In this month’s article we take a look at Aphea.Bio, a V-Bio Ventures portfolio company. This startup is developing microbiome products for improved crop growth and pest protection, using state-of-the art technology.

By Amy LeBlanc. Header image: Dr. Steven Vandenabeele (CSO) and Dr. Isabel Vercauteren (CEO), courtesy of Aphea.Bio.

The microbiome has been a hot topic in the life sciences for the past few years. Usually, the headlines focus on human gut bacteria, but did you know that plants have a microbiome too? Enterprising companies are tapping into these pre-existing relationships between microbes and plants to come up with new sustainable solutions for agriculture.

At the forefront of this effort we find Aphea.Bio. Based in the Zwijnaarde Science Park near Ghent, Belgium, the company operates a smart R&D platform. In their lush laboratories, the Aphea.Bio team are searching for soil microbes that are beneficial to crops.

“We are convinced that there is potential in the ground… Our mission is to provide farmers with innovative and sustainable solutions to reduce fertilizer and pesticide use.” – Isabel Vercauteren, Aphea.Bio

The team is looking for strains or consortia that can help plants defend themselves from pests (bioprotectants) and those that can help promote plant growth through improved nutrient uptake (biostimulants). For now, the main focus is on wheat and maize.

The company is led by Dr. Isabel Vercauteren (CEO) and Dr. Steven Vandenabeele (CSO). According to Vercauteren, Aphea.Bio’s main goal is clear:

“We are convinced that there is potential in the ground. We know that certain microorganisms can stimulate growth or fight pests. Our mission is to provide farmers with innovative and sustainable solutions to reduce fertilizer and pesticide use.”

Dirty discoveries

Named after a Greek goddess of agriculture, Aphea.Bio was founded in 2017 as a spin-off of the VIB, Ghent University and KU Leuven. The company has raised about USD 10 million in funding so far, with V-Bio Ventures as one of the main investors.

The research is supported by both academic partnerships, including Prof. Sofie Goormachtig’s plant biology lab (VIB-Ghent University) and Prof. Jeroen Raes’ microbiome group (VIB-KU Leuven). The company also has an R&D partnership with global fertilizer company EuroChem.

“We invest a lot of our effort and resources into state-of-the-art technology, innovation and automation. We are always thinking: can we do this quicker, better, or more efficiently?” – Isabel Vercauteren, Aphea.Bio

Aphea.Bio’s CSO, Vandenabeele, explained their R&D process:

“The first step is gaining insight into the very complex microbiome of soils and plants. There are thousands of different species of microorganisms in the soil that potentially interact with plants. We grow our target crops, wheat and maize, in soils that each contain a different microbiome and identify the microbial strains that have a beneficial effect using metagenomics.

Once we have these candidate strains, we test them in our greenhouse or our growth chambers and we monitor these in a high-throughput way based on the phenotypic characteristics such as the plant growth speed, greenness and biomass or reduced disease development.”

This discovery process is made possible through a state-of-the-art greenhouse, which includes an automated phenotyping platform. Using a flying camera that produces 3D images of the plant biomass, the growth and health of every plant in the 600 square meter greenhouse can be measured in just a single day. Speaking of this automation, Vercauteren commented:

“We are a smaller company, still a startup, but we invest a lot of our effort and resources into state-of-the-art technology, innovation and automation. We are always thinking: can we do this quicker, better, or more efficiently?”

Navigating half-formed regulations

Enabled by smart tech, the company’s high-throughput approach and broad pipeline discriminates it from other companies in the same space. The Aphea.Bio’s proprietary strain culturing methods allows them to culture unique strains that have never before been isolated. This means there is a high degree of novelty and diversity in the strains that are isolated, which are patented either as individual strains or as consortia.

“We’re striving for results that equal those of current chemical fertilizers and pesticides. If our products prove to be as efficient as the chemicals, they can be used as stand-alone products”. – Steven Vandenabeele, Aphea.Bio

Asked about the regulatory challenges associated with developing a “living product”, Vandenabeele replied:

“There are different routes through regulation depending on the region where you want to market your product. In the US, there are specific biopesticides regulations which clearly define the path for bioprotectant microbials. In Europe, they’re currently reviewing the regulatory process for these types of products. For biostimulants, things are still unclear in both the US and the EU. There is work to be done on both continents, but the regulations do seem to be crystallizing.”

Growing funds for sustainable products

Aphea.Bio started field tests for their first candidate products earlier this year. Though the data are still under further analysis, Vandenabeele stated that they have seen significant effects:

“We’re striving for results that equal those of current chemical fertilizers and pesticides. If our products prove to be as efficient as the chemicals, they can be used as stand-alone products. Alternatively, they could form a part of an integrated pest control or fertilizer program.

We are now in the field validation step and working hard on our formulations. We still need a number of repeated field seasons, but we’re aiming for first product on the market in the next few years.”

To support this shift towards product development, Aphea.Bio are currently fundraising, looking to close the new round early next year. The funds will be used expand the company’s portfolio and product development.

The Aphea.Bio credo “Applied Nature for better Agriculture” perfectly encapsulates the growing move towards innovation and creative solutions for a more sustainable global food system.

This article was authored by Christina Takke from V-Bio Ventures.

In this follow-up to a previous VC Views article, V-Bio Ventures takes a look at several questions that were generated by readers. The VC firm carried out a study of the gender composition of investment teams and the impact of these ratios on investment decisions, reflecting on some strategies that might help women with executive ambitions reach their goals.

In our March VC Views article, we turned the spotlight on the gender gap in biotech funding. Management teams of venture-backed start-up companies are often predominantly male, despite evidence that companies with mixed management teams consistently outperform those with men-only C-level suites, and we wanted to know why.

We concluded our article by looking at the gender ratios of the venture capital firms (VCs) that evaluate the pitches from the entrepreneurs, examining the link between the gender of the investment managers and investment in male-led companies.

To our surprise, this article generated a lot feedback and follow-up questions. A couple of readers had a hypothetical query: if women were to dominate investment groups, would this lead to an overrepresentation of portfolio companies with female-fronted management teams?

These reactions indicate a general interest in the impact of gender diversity in the investment sector. As the Biotech Venture space is the most familiar to us, we took these questions and dug a bit deeper.

