. Investor interest has been high, and we’ve also been receiving very positive feedback from both KOLs and regulators, who recognize the need for novel drugs in these specific indications.”

“It’s good to have this external validation from both the clinical and regulatory standpoint,” Janiak confirms. “It reinforces our confidence that our strategy and approach will make a life-changing difference to the many heart failure patients whose needs are currently unmet by standard treatments.”

Bankruptcy, closures, and layoffs – oh my! But it’s not all doom and gloom for the biotech boom. Innovation is still in demand, and although the VC landscape is changing, companies are still able to find funds.

The market environment in biotech has remained bumpy since last we wrote on the topic. The past few months have seen an acceleration in the number of companies announcing reorganizations and Reductions in Force (RIFs) to reduce cash burn and realign with a newfound austerity among investors. Morbidly, there are even dedicated websites where you can follow recent layoffs, like the Fierce Layoff tracker. It all paints a rather bleak picture.

However – and despite claims to the contrary – this is all a normal part of the market cycle. Over a decade of easy money and low interest rates have lulled us into a false sense of standard, but it is time to adjust our frame of reference towards the new old normal. High interest rates mean you can now get 4.5% on a 2-year treasury bill (up from 0.14% just 2 years ago), and the tightening of the belt is still ongoing. This means a shift towards less risky assets and away from equities (let alone private equities). VC investments have gone down as a result. Who wants to wait for a promising quantum computing startup to deliver, if you can get 5% in a triple-A corporate bond? As it turns out, most people don’t.

Bleak conditions

This shift away from risk has already had severe consequences for companies. Some of the organizations affected are those that that have been around for a long time and reinvented themselves time and time again, like Sorrento Therapeutics, which filed for bankruptcy in February. Even more striking are a series of high-profile companies that have raised inordinate amounts of money in the past few years through private financing rounds or IPOs. The list is long but includes: Rubius Therapeutics (exploring options after raising $200 million in an IPO not even two years ago); Redx (reverse merging into Jounce, a relatively new immuno-oncology darling); and Adaptimmune (merging with TCR2 to consolidate cash and assets in cell therapy). The layoffs have been rife as well: 90% for Magenta therapeutics; 70% for Neoleukin; 40% for Graphite, 25% for Aligos – the list goes on and is likely to grow in the months to come.

“The ‘end of easy money’ is also translating into the ‘end of optimistically propping up companies’ and tempering significant company spendings in others.” – Ward Capoen

The press releases associated with these dismaying announcements often come after disappointing clinical news. But it is also because the risk assessment of investors has changed, and it has subsequently become more difficult for companies to pivot after poor tidings, raising new money to continue operations. The “end of easy money” is also translating into the “end of optimistically propping up companies” and tempering significant company spendings in others.

An additional effect of this changing landscape is the recent sudden collapse of Silicon Valley Bank (SVB) and Signature Bank, and the close call for several other banks catering to VC-backed tech and biotech companies. SVB ended up in what we in Belgium would call a “Dexia scenario”: an asset-liability duration mismatch. The bank was buying long-duration mortgage-backed securities with the deposits of their private tech and biotech companies, who were raising record rounds and putting the cash in the bank. Of course these companies also spend money, but as long as they continued raising new rounds, the deposit base of the bank kept growing. The problem started when the fundraising slowed, and finally reversed at the end of last year. SVB started experiencing liquidity issues, as it could not wind down the mortgage-backed securities portfolio fast enough to keep up with the cash outflows. When the bank had to raise funds to buffer the balance sheet, the very public concerns of VCs triggered a run on the bank, which led to the banks failure and the FDIC stepping in.

A silver lining to the stormy clouds

As we have written many times in the past, these current conditions are not the end of the world, and even open up some opportunities. Has fundraising dried up? Absolutely not. Quralis just announced an $88 million Series B, and the new startup Aera Therapeutics (founded by Feng Zhang of CRISPR fame) just raised an eye-watering $193 million combined Series A and B with a stellar syndicate. Innovation is still in high demand.

Things on the M&A side are also decent, with announcements at the JP Morgan conference in January for three acquisitions each with about $1 billion upfront, of which two are commercial. Pfizer recently made a bid to acquire cancer company Seagen for $43 billion, and Sanofi is acquiring Provention for $2.9 billion for its commercial immune interception portfolio. It is clear from this activity is that the pharmaceutical sector is mitigating risk by acquiring commercial companies or programs with clear clinical proof of concept.

