Octimet Oncology announced today that it has completed its series A investment round. The cancer start-up was able to secure €11.3 million from an investment syndicate led by V-Bio Ventures and Fund+. Other participating investors include DROIA Oncology Ventures and OMNES Capital. Founded in 2016, Octimet has licensed highly selective MET kinase inhibitors from Janssen Pharmaceutica and will focus on advancing the development of these molecules. MET is a popular for cancer drugs, since the receptor is mutated in a broad range of cancer types. The company can build on a strong existing pre-clinical and clinical data set originally generated by Janssen and licensed to Octimet together with the molecules. Octimet is based at the brand new JLINX facilities on the Janssen campus in Beerse, Belgium. Christina Takke, managing partner at V-Bio Ventures: “We are excited being part of this new venture. Octimet’s approach combined with new scientific evidence, a very strong clinical candidate and led by a seasoned management team enables the development of truly differentiated treatment options. This Series A closing supported by a well-diversified investor base is testament to both the quality of the assets as well as of the entire team.” Jan Van den Bossche, partner at Fund+: “We are convinced that Octimet is uniquely positioned to play a significant role in the development of new cancer treatments. The impressive dataset that was available and the experienced and highly motivated management team provided us the necessary comfort to support this exciting venture. Moreover, Octimet fits perfectly with our policy to develop a leadership position for the life sciences sector in Belgium.” Timothy Perera, CEO of Octimet: “We look forward to providing effective new treatment options for selected cancer patients backed by a highly engaged and experienced group of investors. Our long-standing experience in cancer drug development using innovative clinical development and biomarker strategies will allow us to rapidly generate clinical proof of concept for innovative drugs in areas of high unmet medical need.“

Mosquitoes are carriers of a range of crippling diseases, posing an enormous global health burden. Because current methods based on insecticides are inadequate, new tools are urgently needed. Widely different companies are tackling the problem of mosquito control from very different angles; who will be successful in getting a grip on these tiny flying terrors? A view by V-Bio Ventures.

Mosquitoes are carriers of a range of crippling diseases, posing an enormous global health burden. Because current methods based on insecticides are inadequate, new tools are urgently needed. Widely different companies are tackling the problem of mosquito control from very different angles; who will be successful in getting a grip on these tiny flying terrors? A view by V-Bio Ventures.

The field

While a tiger or a great white shark might seem like a more dangerous encounter, the most lethal animal on the planet is actually the mosquito. These little bloodsuckers cause about one million deaths annually through their transmission of various pathogens, including malaria, dengue, and the recently resurfaced zika virus.

Mosquitoes and the diseases they transmit are recognized as a global health threat by the World Health Organization (WHO), basically placing them on the top of the organization’s “most wanted” list. Scientists have been looking for efficient ways to control the insect population for decades. Current methods rely heavily on chemicals as insecticides, but next to high costs, resistance and worries concerning their effect on human health and the environment, the use of chemicals is unsustainable and inefficient in eradicating large groups of mosquitoes. An alternative would be the use of x-ray irradiation to breed sterile males (aka the Sterile Insect Technique or SIT), which was successful in controlling several agricultural pests. However, SIT significantly reduces the mating fitness of male mosquitoes. As SIT causes infertile males to provide little mating competition for the fertile males, the technique is rendered useless in mosquitoes.

The players

Luckily, companies ranging from smaller biotechs to technology giants are working on innovative ways to get a grip on the flying terrors.

One of those tech giants is the widely known Microsoft, which has been busy designing a new and improved mosquito trap. The trap is capable of encaging only a certain type of mosquito instead of the plethora of insects caught in conventional traps. Microsoft’s smart trap also tells researchers when the mosquito was trapped and what the temperature and humidity was when the critter was caught. By using these data, researchers can learn new aspects of mosquito behavior, hopefully helping us in our battle against them.

Second technology heavyweight in the mosquito field is reigning search engine champion Google. Their healthcare branch, Verily, is looking to use the bacterium Wolbachia as a form of mosquito birth control. When males infected with Wolbachia mate with normal females, the bacterium interferes with fertilization, preventing the development of offspring. A similar strategy is also being followed by MosquitoMate, which has already done some field testing with the technology.