A male majority

To get a better grip on this topic, we decided to analyse some real-life data from the European Investments Fund (EIF). Our analysis is based on 28 of the most recent EU Biotech/Life Sciences VC funds financed by the EIF, from 2008 to 2018, where there was public information available on the composition of the management teams.

For the purpose of our analyses, we defined the senior investment professionals as those carrying the titles of either managing partner, general partner or investment partner. Later, we decided to include also investment professionals at the level of principal. In the first analysis, using only partners, 13% of the cohorts were female. When we added the principals, the proportion increased to 18% female investment professionals.

The 13% average was driven up by a handful of funds where the female partner ratio was over 40%. These outliers masked the majority of funds (57%) without a single female senior partner in their investment team.

It bears mentioning that the 13% average was driven up by a handful of funds where the female partner ratio was over 40%. These outliers masked the majority of funds (57%) without a single female senior partner in their investment team. Even if including the principal level, the percentage of funds without any women in senior positions was still 39%.

The gender proportions weren’t quite as extreme when we examined the few EU corporate VC funds in the healthcare sector. In this group, the proportion of female senior partners reached 27%, even reaching a high of 38% when the principle level was added. The skew towards men was still present though.

Why are there more women in corporate funds?

The investment teams of corporate funds seemed better able (or at least, more willing) to attract and promote female talent than the teams of purely financial VC firms. We wondered why this might be?

There were a few reasons we identified as potential contributors to a more even gender balance in corporate funds. Firstly, large corporate organisations have implemented gender equality policies in their personnel search strategies, which trickles down to their venture organisations. Searches deliberately targeting both genders tend to result in more diverse teams.

Secondly, young, ambitious women may be receiving more opportunities to develop their talent within a larger and more structured organisation, where there are clear career paths and development programs. Once the first few career steps have been taken within these large corporations, the jump to a more entrepreneurial Venture organisation might appear less challenging. Many partners in corporate VC firms are recruited from either within the parent organisation itself, or from their competitors. Previous achievements within a larger organization works to build trust in a job candidate, increasing their chances of recruitment.

Young, ambitious women may be receiving more opportunities to develop their talent within a larger and more structured organisation, where there are clear career paths and development programs.

A third factor may be that there is a higher senior staff turnover at corporate VC funds, as senior partners are less bound by golden handcuffs. The result is that new talents, including women, are allowed to climb up the ladder faster. Senior partnerships in classical VC funds, by comparison, tend to remain steady over multiple funds, limiting positions for newcomers and prolonging the rectification of the historic male bias.

If men fund men, do women prefer to fund women?

We established that investment teams tend to have more male than female members. But does the gender balance of these teams really have an impact on investment decisions and portfolio composition?

To answer this second question, we went back to our analysis above and examined the gender composition of the C-level suites of the active portfolio companies from the funds with the highest percentages of female investment partners. Many studies have found that male-fronted companies are more likely to obtain funding than equivalent female-fronted companies. We wanted to know if investment teams with a higher proportion of women were more likely to invest in companies with women in their executive management.

It could be that there is an implicit bias against female-fronted start-ups by both female and male investors, with both preferentially investing in start-ups with male teams.

We didn’t find any bias in our analysis, in the sense that a higher proportion of female investment professionals did not appear to be linked to an increased number of investments in companies with women in their executive teams. However, women were still in the minority on these investment teams, and we were simply using the presence or absence of women in the C-level suites for our measurements. From these results we cannot really draw any conclusions about the bias of female investors. Even if our results did hold up in a more rigorous study, it could be that there is an implicit bias against female-fronted start-ups by both female and male investors, with both preferentially investing in start-ups with male teams.

Admittedly, our analysis also had some shortcomings. We were dependent on the online information that the companies have made publicly available. When performing the analysis, we only included individuals with ‘Chief’ in their title. When delving deeper, we realized that many of the second and third individuals named and pictured on the companies’ websites are in fact women, but only a very limited number of these women have been given a title including the word ‘Chief’. We assume these individuals are mentioned on the websites because they are important to the success of their companies, so why are the C-titles predominantly reserved for men?

Closing the funding gap

Is the gender gap in funding influenced by the lack of women on investment teams? Likely, yes. Our analysis did not support the idea that investment groups with more women would disproportionately invest in companies with female-fronted management teams. However, this just raises further questions as to what the underlying causes of the gender gap in funding might be.

Both men and women need to examine their own biases and strive for equal opportunity for everyone.

One thing is clear: climbing the corporate ladder is challenging for women both in investment and life sciences companies. In order to achieve a better gender balance in both industries, we need more structured career paths and professional support. Opportunities for young talent in the Venture Capital industry would also be helpful. Perhaps most importantly though, both men and women need to examine their own biases and strive for equal opportunity for everyone. Change is slow to come, but with a concerted effort we can close this gap.

The newest generation of ground-breaking gene therapy drugs, Zolgensma and Zynteglo, come with eye-catching price tags of more than a million dollars per treatment. Is the pharma industry recklessly overstepping a line here, or do they fall within current standards of value-based drug pricing? With more of these drugs soon to be rolling out of pharma pipelines, the stakes are rising high for patients, industry, governments, health insurance companies, as well as investors. It all warrants a deeper dive into the case.

Lifesaving therapies

Gene therapy has been on the market since 2012, albeit with little commercial success so far. This is likely to change now that two novel drugs with blockbuster potential have entered the scene.

Zolgensma is a life-changing gene therapy aimed at treating infants with Spinal Muscular Atrophy (SMA), a disease caused by bi-allelic mutations in the SMN1 gene. Zolgensma has the potential to expand the lifespan of these patients from less than 2 years to well into adult age. Novartis launched the product in May 2019 in the USA at a price of $2.1 million.

The other drug, Zynteglo, will initially be launched in 2020 in Europe by Bluebird at an estimated cost of about €1.6 million. Zynteglo is aimed at a subgroup of patients with transfusion-dependent ß-thalassemia (TDT), due to a mutation in the beta-globin gene. This makes them dependent on lifelong chronic blood transfusions for survival, at the risk of progressive multi-organ damage due to iron overload. Zynteglo adds a modified beta-globin gene into the patient’s own hematopoietic stem cells, enabling production of hemoglobin in the body at sufficient levels to allow independence from constant blood transfusions.