The night is always darkest just before dawn. Although there may yet be bumpy roads ahead, there is also a light on the horizon, and no need to despair.

Everyone in the investment business is familiar with the phenomenon of technology hypes. These trends tend to come and go like inevitable tidal waves, and it’s easy to get swept up in the furious rush. But should you go with the flow, or are you better off swimming against the tide of technology trends?

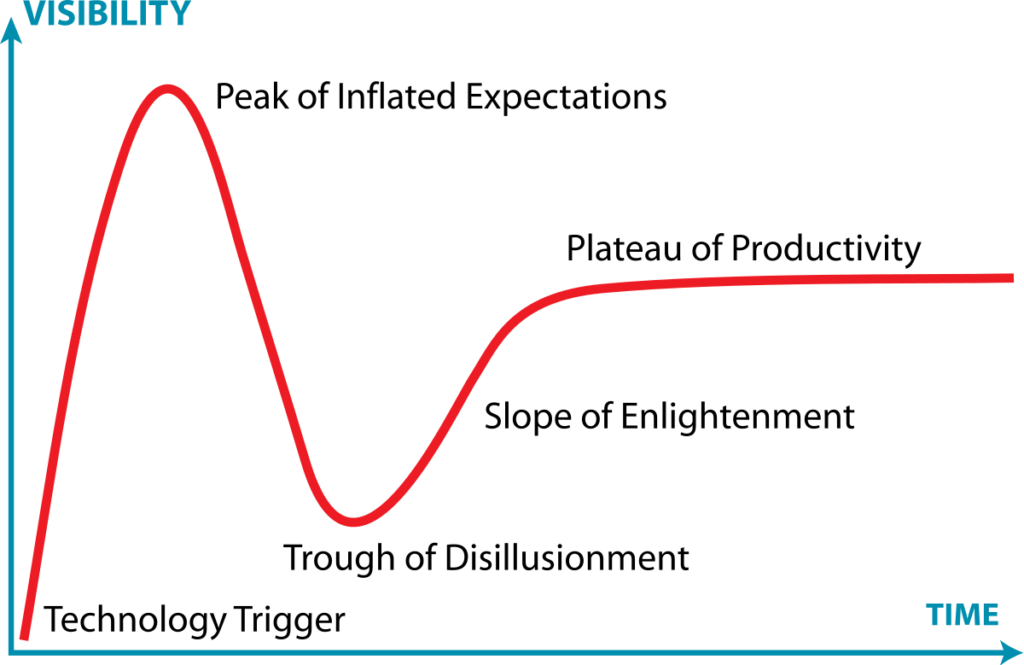

Gartner, Inc. – a consulting firm specialized in research on emerging technology trends in the IT sector – was the first to analyze how a technology hype cycle plays out. Typically, it follows a predictable pattern:

Image: Gartner Research’s Hype Cycle diagram (CC Jeremy Kemp)

Hype cycles in the life sciences

Although the Gartner Hype Cycle was initially conceived to describe trends in IT, the cycle applies to new technologies in the life sciences as well. Antibodies are a perfect example: today they are among the bestselling pharmaceutical drugs, touted for their efficacy and exquisite safety. But it wasn’t always smooth sailing. The start of the antibody hype cycle dates back to 1975, when the first monoclonal antibodies were initially generated. Unfortunately, this resulting first generation of antibody therapies came with unacceptable adverse reactions and rapidly waning therapeutic efficacy, because the antibodies were derived from mice and patient’s immune systems rejected them. It wasn’t until years later that the antibody humanization technique was perfected, and the first clinically and commercially successful drugs hit the market. The first successful humanized monoclonal antibody product Rituximab wasn’t approved by the US FDA until 1997, a full 22 years after the hype began. The monoclonal antibody space has since expanded exponentially – it is now valued at billions of euros and includes a wide range of indications such as oncology, infectious diseases, and cardiovascular conditions.