More controversial is the approach of Oxitec. The Oxford-based biotech, acquired by Intrexon for $160 million, genetically engineers a lethal gene into male mosquitoes. In the absence of a specific compound, development is halted and the mosquitoes die. Thus, mosquitoes can be bred in the lab in the presence of this compound, but when the males pass this gene to their offspring in the environment, the offspring are not viable. However, public opinion is divided over the idea of releasing genetically engineered bugs into people’s back yards.

To circumvent the permanent genetic engineering, Forrest Innovations goes for an RNAi strategy—larvae are soaked in a solution containing double-stranded RNAs, which knocks down certain fertility genes. This technology creates sterile, non-GMO males without the regulatory hassle of GMO mosquitoes or the potential spread of Wolbachia bacteria. Additionally, Forrest Innovations is working on ways to distribute their mosquitoes. While spreading infertile fruit flies can be done using air drops, mosquitoes don’t survive the process. Forrest is now working on innovations to make the six-legged biters survive an aerial maneuver.

The race

Which company will be the first to come up with an economically viable, regulatory-approved, effective method to suppress mosquitoes’ spread of deadly diseases? The unusual mix of biotech companies and technology heavyweights makes this an interesting race to follow.

Perhaps the smaller, more flexible companies such as Forrest Innovations will be able to outsmart the larger players straying from their comfort zones. But who will fund these smaller undertakings? The risk and competition in the market make it more suitable for larger venture capital funds that can afford to place a bet, so they are the more obvious candidates.

An important challenge is the intended customer; public authorities will need convincing before allocating their funds to experimental approaches. But once they are convinced, companies can be assured of a steady income. Huge areas are at risk of mosquito-borne diseases, and considerable upscaling will be needed to cover them all.

Llama single-domain antibodies have found yet another application, one that Confo Therapeutics is fully exploiting. Ablynx is developing Nanobodies®, AgroSavfe focuses on Agrobodies®, and Confo will now use its Confobodies® to lock G-protein coupled receptors (GPCRs) into position. This enables the company to screen for small molecules targeting specific GPCR conformations, a most innovative approach to GPCR drug development!

GPCRs are a huge family of protein receptors. They are present on all cell types and are involved in numerous biological processes and diseases. Metabolism, cell growth, inflammation and immunity, neurotransmission, behavior: all are regulated by GPCRs. For this reason, the receptors are extremely popular drug targets. Approximately 30% of all existing drugs target GPCRs, amounting to tens of billions of dollars in annual revenue.

Currently, GPCR-targeting drugs are mostly antagonists, drugs that block GPCR signaling. In some diseases, however, a stimulatory therapy is needed to restore natural signaling. Unfortunately, developing small molecule GPCR-stimulating drugs, or agonists, has proven to be a huge challenge.

Freeze ’em, scan ’em, drug ’em

One VIB startup company now has the means to revolutionize GPCR drug discovery: Confo Therapeutics. The key element in the company’s technology? Llama single-domain antibodies. These became famous when Confo’s older brother Ablynx started to use them as therapeutics, calling them Nanobodies. Confo Therapeutics deploys its “Confobodies” in a very different way.

“GPCRs are incredibly flexible,” explains Cedric Ververken, CEO at Confo and former Vice President of Business Development at Ablynx. “Depending on their different shapes or conformations, different signaling pathways in the cell can be activated. The trick is to specifically activate the pathway of your therapeutic interest. By using single-domain antibodies from llama’s, or Confobodies as we call them, we can stabilize the GPCR in the desired conformation. Once we have achieved this, the frozen GPCR is used to screen small molecules for therapeutic effects.”

A practical example is the opioid receptor, a frequently used target to relieve pain. The use of opioids, such as morphine, is associated with a range of side effects, including constipation, respiratory distress and addiction. This is because these compounds activate multiple signaling pathways through the receptor. Confo can now use its technology to identify and freeze the state of the opioid receptor responsible for pain alleviation, and develop drugs that are specific for this conformation, eliminating side effects.