Is the treatment worth the price?

Although these product’s prices look outlandish at first sight, they have been relatively well-received by the health community. To understand why, we need to remind ourselves that gene therapies have the potential to provide a lifelong cure with a single treatment. So, the price needs to be spread over the number of years that the patient benefits from the treatment.

For the treatment of SMA, there is only one other approved drug: Spinraza, an antisense-oligonucleotide from Biogen. Spinraza has to be continually administered via three intrathecal injections per year, costing $750,000 for the first year, and $375,000 for each subsequent year. If Zolgensma is effective over a ten-year period, the cost per year would be $210,000. This is still a significant amount, but within the ‘normal’ range for disease-modifying treatments of rare diseases.

Comparisons aside, is this high price justified by the value the treatment brings to the patient? In Europe, this question is typically addressed by governmental Health Technology Assessment (HTA) agencies like NICE in the UK or IQWiG in Germany. In the USA, the HTA role is mainly filled by ICER, which is an independent non-governmental organisation that wields increasingly strong influence on decisions of health insurance payers.

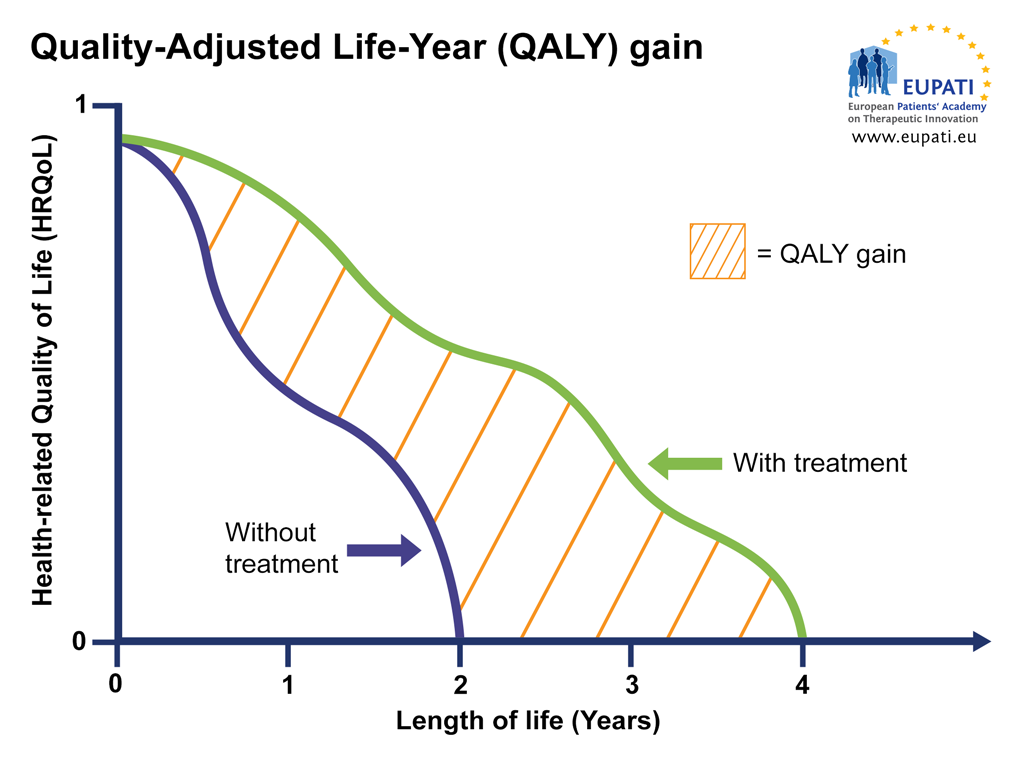

HTAs are continuously refining health economics models to establish the cost-benefit ratio of drugs based on objective criteria. At the centre of these models is the concept of QALY (Quality-Adjusted Life-Year), which attempts to capture the impact of a treatment on both the patient’s length of life and health-related quality of life.

Image: QALY attempts to represent the impact a therapy has on the length of life while also taking into account any changes in the health-related quality of life (HRQoL). HRQoL is calculated on a scale where 0 = ‘death’ and 1 = ‘perfect’ health. This means that, for example, 4 years at perfect health is 4 x 1 = 4 QALY, but 4 years at sub-par health is 4 x 0.5 = 2 QALY (image courtesy of EUPATI).

ICER’s standard model for assessing cost effectiveness of a treatment uses a threshold of $150,000 per QALY, and $500,000 for ultra-rare diseases. Using these metrics, ICER established that Zolgensma is cost effective at the $500,000/QALY threshold, even if it would be priced at $5 million, well above the actual $2.1 price mark. For Zynteglo, NICE’s assessment report is expected by mid 2020.

Meanwhile, Bluebird has performed its own health economics study and insists that the anticipated €1.6 million price tag is below the cost-effectiveness standard $150,000 per QALY cost-effectivity threshold, even without factoring in offsets in supportive care costs for the patient. This is in marked contrast with many of the newly launched conventional drugs treating orphan diseases. According to ICER, for instance, the small molecule drugs Symdeko and Kalydeco, both cystic fibrosis treatments from Vertex, would have to be sold at half their price in order to reach the $500,000 per QALY threshold.

An innovative pricing model

One differentiating feature of gene therapy is that the treatment is typically given once rather than continuously at regular intervals. This brings dilemmas to gene therapy developers: should they charge for the therapy immediately, or in instalments? What happens if the treatment is paid for, but isn’t effective or loses efficacy over time? Should the patient get a free repeat treatment if the therapy wanes before a certain date?

For Zolgensma and Zynteglo, both Novartis and Bluebird have chosen a payment model with annuities over a 5-year period. Additionally, in Bluebird’s payment model for the European launch of Zynteglo, the vast majority of the annuities will be performance-based. In total, 80% of the drug’s cost will be contingent on the patient’s continued response during the first 5 years of the therapy. Although Novartis also claims to be in favour of such model, a maximum 17.1% of Zolgensma’s $2.125 million price in the USA will be performance-based, due to current limitations pertaining to Medicaid’s ‘best price’ rule.