In the agriculture sector, an ongoing hype cycle was kick-started in 1999 when Dickson Despommier (a professor at New York’s Columbia University) shared his visionary ideas about vertical farming. The prospect of food production in an urban environment with reduced water usage and transport costs appealed to many – soon thereafter, investor money started pouring into the first vertical farming startups, such as AeroFarms back in 2004. AeroFarms even made it into the top 100 list of TIME magazine’s ‘Best Inventions in 2019’, yet a mere two years later, an anticipated SPAC financing had to be called off. Similarly, another high-profile VC-backed vertical farming startup called Fifth Season, founded in 2016, folded in 2022. The companies had both become victims of increased disillusion in the sector. Unlike monoclonal antibodies, vertical farming has yet to deliver on its promises. This technology still struggles with scaling complexities and high running costs, including the massive amounts of energy required to power the LED lights. Time will tell if these challenges can be overcome – vertical farming may yet become a significant contributor to our food chain, but more bankruptcies will likely occur before we reach that stage.

When is the best time to invest?

Now that we’ve identified the hype cycle pattern, what can early-stage life sciences investors learn from this? When is the best time to invest with the current trend, and when is it best to hold off?

Firstly, venture capitalists are usually attracted to the initial ascent of the hype curve. When the rumor mill starts to churn, investors often leap into action spurred on by an intense fear of missing out on a promising new technology. In their frenzy to obtain a slice of the cake, they often create even more hype, simultaneously transmitting an inflated expectation of success while downplaying potential difficulties to others. Negative as it sounds, this investment strategy may nevertheless pay off, particularly for those who manage to enter the game very early on. Often, these are investors who have pre-established links with the technology originators, and therefore learn of the breakthrough well before the buzz starts to spread. The benefit of investing with the initial startups pioneering a novel technology is that these companies are best positioned to strike lucrative deals with corporate leaders looking for new innovation. This allows the pioneering startups to fill their war chest and punch through in rougher times, while younger companies (though they likely have an easier time with initial financing thanks to the hype) struggle more when disillusionment shakes up the sector. The take-home message? It pays to keep a finger on the pulse in this industry, and get onboard very early.

“It pays to keep a finger on the pulse in this industry, and get onboard very early.” – Willem Broekaert

Interestingly, there is an alternative strategy that may also pay off: in some specific cases it can be worthwhile to invest in a company created during the hype’s descent into disillusionment or the ensuing recovery slope. These companies will often have learned from earlier setbacks and developed next-generation technologies that are better able to reach the threshold required for technical and commercial success. It is worth noting however that these startups will also face additional hurdles in raising funds, as they have to battle the negative perception caused by the failures of their earlier peers. Worth it? Potentially, but proceed with caution.

Obviously it is much easier to identify the phases of a hype cycle in hindsight than in real time, making it hard for investors who are wondering if now is the right time to invest in a trending innovation. Venture capitalists should always rigorously assess each case and situation, acknowledging that external perceptions will impact the perceived value of their investment as it moves through the hype cycle, while also bearing in mind that the most important element of success is ultimately the value of the innovation itself.

Ghent, Belgium – March 2, 2023 – Confo Therapeutics, a leader in the discovery of medicines targeting G-protein coupled receptors (GPCRs), today announced a worldwide licensing agreement with Eli Lilly and Company for Confo’s clinical stage CFTX-1554 and back-up compounds.

CFTX-1554, a novel inhibitor of the angiotensin II type 2 receptor (AT2R) currently in Phase 1 clinical development, represents a non-opioid approach to treating neuropathic pain, a devastating condition caused by damage to the nerves outside of the brain and spinal cord, and potentially additional peripheral pain indications. Current treatment methods are often insufficiently effective and can lead to serious side effects including addiction. Patients suffering from peripheral pain are therefore in urgent need of effective analgesics that are well-tolerated and do not impact quality of life.

Under the terms of the agreement, Lilly will continue the clinical development program beyond Phase 1. In addition, the agreement considers a program to further develop Confo’s existing therapeutic antibody candidates targeting the same receptor. Confo will receive a USD 40M upfront payment from Lilly as well as up to USD 590M in potential milestone payments per program and tiered royalties. Confo maintains a co-investment option to participate in the funding of future development programs after clinical proof-of-concept for additional royalties.

“We are pleased that Lilly, an expert in chronic pain with a wealth of experience in bringing novel therapies to patients, has recognized Confo’s ability to develop best-in-class GPCR drug candidates,” said Cedric Ververken, CEO of Confo Therapeutics. “CFTX-1554’s progression through the clinic will benefit from Lilly’s experience and global organization, while we will continue to develop and expand our growing, innovative pipeline of GPCR-targeted assets, both small molecules and biologics.”