From technology platform to drug discovery company

As such, Confo Therapeutics owns an incredibly versatile technology platform. Of course it’s impossible for a start up to explore the entire range of possibilities of the platform because of restrictions on resources. So how does Confo pick the targets it wants to pursue? Ververken sheds light on the company’s portfolio strategy:

“First of all, we analyze where the technology has the most to offer. In which diseases or targets have traditional methods failed, and can we offer a solution? Secondly, we spread our risk. Only going after unknown or poorly characterized targets is incredibly risky. A last factor is the starting points we have from our lab of origin, the lab of prof. Steyaert at the VUB. We know that we can generate candidate drugs to those targets much faster than if we would start all over with completely new targets. Our portfolio is a healthy mix of known GPCRs where our technology can make a difference and new targets where we can do something truly innovative.”

In addition to a highly innovative technology platform, Confo Therapeutics is led and supported by an impressive team. As an expert in structural biology, founder Prof. Steyaert consults as scientific advisor to the company. Co-founder Toon Laeremans, Head of Technology, specialized in generating single-domain antibodies, and has years of experience at Ablynx and in the Steyaert lab, where the Nanobodies were initially discovered and where the Confo Technology was established. To bring drug discovery and development experience into the team, Confo was able to attract another A-list talent: Galapagos veteran Christel Menet. Menet led the discovery of Galapagos’ flagship molecule, filgotinib, and was appointed CSO at Confo. Moreover, CEO Ververken has more than 10 years of experience in both R&D and business development at Ablynx. It seems like this technology is in good hands!

The Venture Capitalist’s view

V-Bio Ventures was in contact with Confo since day one and has invested upon the first closing of the fund end 2015, when it joined the initial investors syndicate formed by Capricorn, QBic and SOFI, with additional investors VIB, MINTS (University of Michigan) and PMV. V-Bio Ventures holds an unshakable belief in the company’s potential:

“Confo’s profile is right up our alley. The company owns a breakthrough technology, which is broadly endorsed by the scientific community. By enabling drug development for previously undruggable targets, they bring significant added value to the already huge market of GPCR-targeting medicines.

We’re also convinced that the company employs a solid strategy to capture the value of the technology platform: building a pipeline of proprietary projects on the one hand and starting strategic collaborations with partners on the other hand.

Together with the management, we have developed a clear vision of the company’s trajectory and future, and we’re confident that the team behind Confo is more than able to make it a very bright future.”

Only one year after its inception, the life science investment fund V-Bio Ventures made its first investments in three companies and announced the final closing […]

Only one year after its inception, the life science investment fund V-Bio Ventures made its first investments in three companies and announced the final closing of their first fund. Time to discuss how V-Bio is going to put their €76 million to work!

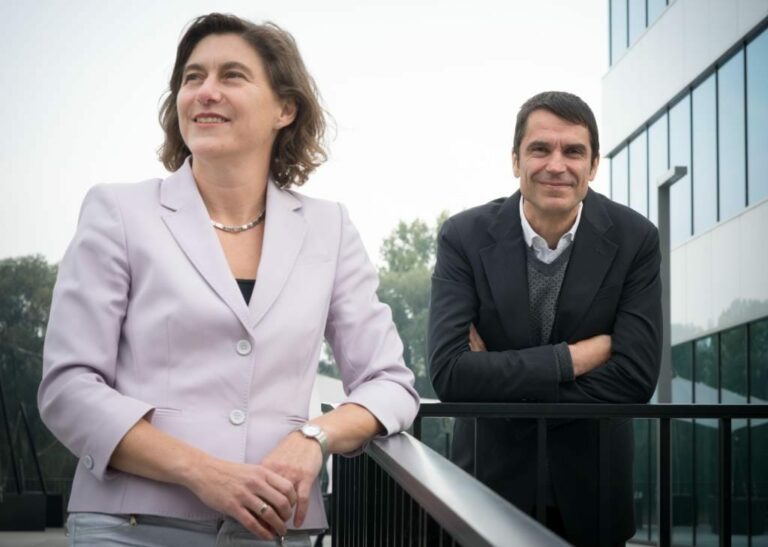

In November 2015, V-Bio Ventures announced the initial closing of its first fund. The specialized investor in early-stage life science companies had gathered €63 million from five investors. Only one year later, the fund announced its second closing, with four new investors joining the initial group. V-Bio’s proud managing partners, Christina Takke and Willem Broekaert, guide us through the fund’s first year.

Takke: “We were able to start investing from Day One and proved we could spot great opportunities. Our activities over the past year were a convincing factor for the second closing.”