Zolgensma and Zynteglo show that it is possible to introduce an innovative pricing model that is both value and performance-based, even for a therapeutic modality that is more complex than conventional drugs. Novartis and Bluebird have broken away from the old pharma company habit of setting the prices of game-changing drugs at the highest possible level, regardless of value and performance.

Multiple companies will soon be ready to release new gene therapies from their well-filled pipelines. If these companies copy the Zolgensma and Zynteglo models, these performance-based modalities have a good chance of becoming firmly rooted over the next decade.

Drug development is an exorbitantly expensive endeavor. A large expense factor for developing a new therapy is the high cost of conducting clinical trials. Why are clinical trials so insanely expensive to run? And what can be done to increase the affordability of these trials?

The last decade has seen the launch of multiple innovative drugs that have brought major therapeutic benefits to patients. However, these new therapies often come with a hefty price-tag: in 2012, for example, 12 out of the 13 newly approved cancer drugs were priced above $100,000 USD. These exorbitant drug prices are often caused by sky-high development costs.

According to Tufts Centre for the Study of Drug Development, the average cost of bringing a drug to the market is estimated at $2.6 billion. Most of these expenses can be attributed to the multiple clinical trials required, with each trial usually costing a company between $2 – $600 million.

Why are clinical trials so expensive?

The more patients needed, the more expensive the trial. The cost therefore varies considerably according to stage as less patients are needed earlier in the process: 5-50 patients for a phase I, 50-300 patients for phase II and 300-3000 patients for a phase III trial. The cost of enrolling a single patient has also gone up in recent years. As the number of clinical trials being conducted globally is on the rise, the competition for patients has increased sharply.

Not only the trial stage influences the number of patients needed. Clinical trial design and disease indication also contribute heavily to this factor. A novel drug for an orphan disease, where there are no other approved treatments available, will typically enroll between 10-50 patients in a single-arm, open-label trial. On the other hand, a cardiovascular or central nervous system (CNS) disease trial, where the new drug might only provide incremental benefits over other approved drugs, will enroll hundreds or even thousands of patients in a placebo or active-controlled trial to ensure statistical power.

The increasing cost of clinical trials in particular effects early stage biopharmaceutical start-ups in need of external financing to be able to conduct clinical trials for their pipeline drugs. – Rishabh Chawla, V-Bio Ventures

Due to the increase in the number of clinical trials a smaller number of patients are available, driving up the price for patient enrolment by CROs. Once the patients have been enrolled, the cost of the drug itself becomes a factor. The cost of manufacturing enough of a drug for a full clinical trial is very dependent on the type of drug in question: a small molecule inhibitor drug may only cost US$0.5 million to produce, whereas an investigational cell or gene therapy may cost millions.

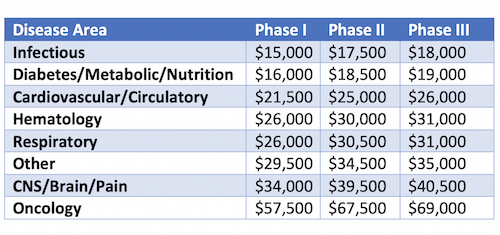

Finally, the average cost of a single patient in a clinical trial differs significantly depending on the type of disease being targeted (Table 1). Certain insidious, slow progressing diseases require longer treatment and follow-up periods compared to other rapidly progressing diseases. Coupled with the use of expensive biomarkers, imaging services/monitoring tools such as computed axial tomography (CAT) and magnetic resonance imaging (MRI) required for some indications, it all adds up to an increased cost per patient.

Table 1: Average cost per patient across different disease indications (Adopted from Biopharmaceutical Industry-Sponsored Clinical Trials: Impact on State Economies; 2015)

Problems for biopharmaceutical start-ups

According to Grand View Research, the cost of conducting clinical trials is rising at an annual rate of 5.7%. At this rate, clinical trials would be costing companies an extraordinary $68.9 billion by 2026. The increasing cost of clinical trials in particular effects early stage biopharmaceutical start-ups in need of external financing to be able to conduct clinical trials for their pipeline drugs.

Partly due to the increased price of clinical trials, we’re seeing larger and larger financing rounds being raised by early stage companies. These increasing financial requirements may result in high-competition among start-ups. They may also drive investors towards relatively lower risk development and clinical programs, which would be a big set-back for innovative drugs and the patients who stand to benefit from them.

Driving the prices down

There are several digital health companies that are currently attempting to use artificial intelligence (AI) to find a solution to the increasing cost of clinical trials. Flatiron Health, acquired by Roche in 2018, has developed a database of electronic and genomic records of millions of cancer patients. The database helps to optimize treatments for newly diagnosed cancer patients, propose changes to clinical trial design and identify new biomarkers.

Pharmaceutical companies, such as Pfizer, Merck and Amgen, have started using an external control arm where the control data is collected either from previous trials or from electronic health records. These innovative approaches help to reduce the number of patients per clinical trial and encourages patients to enroll in clinical trial by eliminating the risk of receiving placebo as against the experimental drug.

Our hope for the next decade is that companies not only focus on the development of novel innovative therapies, but also invest in strategic initiatives to decrease the cost of clinical trials and bring down prices. – Rishabh Chawla, V-Bio Ventures

Another possible route to decreasing trial costs may be accelerating time between clinical trial application and trial site initiation. This could be done by implementing efficient coordination between local ethics committees, trial bureaucracies and sites. The method is already being used in South Korea, where the time to complete trials has been reduced from 117 to 61 days.

Designing patient-centric trials could also help small to medium sized pharmaceutical companies increase patient enrolment. A 2019 study by the FDA revealed that over 70% of Americans are willing to participate in a clinical trial, but only about 5% of adult cancer patients are actually enrolled in a trial program. Increasing patient awareness at potential trials sites, creating better consent and education materials could help increase patient participation.

Despite their high cost, clinical trials are crucial for the development of innovative products that benefit patients. Our hope for the next decade is that companies not only focus on the development of novel innovative therapies, but also invest in strategic initiatives to decrease the cost of clinical trials and bring down prices.

This article was authored by Ward Capoen from V-Bio Ventures.

The American Society of Clinical Oncology (ASCO) just held their annual gathering in Chicago. The event coincided with some interesting new developments in the field of early cancer detection, as well as news of significant new investments in the oncology space.