CFTX-1554 is Confo Therapeutics’ first product candidate in clinical development and is a non-opioid approach designed to address peripheral (neuropathic) pain while avoiding centrally mediated side effects, such as addiction and sedation. The compound is a novel inhibitor of angiotensin II type 2 receptor (AT2R), a clinically precedented target for the treatment of neuropathic pain. Whereas previous compounds targeting AT2R have failed to reach market approval, CFTX-1554 is distinct in that it interacts more efficiently with the AT2R binding site, resulting in improved drug-like properties. CFTX-1554 is currently being examined in a Phase 1 first-in-human clinical study (ClinicalTrials.gov Identifier: NCT05260658).

Confo Therapeutics’ unparalleled technology stabilizes functional conformations of GPCRs (G-protein coupled receptors), thereby enabling the discovery of chemical or biological ligands that are conformationally selective. This platform combined with the pharmacologic and biologic insight it provides, allows Confo to build a multi-indication pipeline of drug candidates with the vision of transforming therapeutic outcomes for patients with severe illnesses lacking disease-modifying treatments. Confo Therapeutics was spun out of VIB-VUB (Vrije Universiteit Brussel) in 2015. Supported by international life-science focused investors and led by an experienced team of entrepreneurial professionals and scientists from successful biopharmaceutical companies, Confo Therapeutics benefits from the rich scientific and innovative ecosystem in Belgium.

For more information, visit www.confotherapeutics.com

V-Bio Ventures is an independent venture capital firm specialised in building and financing young, innovative life science companies. V-Bio Ventures was established in 2015 and works closely with Belgium-based VIB, one of the world’s premier life science institutes. The fund invests throughout Europe in start-up and early-stage companies with high growth potential focusing on technologies that provide transformational improvements in the biopharmaceutical, pharmaceutical, diagnostics and agricultural sectors. V-Bio Ventures’ cornerstone investor is the European Investment Fund (EIF). EIF’s contribution is supported by InnovFin Equity, with the financial backing of the European Union under Horizon 2020 Financial Instruments and the European Fund for Strategic Investments (EFSI) set up under the Investment Plan for Europe.

Coave Therapeutics is a French biotech developing gene therapies for neurodegenerative and ocular diseases. The company has developed a technology platform that can be used to redecorate the outer surface of viruses, creating gene therapy vectors that are better at accurately delivering healthy genes to the right target cells, including neurons in the deep brain tissue. By combining this vector technology with transgenes restoring natural cell cleaning pathways, the company has created a pipeline of therapies for both genetically and non-genetically defined neurodegenerative diseases, such as Parkinson’s Disease, Multiple System Atrophy (MSA), and Amyotrophic Lateral Sclerosis (ALS).

Q: Can you tell me about Coave Therapeutics and the ALIGATER™ (AAV-Ligand Conjugates) platform?

Rodolphe Clerval (Coave Therapeutics CEO): “The company was founded in 2015 as a spin-out from the University of Nantes and was previously named Horama. Initially it was a single-asset company focused on gene therapy in ophthalmology, but in 2020 we refocused on neurology, where our unique technology platform ALIGATER allows us to easily create viral vectors for extremely targeted gene therapy.

“If you look at the gene therapy field today, most of the products that have been approved so far use a specific type of vector called an Adeno-associated virus [AAV, ed.]. Those vectors have demonstrated some efficacy, but also a lot of limitations in terms of distribution and specificity, which have in some cases led to severe safety issues. There are many companies in the gene therapy field trying to develop better vectors, but most of them are currently using genetic engineering to slightly modify existing vectors. What we are doing with our next-generation vector technology is far more dramatic!

“Our ALIGATER technology is very versatile – theoretically we can use it to create a gene therapy for any type of cell in the body.” – Rodolphe Clerval

“The ALIGATER platform uses a pure chemical process to decorate the protein shells of viral vectors with specific small molecules called ligands. These ligands on the viral capsid bind to receptors on the outside of cells, ensuring that the viral vector is able to find and deliver its payload (i.e. the therapeutic gene) to the target cell in the right type of tissue. For example, we can modify an AAV capsid so that it is covered in ligands specific for neurons in the brain, or photoreceptors in the retina, or cells in the liver (and so on).