We’re really excited that we were able to raise more capital than anticipated.

V-Bio manages €76 million and has cemented its position as one of the larger European early-stage funds in life sciences.

Takke: “We’re really excited that we were able to raise more capital than anticipated. Most comparable funds manage €30 to 50 million. With our fund, we can make a considerable contribution to early-stage investments and provide follow-up funding in different stages of a company’s trajectory.”

Broekaert: “The size of the fund and the sector in which you invest determine the number of companies in which you can invest. Biotech is very capital-intensive, but you still want to hold a significant stake in a portfolio company. Also, spreading of risk is an important factor. With the amount raised, we’re looking to build a portfolio of about 15 companies.”

An international view on investments

Our vision extends beyond the boundaries of VIB.

V-Bio Ventures has a close relationship with VIB; the research institute is a co-founder and minor investor in the fund. However, V-Bio doesn’t limit itself to investing in VIB spin-off companies.

Broekaert: “We have access to VIB’s proprietary pipeline of innovations early on. That is a unique position, and we are certainly building on the expertise of this world-renowned research institute. However, our vision extends beyond the boundaries of VIB.”

Takke: “We’ve built a portfolio of three companies over the last year. Confo Therapeutics and Orionis Biosciences both originated from VIB, while our third portfolio company, Oxular Ltd, was founded in the UK. These three investments show our pan-European strategy and exemplify the international attention our projects generate. We value investing in companies with different investor syndicates, and we’re proud to say that we’re the only European investor in Orionis.”

Investing is like getting married

When it comes to investing, V-Bio does a lot more than just put money on the table.

Takke: “Many funds invest in something that’s already there. We will actively help management teams build a strong company that’s also a good investment. Therefore, it’s very important that both management and investors see eye to eye and are behind all decisions 100%.”

Broekaert: “This is very important when we choose our projects. Teams need to be willing to work closely together with us, presenting all data, good and bad. Mutual trust is crucial. We are in it together, for better or for worse. Sometimes, we can get on board very early on and help to bring the management team together.

Teams need to be willing to work closely together with us, presenting all data, good and bad.

Of course, we can’t do this for every company in our portfolio. We will grow our portfolio with companies in which we’re involved from the very inception and others where we join when other investors have already stepped in.”

V-Bio reviews approximately 100 dossiers per year. Out of these, an average of approximately three projects will meet all criteria and become part of the V-Bio family. It’s a very young and dynamic team with an open-minded spirit. No time to lose, so take your shot!

Ward Capoen studied biology and subsequently obtained a PhD in biotechnology at Ghent University. He worked as a postdoctoral fellow at the John Innes Centre in the UK, to continue his career as a researcher at the prestigious Harvard University in Boston. He became more interested in the commercial side of biotechnology and decided to specialize in Business Administration with an MBA at Vlerick. This was a stepping-stone for his current career at Candriam as a Biotechnology Analyst.

Capoen took his first professional steps as a biotech analyst at Candriam Investors Group (the former Dexia Asset Management). Candriam manages over $100 billion in assets and among them a fund of $900 million that invests in public biotech companies. Ward helped to choose which assets to buy so that the fund could grow. He stayed informed on all of the latest developments by going to conferences, reading papers, following news updates and watching the developments on Wall Street.

Today, Ward uses his skills and experience at V-Bio Ventures, an early stage life science investment fund focused on investing and supporting small biotech start-ups.

Science behind the money

Although I work in finance, about 90% of my time is still occupied with science.

“As I am not specialized in one specific subject, I spoke with a whole range of companies on their latest innovations during my time at Candriam. This ranged from the pathology behind Alzheimer’s, to cardiac stem cells and eye diseases”, says Capoen. He also analysed the technical side of assets. “I’m looking for benchmarks on how to judge clinical data. These are different for every disease. For example, if the overall survival rate of people with a certain type of cancer is between 10 to 20% on current therapies, then, if the survival rate from a clinical trial is 40%, this is a good result and possibly worth the investment,” continues Ward. These benchmarks can, next to efficacy, be safety. For example, it’s interesting to know if a drug has 50% less side effects compared to another drug with comparable efficacy.

Is Europe running behind the USA?