A lot of advances have been made in treating advanced cancer patients in the past few years. However, it is easy to forget that this multi-billion-dollar segment represents only a small fraction of the actual cancer treatment landscape. About 75% of diagnosed patients first undergo a combination of surgery, radiotherapy and chemotherapy; for many, these treatments lead to remission with no need for further therapy.

In most cases, the headline-grabbing drugs are targeting recurrent or metastatic cancer. However, despite the great strides that have been made in advanced cancer treatments, survival probabilities are still much greater if the tumour is detected early and can be eradicated before it spreads.

With the advent of next-generation sequencing technologies and a better understanding of what drives cancer formation, oncology is trending towards early detection. The goal is to catch the cancer before the disease can get out of control, so as to greatly increase chances for survival.

Catching cancer in the bloodstream

To achieve this early detection, most companies use circulating tumour DNA (ctDNA): DNA that is shed by tumours and appears in the blood where it can be detected using advanced analytical methods.

An added bonus of this technique, albeit a cynical one, is that the total addressable market for the method is huge: there are far more “healthy” people in the world than people already diagnosed with cancer. And if there is one thing big investors like, it’s large addressable markets.

Oncology is trending towards early detection. The goal is to catch the cancer before the disease can get out of control, so as to greatly increase chances for survival. – Ward Capoen, V-Bio Ventures

We already wrote an article last year about Grail, the cancer-detecting unicorn that raised $1.6 billion in venture financing from tech legends Jeff Bezos and Bill Gates, as well as numerous tech and life sciences VCs. Grail’s technology measures changes in methylation on circulating tumour DNA to detect cancers early in their formation. Data show that they can diagnose between 59%-86% of early stage cancers, depending on the tumour type, and can even predict the organ affected.

Another oncology behemoth is Guardant Health: a now public unicorn with a whopping $7.5 billion valuation. This company uses digital sequencing to test up to 500 cancer-related genes using circulating tumour DNA. Their test is currently marketed towards diagnosing advanced cancers, but they are industriously working on tests to monitor cancer survivors. The ultimate aim for Guardant, as with Grail, is being able to test healthy people and detect cancers before they spread.

New kid on the block

You may think the players in this field had already soaked up all the funding, but you’d be wrong: a new company has recently emerged with a meaty $110 million in initial financing. Thrive Early Detection was launched with backing of Third Rock Ventures and friends, including the venture arms of some insurance companies (a sign of things to come in the insurance world perhaps?).

A combination of new insights, datamining and artificial intelligence, and access to next-gen sequencing technology has set the scene…VCs can’t get on the ‘early cancer detection’ bandwagon fast enough. – Ward Capoen, V-Bio Ventures

The company has already shown that their test, called CancerSEEK, is able to find about 70% of early-stage tumours in a select number of cancer types. The test, developed at Johns Hopkins University, uses a machine learning algorithm that combines the detection of mutations in 16 genes with changes in 8 protein markers, to form a predictive signature for early cancers. Thrive is now planning to set up a 10 000-patient prospective study to validate the test.

The powers-that-be have clearly judged that the time is ripe for preventative cancer screening. A combination of new insights, datamining and artificial intelligence, and access to next-gen sequencing technology has set the scene. Coupled with the high human cost of tardy interventions, VCs can’t get on the ‘early cancer detection’ bandwagon fast enough.

Is screening worth the cost?

The potential of early cancer detection is promising, but are we there yet? It is still hard to know, as large prospective studies are still underway, and many questions remain. Currently, the jury’s still out on whether screening for early intervention is actually worth it. Mammography screening for breast cancer and PSA testing for prostate cancer are, at best, marginally effective, and even these results depend on the study and the age of the patient.

There is clearly a race to be the first to take the plunge and ride the biggest wave to success. It is a classic Silicon Valley-style approach, but it has not always worked out well for investors. – Ward Capoen, V-Bio Ventures

Will things be different for this new type of cancer detection? It is hard to say without trial data. Many of the tumours detected using circulating tumour DNA would never have resulted in death anyways, not to mention that a significant number of tumours would also still be missed using this technique (up to 50% in some current tests).

Finally, and perhaps most importantly, if you were to test hundreds of millions of individuals, even with a specificity of 99% (as is the case for CancerSEEK), millions of people would be falsely diagnosed with cancer. The impact of these false diagnoses would of course lead to untold anxiety, overtreatment and mayhem. A complex, multi-parametric health economics study will be required to establish if the benefits of detecting and curing some cancers earlier outweigh the costs of testing the general population.

The ultimate gamble

The business model may be clashing with reality. Silicon Valley investors are funding companies with monster valuations, assuming that the markets are infinite and sales astronomical. If it turns out that it is in fact better to not screen too early (eg. if it is only economical to screen people over a certain age or with certain risk factors), and the market is smaller than expected, these investors stand to lose fortunes.

There is clearly a race to be the first to take the plunge and ride the biggest wave to success. It is a classic Silicon Valley-style approach, but it has not always worked out well for investors (eg. think Uber, Lyft, WeWork, Theranos, etc.). It remains to be seen how this particular gamble will play out. The bets have been placed and the board is set; we will be waiting with bated breath to see how the play resolves.

In this article, V-Bio Ventures introduces one of their portfolio companies, OCTIMET. This Belgian oncology startup just added a new member to its executive team, with the appointment of Shelley Margetson as CEO. It’s exciting times for OCTIMET, who are gearing up for a series B with their sights set on potential partners in China.

By Amy LeBlanc. Image: Shelley Margetson, CEO of OCTIMET.

OCTIMET is a thoroughly Belgian company with international/global ambitions. With new CEO Shelley Margetson in charge, these aspirations look justified for the young oncology company. As Margetson takes on the executive position, founder and former CEO/CSO Tim Perera will now focus on the role of CSO, thereby providing OCTIMET’s management team with the well-rounded and complementary skillset they need for future development.

OCTIMET’s lead compound OMO-1 is a selective MET kinase inhibitor. MET is a popular target for cancer drugs, as the receptor is mutated in a broad range of cancer types including lung cancer. The compound is currently undergoing Phase II clinical trials.

BioVox previously covered OCTIMET’s 11 million series A round.

BioVox spoke to founder and CSO Tim Perera about the company’s history and with new CEO Shelley Margetson about OCTIMET’s future.