“Our ALIGATER technology is very versatile – theoretically we can use it to create a gene therapy for any type of cell in the body. We have in vivo data from animal models, including Non-Human Primates, demonstrating the superiority of our vectors in biodistribution and cell targeting, and since our technology uses just a single step to bind the ligands to the viral vectors, it is easy chemistry to perform at a large scale.”

Q: So you can use this technology to create new viral vectors, but can you also use it to alter existing ones?

Rodolphe Clerval: “Yes, that’s the other big advantage of the ALIGATER platform: we can use it to redecorate too! Say for example your company has already developed a gene therapy product using AAV, but you’re not entirely happy with the vector. Normally, you would have to go through the whole process of changing your entire capsid, which can take up to three years. This is hugely disruptive. Using the ALIGATER platform, we can instead redecorate the existing AAV, eliminating the need to screen for new capsids and saving a lot of time and hassle. This makes our platform very attractive for external partners.

“This is really the only technology currently available that can be used to improve viral capsids, generating a better gene therapy product from one that already exists.” – Rodolphe Clerval

“We have in fact recently signed three collaborations with Nasdaq-listed gene therapy companies. These companies came to us with their existing AAV products, complete with the transgene payloads. In just a few weeks, we were able to modify the capsids without otherwise changing the product. This is really the only technology currently available that can be used to improve viral capsids, generating a better gene therapy product from one that already exists.”

Q: Do you also have your own pipeline of candidate therapies, in addition to the ALIGATER platform?

Rodolphe Clerval: “We do. The most advanced candidate in our pipeline is a Phase I/II legacy program from the early days of the company – a product created using traditional AAV to treat an ocular disorder. Our other programs were created using the ALIGATER capsid technology and our own payloads and are advancing through preclinical studies.

“We’re very excited about these programs, which are all targeting neurodegenerative diseases at a really fundamental, preventative level. The hallmark of many neurodegenerative disorders is that you have an aggregation of proteins that occurs in the brain, leading to cell deterioration and death. Many companies have tried to target those protein aggregates with antibodies, to varying degrees of success. We have decided to take a different route by going upstream of the problem to stop aggregates forming in the first place.

“This is our approach: harnessing our ALIGATER capsid technology to create gene therapies that can precisely target neurons at a low dose, restoring their natural cell cleaning mechanism to prevent protein aggregation and cell death.” – Rodolphe Clerval

“There is a natural pathway in all of our cells called the Autophagy Lysosomal Pathway (ALP), which is the cleaning mechanism cells use to degrade proteins and rid themselves of plaques. In neurodegenerative disorders, this mechanism is dysfunctional, leading to the buildup of these toxic protein plaques, which in turn leads to the death of neurons. In some disorders, ALP dysfunction is caused by a mutation of a single gene, like the GBA1 gene in Parkinson’s Disease. In others, we’re not entirely sure why the mechanism isn’t working, but there is a master regulator of the pathway called TFEB that can be used like a master switch to restore the cell cleaning function.

“So this is our approach: harnessing our ALIGATER capsid technology to create gene therapies that can precisely target neurons at a low dose, restoring their natural cell cleaning mechanism to prevent protein aggregation and cell death. In Parkinson’s Disease we are doing this by targeting GBA1 in the deep structure of the brain – we’re expecting this program to be in the clinic by 2025. In non-genetically defined diseases like ALS and MSA we are targeting the master regulator TFEB, which may well be the future for gene therapy in neurodegenerative disorders.”

Q: Most gene therapies approved so far have been for diseases with a single target gene. Are your efforts to target non-genetically defined diseases a next-gen approach?

Rodolphe Clerval: “All gene therapies approved so far have indeed targeted monogenic diseases – relatively low hanging fruit where the issue was clearly caused by a single faulty gene. But over the last ten years or so, we’ve started seeing a few companies like ours entering the non-monogenetic space. Gene therapy has achieved a certain level of maturity, including in terms of vector technology, which is making this possible. This is where we really see a chance for widespread impact: in these big, non-genetically defined patient populations where the disorders aren’t caused by a simple genetic mutation, but millions of people can still benefit from gene therapy. I think this kind of strategy may well form a significant part of the future of the field.”