The number one geographical player in the biotech sector remains the United States. “Funding and financing in the US is much better and bigger than ours. The sector is also more mature there. The first biotech companies in the US dates back to the 80s’. They have a larger pool of investors, scientists and experienced managers, but in Europe this is coming too,” says Ward, “within Europe, France has currently the most eye-catching biotech, but Belgium is not far behind. Companies such as Galapagos (Mechelen) and Ablynx (Ghent), both have very promising data.”

For once, we should not (yet) be afraid of China

“We keep an eye on China, but not much is happening there yet. Japan, in contrast, has a rich pharmaceutical tradition. It is the third largest market and should not be underestimated,” Ward states, “a lot of good molecules were discovered in Japan and marketed by Western companies.”

To NASDAQ or not to NASDAQ

“In the US there is more visibility and liquidity. The disadvantage of going to NASDAQ is that you have to do all the reporting according to US accounting rules and regulations. You need double accounting, one for the States and one for Europe. Being listed on NASDAQ is not always an advantage. A unpromising company will not suddenly outperform because it is listed in America,” argues Ward, “if you plan to set-up labs and operations in the US, then it can be an advantage to have a dual listing.”

Strong innovation and big prices are the fundaments of biotech

Capoen explains: “Of the total health care spending, only about 10 % is the cost for medication. The rest are medical and nursing costs. However, we now start to feel the pressure from the insurance company to get the price down, as certain classes of drugs are very expensive. For example, Gilead has a new drug on the market for Hepatitis C. There are millions of people with Hepatitis C and Gilead asked $ 85,000 per patient. So within one year, the reimbursement costs rose enormously. This drove the insurance company up the wall.” It is well-known that price competition can occur when different companies develop similar drugs. In contrast, when medication is developed for orphan diseases, there is very little competition and therefore no means for price negotiation. “Yes, but as the number of patients with an orphan disease is so low, the cost is reasonable in comparison to the total budget for health insurance.”

The more innovative and differentiated the drug is, the less

price pressure. The more pressure on pricing, the more pressure to innovate.

Biotech is less correlated to the broader market

The biotech sector is not as highly correlated with the overall market because it is less dependent on the macro economy. Ward Capoen confirmed: “Healthcare is a defensive sector because, unfortunately, it’s human nature to become sick sometimes. It is not the case that in times of financial crisis you sell less cancer drugs. Therefore, the biotech sector is less sensitive to economic conditions.” A biotech company does not borrow money from a bank because of its risk profile. Biotech companies focus on private equity. This has the advantage that biotech companies are less sensitive to interest rates. The biotech sector is now more stable and mature than a decade ago. “There are already dozens of companies that make a profit now. Fifteen years ago there were only a few,” concludes Ward, “the profitability of the biotech sector is growing faster than the overall market.”

V-Bio Ventures, the new Belgian fund for life sciences startups, is currently being managed by Christina Takke and Willem Broekaert. They both have a life sciences background and gained experience in finance before setting up this new fund. In this interview, they share with us their role in the fund, their view on the life sciences investment market, their personal ambitions and some good advice for starters.

Christina Takke studied biology in Germany, after which she obtained a PhD in Developmental Biology. She started her career in the non-profit sector at BioGenTech-NRW, where she evaluated business ideas and patent applications. Next, she moved to ABN AMRO to assess venture capital investments in life sciences, and she then continued this work at Forbion, a spin-off from ABN AMRO. Takke: “I am passionate about turning science into products. Education and research are to a large extent supported by public funding; therefore, it is important to focus investments on innovations that are highly relevant to society. V-Bio Ventures, as an independent investment fund, will play an important role in this respect.”

It is important to focus investments on innovations that are highly relevant to society.

Willem Broekaert is Professor at the KU Leuven in plant biotechnology. During the initial phase of his career, he performed fundamental research, but without losing his focus on applicability. He took part in the foundation of several spin-offs, supported by venture capital, such as CropDesign and Fugeia. Broekaert: “I am on the other side now when it comes to investments. During my career, I gained experience on how to select projects that are worth investing into. I feel privileged to be able to give the necessary support and chances to promising teams.”

What are the conditions for a startup to get funding from V-Bio Ventures?