Tim, you were one of the founders of OCTIMET back in 2016: why the focus on a small molecule oncology solution?

Tim Perera: OCTIMET is a spin-out from Janssen Pharmaceutica, where I was a drug discovery scientist for many years. This was one of the discovery projects for which I was the Biology team leader. Janssen took the OMO-1 compound into the clinic in a healthy volunteer study which went well, but then for strategic reasons they couldn’t develop it further. So, they were looking to partner it out and supported the founding of OCTIMET to move the compound forward into clinical development.

China is of interest to us for multiple reasons: the prevalence of abnormal MET gene activation is particularly high in Asia; there is a huge patient population with poor access to targeted oncology drugs; and Chinese investors have a lot of money which they are looking to invest in European companies. – Shelley Margetson

Originally, we were a part of the JLINX incubator (now JLABS). For me, this was highly valuable, as I came from a scientific R&D background rather than from business. Founding OCTIMET was a huge learning process for me; JLINX gave me access to training and opened a lot of doors.

One of the first investors I spoke with was actually Christina Takke, who was setting up V-Bio Ventures at the time. VIB, V-Bio Ventures and Fund Plus provided us with seed funding to get the company going and later also co-lead OCTIMET’s series A financing round.

When JLINX transitioned to JLABS last year, we stayed on and became a part of the JLABS community. They’ve given us a different set of added value inputs, including a much bigger network to tap into. This has been a timely transition for us as a company, as we’re now gearing up for a series B financing. Already next month, we’re attending the grand opening of JLABS Shanghai, where we’ll get the chance to meet Chinese investors.

Are you particularly interested in Chinese investment?

Shelley Margetson: China is of interest to us for multiple reasons: the prevalence of abnormal MET gene activation is particularly high in Asia; there is a huge patient population with poor access to targeted oncology drugs; and Chinese investors have a lot of money which they are looking to invest in European companies.

People were initially quite wary of Chinese investors, but I think that has started to normalize. Companies are starting to take Chinese investors seriously. Having a syndicate including Chinese investors would be very beneficial to us, especially because we want to bring our therapy to Chinese patients.

My background is in finance and business, but I love the innovation and the dynamic nature of the biotech industry. I’ve worked in several different European countries: France, The UK and The Netherlands. I’ve circled Belgium and finally hit the bullseye! – Shelley Margetson

You mentioned the Chinese have a higher incidence of MET kinase; is that a naturally occurring population difference?

Tim Perera: Lung cancer is known to be a disease related to environmental factors such as smoking and air pollution. Over time, many Chinese have unfortunately been exposed to high levels of air pollution and the incidence of smoking in China is also very high. Lung cancer is therefore a large and growing problem in China.

The sub-types of cancer prevalent in China is also slightly different to that found in a lot of Western countries: it’s not entirely clear why, but a lot of non-smoking Asian women develop lung cancer. It has been suggested that this may be related to exposure to the toxins released due to the cooking styles more common in China. Mutations in the MET kinase seems to be playing a role there, making our compound highly relevant as a potential therapy.

So, when you’re looking to China, it’s not just for investment but also towards an unmet need?

Shelley Margetson: Absolutely. What we’re aiming for is a parallel trajectory with both VCs and partnering opportunities. We’re not insisting on following this preconceived path though: we will also be talking to multiple people in the US, Europe and Asia.

We’re really excited to have Shelley on board and take advantage of her experience and skills to push the company forwards. – Tim Perera

How are things going to change for OCTIMET, now that Shelley has joined the team?

Shelley Margetson: My background is in finance and business, but I love the innovation and the dynamic nature of the biotech industry. I’ve worked in several different European countries: France, The UK and The Netherlands. I’ve circled Belgium and finally hit the bullseye!

OCTIMET really pushes all the buttons: it has great science, connections to Janssen Pharmaceutica, and a really solid data package for further development of OMO-1. We have Tim as CSO, an extremely knowledgeable scientist, and our clinical team including CMO Glen Clack and COO Annegret Van der Aa have a lot of experience. With my experience in business and finance, we now have a full complement of skills as a management team.

Was this a very conscious choice for OCTIMET, to expand and hone the skillset of the leadership team?

Tim Perera: Indeed, Shelley complements the team very well! I am a discovery scientist at heart; that is what drives me. I am fortunate to have learned a lot when setting up OCTIMET but business is still not my area of expertise. The opportunity to go back to the science, which is getting very exciting, is too much of a draw for me personally.

We’re really excited to have Shelley on board and take advantage of her experience and skills to push the company forwards. Raising new funds will also allow us to valorize our asset into multiple indications. We think this compound really has the potential to impact a lot of patients in a lot of different areas. It’s a very exciting time for us and we’re really looking forward to the future!

When it comes to food, our key sources of nutrition haven’t changed much in the last ten thousand years. Though hyped-up food trends and diets come and go, our ancestors established the status quo for our primary protein sources a long time ago: animal products, like dairy, eggs and meat, have been the staples ever since we switched from hunters to farmers. However, with rising global populations driving sky-high demand for animal products, is it time for another food revolution?

The industrialization of food production over the last century gave rise to a livestock industry that is rapidly approaching a crisis. Breaking-point sustainability issues include greenhouse gas emissions, huge land and water requirements as well as ethical concerns about animal welfare.

Nevertheless, our appetite for animal protein keeps on rising. This increase in demand is driven not only by population growth but is also exacerbated by the new trend towards a diet high in fat and protein but low in carbohydrates (so-called keto diet), eliminating “sugars” contained in bread, pasta, rice, fruits and potatoes from the daily meal plan in favour of meat, dairy, eggs and selected vegetables.

With rocketing demand for animal products coinciding with a looming environmental crisis, we are forced to rethink how we are sourcing our ingredients. How can we obtain protein in sufficiently large amounts to feed the ravenous masses and in a sustainable manner? This question may lead to an overhaul of human protein consumption as we know it. However, scientists, investors and companies around the world are already working on new ways to still the protein hunger.

Eliminating cattle, poultry and fish as our primary protein sources is no small matter: the meat industry is a $90bn mammoth network of producers, processors and middlemen.

Manufactured meat

One alternative to classically-sourced animal protein is what’s referred to as cultured meat. In essence, “clean meat” products (or “cultured tissue”, as opponents like to label it) are actually composed of animal proteins, but the meat has been grown outside of an animal. The cultured meat is made of muscle cells, obtained from a small sample taken from a living animal, that are then grown in vitro: essentially, the cells are bathed in a highly nutritious serum, given scaffolding and exercise and encouraged to reproduce and grow into muscle-like fibres. The resulting “meat” is then harvested and processed into meatballs or even steaks.

Image: The world’s first cultured hamburger, eaten 5 August 2013. The cultured meat product was developed by a team of scientists from Maastricht University led by Mark Post (World Economic Forum, wikimedia).

While the first burger developed using this method came with the hefty price tag of €250.0000, a couple of companies (like Dutch Mosa Meat, US Memphis Meats, London´s Higher Steaks or Israel’s Aleph Farm) are eager to make the technology cost-effective. These companies are currently attempting to create products that are a viable and affordable alternative to traditional meat. Several companies, including Israel’s SuperMeat, want to take this method one step further: they aim to decentralize meat production so that your cultured meat could be grown on-site in shops, restaurants or even at home. The method isn’t just for burgers either: US Wild Type and Finless Foods are using the cultured meat method to grow seafood substitutes. Other companies are using similar methods to grow mass-produced ingredients like milk and egg whites for large-scale industrial applications.

With rocketing demand for animal products coinciding with a looming environmental crisis, we are forced to rethink how we are sourcing our ingredients.

While this new form of protein production might on first sight tick a lot of boxes with the environmental impact and ethical concerns, there are still some significant challenges to overcome. In addition to the necessary cost reduction, growing these cells still relies on huge amounts of animal serum. Food safety is also a potential concern: protecting the cultures requires significant amounts of antibiotics, which continues the enormously problematic use of antibiotics in the livestock industry. Thus, this method still has a long way to go before we’re manufacturing our own steaks in the kitchen pantry.

Plant-based proteins

Plants present us with another alternative source of protein. Plant-based products, made to imitate meat, dairy and egg, are already flying off supermarket shelves all around the world. With many vegans and vegetarians choosing these alternatives on a daily basis, sales for plant-based milk, cheese, mayonnaise and meat are booming. The products are becoming increasingly popular with omnivores as well. Many companies have dedicated themselves exclusively to these animal-product alternatives: e.g. Perfect Day (US), Soylent (US), Huel (UK), Ripple Foods (US) and Kite Hill (US).

Worldwide, investors are betting on these new methods of protein production; the first few products are already on the shelves and on our plates.

Again, investors are paying attention to consumer trends. California´s Impossible Foods, responsible for the “Impossible burger” currently confounding Burger King customers, raised $114m in April last year, bringing their total funding to over $400m. Other competitors in the space, like Beyond Meat (US), Good Catch (US) or New Wave Foods (US), have also obtained significant funding to develop and commercialize meat and seafood alternatives based on proteins derived from peas, beans and even algae.

Although these plant-based products might indeed meet our need for protein, the trick to consumer satisfaction will be to give them the right taste, texture and appearance. In other words: making them taste like the “real” thing. Currently, matching the amino acid and nutrient profile of meat requires significant processing and modification with flavours, colours and food additives which is not exactly in line with the pure nature image suggested by the labels. Still, as popularity increases the prices are dropping and sales are at an all-time high.

Bug burgers

Along with plant-based alternatives and cultured meat, the third new protein pillar could be derived from bugs. While entomophagy (insect consumption) is common in more than 110 countries worldwide, caterpillars, mealworms and crickets are, so far, not common additions to a Western diet.

Even so, high-tech, automated insect factories are popping up all over the globe and insects have the potential to become a major source of human nutrition. Compared to other protein sources, insects offer several significant advantages: they have short generation cycles, produce rapidly, are low cost to raise while being high in fat, protein and micronutrients.

How can we obtain protein in sufficiently large amounts to feed the ravenous masses and in a sustainable manner?

Under European “Novel Food” regulations, crickets, grasshoppers and mealworms can currently only be sold as whole organism (under the label “traditional foods from a third country”). Mealworm flour and other processed bug products need to undergo a 1.5-year regulatory procedure before they can be sold in the EU, which is a barrier to market entry for a lot for start-ups. Still, companies like Ynsect are finding the funds to make it work: the French company recently closed a Series C round of € 110M, the largest round ever for agriculture technology outside of the US. They are currently focusing on providing protein-rich feed for fish farming, pet food and even fertilizer. It might still take a while until insect flour will also be available in European supermarkets, but the change is coming.

Altered appetites

The paradigm shift required to move away from unsustainable practices is enormous. Eliminating cattle, poultry and fish as our primary protein sources is no small matter: the meat industry is a $90bn mammoth network of producers, processors and middlemen. The logistics needed to change this system are daunting.

Nonetheless, worldwide, investors are betting on these new methods of protein production; the first few products are already on the shelves and on our plates. The list of investors contributing funding animal-free protein products is extensive: top VCs like Khosla Ventures, Kleiner Perkins, Google Ventures, Draper Fisher Jurvetson; wealthy individuals including Bill Gates and Richard Branson; food tycoons like Cargill and Tyson Food. The monetary support for this market shift is there.

While this new investment segment has some serious tailwind, there are still significant technical challenges before any of these three alternative protein sources become serious staples of our diet. However, the biggest decider, and the biggest unknown variable in the equation, is the consumer. While many customers are willing to try one of these new protein resources, a recent European survey found that almost 75% of respondents wouldn’t consider eating either an insect, seaweed, algae or lab-grown burger on a regular basis.

We will simply have to wait and see if attitudes towards cultured meat, plant-based patties and insect meal alter over time. It is the consumer who holds the key to success. Whether we’re happy to switch from animal meat to alternative proteins in the long-term is the billion-dollar question. The race is on.

Companies with a good gender balance consistently outperform those with only men in their management teams. Yet despite this, start-ups with female founders and management team members are consistently underfunded compared to all male companies. Could it be that the gender gap in funding has its roots in the gender disparity in the financing firms themselves?

When investing in science-driven companies, identifying promising risk reward profiles is only half of the decision-making process. Though identifying and analysing promising investment opportunities is important, the decision to fund a specific company is often ultimately based on a gut feeling. This gut feeling is largely rooted in a feeling of trust.