Takke: “The company needs to be active in the field of therapeutics, diagnostics or green biotech in an early developmental phase. We verify the scientific support, such as publications in renowned journals. Often, startups are based on an innovative technology or platform and need money for the preclinical research and to collect confirmatory data. We help these companies to create a viable business plan, and provide mentoring and coaching to the young management team. When we fund a company, we become co-owner and continue contributing to the business by taking a seat on the board of directors.”

V-Bio Ventures was founded by the VIB. What does this connection mean in practice?

Broekaert: “A substantial part of the financial resources will be invested in VIB-related projects, either in direct VIB spin-outs or in projects for which we see a relevant cooperation or synergy with a VIB technology. Next to the VIB-related opportunities, the fund will also invest in promising projects derived from other sources without a particular link to VIB.”

Why is B-Vio Ventures also investing in foreign companies?

Broekaert: “The supply of new dossiers has to be vast, because we only want to invest in the best projects. We need many applications to be able to compare them and subsequently pick the best options.”

Takke: “By also looking abroad for new investments, we establish contacts with foreign investors, and reciprocally this can help to turn their attention to Belgium. In this way we aim to reinforce the local financial ecosystem and foster long-term growth. But first, we want to create a strong portfolio, a solid team and establish our name.”

Is it a smart choice for companies to install themselves in Belgium?

Broekaert: “I think it is. Compared to other countries such as The Netherlands, France and Germany, Belgium has a stronger biotech industry when measured on a per capita basis. On the one hand, this might make you think that the competition here would be too strong. But on the other hand, you might also look at our biotech industry as a self-reinforcing network. In Belgium, there are many people in biotech with a lot of experience in management, but also technical experts, IP specialists and regulatory professionals. Furthermore, the sector strongly benefits from the support of governmental institutions.”

You might also look at our biotech industry as a self-reinforcing network.

Takke: “Although Belgium is performing very well compared to other regions, the financial support for biotech startups is, in our opinion, not yet strong enough. For example, the amount of money that biotech startups in Scandinavia and Switzerland are able to raise is still higher. But we’re heading in the right direction, as more funds for startups, such as ours, are becoming available. Also, the strong biotech cluster here, as my colleague just mentioned, is very valuable.”

Are you also investing in the fund?

Broekaert: “Currently, Christina and I are managing V-Bio Ventures, but the team will grow to 5 people in the future. The management team personally contributes to the financial resources of the fund. We are pleased to make this commitment, because in this way we are aligned with our investors, and this ensures that we invest in opportunities in which we truly believe ourselves.”

What is your advice for starters?

Takke: “It is very important to know what your Unique Selling Points (USPs) are and how you can protect your market position and your IP. Next, you should openly discuss your idea with potential clients, people with whom you will cooperate and everyone who wants to hear about it.

Don’t stay in your ivory tower.

Companies can contact us via our website, by phone or meet us on conferences. You can also just call us for feedback. Get in touch with us and we will brainstorm with you. You might have an idea and maybe we see an opportunity to develop it, perhaps in combination with something else. One plus one is three. Don’t stay in your ivory tower.”

After an initial closing in November 2015, V-Bio Ventures now expands its already impressive investor roster and establishes itself as one of Europe’s largest early stage life sciences investment funds.

The Ghent-based life science fund V-Bio Ventures has announced the final closing of its first fund. While the fund was already up and running in November of last year, the team has now further increased its capital to manage a total of €76 million. New participants in the fund include UGent, Gimv, BNP Paribas Fortis Private Equity and federal investment vehicle FPIM/SFPI. They complete the already existing supporters Korys, ARKimedes, KULeuven and the European Investment Fund (EIF).

V-Bio hasn’t been idle in its first year: the fund has invested in three promising young companies. Orionis Biosciences and Confo Therapeutics are two spin-outs from VIB, exemplifying V-Bio’s close relationship with the research institute. UK-based eye specialist Oxular Ltd (formerly Precision Ocular Ltd) was identified as a third opportunity.

Also the fund’s team expanded since last year. Ward Capoen joined from Candrian Investment group while Katja Rosenkranz, originally from Munich and with extensive tech transfer experience, gives the team some international flair. Together with Managing Partners Christina Takke and Willem Broekaert, they form the team of seasoned professionals behind V-Bio Ventures.