There are three different company characteristics where trust plays a crucial role for a potential investor:

Investment professionals can use a variety of tools to evaluate these three different categories. To assess the underlying science, investors can check the data points, ensure the experimental setup is sound, check whether the right controls and most predictive models have been used, etc. For the market, one can look into past developments and try to extrapolate what the future will bring. But to evaluate a management team, especially in start-up companies with first time CEOs/CSOs, decisions are usually subjective and based on instinct.

Failing to fund females

Venture capital funds try to base their investments on informed decision-making: thorough analyses backed by statistically sound assumptions. There is however an important factor that often gets overlooked by investment managers: the impact of gender diversity on the performance of start-up companies. Companies with both men and women in their management teams simply do better than those with only one gender.

Judging by the figures, investors seem to have missed the memo on the benefits of gender diversity. In an article published just last year, Eva de Mol and Janneke Niessen analysed 40 investment funds, from 2010-2018, and evaluated the gender composition of management teams from the start-up companies that received funding. Their results were shocking: only 6.8% of the companies backed by investors were headed by mixed-gender teams. Companies with female-only teams raised a measly 1.6% of the total capital; the overwhelming majority of the funding went to male-only start-ups. This bias cannot be explained by the lack of women in management positions alone: although the gender composition of management teams is imbalanced, according to a study by MassBio women still account for close to 25% of C-level positions in life sciences companies.

Companies with both men and women in their management teams simply do better than those with only one gender.

The results of this study should be alarming to investors. There is a rapidly growing body of evidence showing that businesses with more women in leadership roles outperform male-dominated companies. A BCG analysis, published in May 2018 in collaboration with MassChallenge (a US-based global network of accelerators offering start-up companies access to mentors, industry experts and other resources), revealed that businesses with women in the founding team generate twice as much revenue per dollar invested compared to exclusively male-led ventures.

According to PitchBook Data, companies with female founders only received 2.2% of the Venture Capital raised across all sectors and geographies between 2016 and 2018. Furthermore, female-founded companies only receive half the amount of capital as compared to that raised by male-led counterparts. As with the C-level management, this percentage is not based on the lower number of female-founded companies looking to raise money: in the MassChallenge-accelerated companies, 42% had at least one female founder. Clearly, all these observations consistently point to a biased decision making, so this begs the question: what is causing it?

An issue of trust

The gender disparity in funding can’t be explained by the underrepresentation of women in management and founder positions. It also doesn’t make sound financial sense. Could it be that the subjective choices taking place when investors evaluate a new company are somehow skewing the funding in favour of men? Is the gender of the investors themselves affecting investment decisions?

Businesses with women in the founding team generate twice as much revenue per dollar invested compared to exclusively male-led ventures.

To put things in context, according to CrunchBase, a full 92% of partners in the biggest US VC firms are men. In the EU, these numbers may be slightly better, but nevertheless there is no escaping the fact that most investment pitches are evaluated by men. This may be at the root of the problem.

People like to finance people they resemble and understand; familiarity builds trust, and as we discussed in the opening of this article, the instinctive trust in management team members is a huge factor in the decision to fund a company. It could be that we are caught in a loop of men funding men, despite the numbers telling us that diversity is better for business.

Bleak though it may seem, there is opportunity hiding in this tangled web of inequality. By uncovering a potential reason for the gender gap in funding, we bring to light a potential solution: if we address the gender imbalance in the investment industry, we may also inadvertently rectify the underfunding of female-fronted companies.

On a final, uplifting note: it’s important to remember that things are already moving in the right direction. The Labiotech.eu lists ‘Women Leading in European Biotech’ and ‘Women Entrepreneurs in EU Biotech’ are both continuously expanding! And authoring this article is a female Managing Partner of a life sciences investment firm; we just need to keep the ball rolling!

Sources:

How diverse leadership teams boost Innovation BCG January 2018

Why Woman owned start-ups are a better bet, BCG May 2018

Page 1, 27-09-2018 © Het Financieele Dagblad

This article was authored by Rishabh Chawla from V-Bio Ventures.

Having finished a PhD in life sciences can often leave you wondering: what’s next? The classic question is often “academia or industry?”, with a lot of preconceptions made about both career paths. In this vc-views article, I’ve drawn on both my personal experience, having made the transition from PhD student to industry member recently, as well as recent publications about the pros and cons of working in academia and industry.

The last few miles on the path to a PhD in the life sciences are often paved with anxiety for the future. You think: “Sure, it was fun at times, but was it worth all the effort and sacrifice? What if I hadn’t lost so much time stubbornly completing that experiment that never worked out? Is this really what I want to keep doing in the long term?”

Bleak prospects for PhD graduates?

These kinds of introspections are illustrated in a paper published just last year in Nature Biotechnology. The study, titled ‘Evidence for a mental health crisis in graduate education’, showed how the pressure in academia has resulted in “strikingly high rates of anxiety and depression” amongst graduate students (Evans et al. 2018).

Exacerbating the stress are overwhelmingly poor odds when it comes to academic employment opportunities for graduating PhD students. The number of PhD students in biological sciences has increased by 83% over the past 10 years, yet current graduates have only a 12.8% chance to attain academic positions in the USA (Larson et al. 2013).

With the odds stacked against them, many are starting to consider positions in industry. However, PhD students often doubt their ability to obtain an industry position due to undervaluing their own skills and knowledge. This perception is exacerbated by a lack of support from peers and supervisors, who often portray industry as “the dark side” of research.

Academia and Industry: not so different after all

For the sake of student sanity, we must all remind ourselves that the similarities between academia and industry outweigh the differences. Though the mindset and training may differ, the science and quality of research remains the same. Where academia focuses on novel discoveries and high impact publications, research in the life sciences industry focuses on the market need.

There are of course some basic differences in how research is conducted. The pace is much faster in industry, as there are often many people relying on your work to move forward with their own. In an academic system you are often more isolated, responsible only for your own project. This means that, contrary to the general perception of secrecy, there is often more teamwork in industry than in academia.

PhD skills are key to industry success

As I’ve mentioned, most PhDs perceive the world outside of academia as alien and unpromising. Having spent their science career to-date within the confines of academia, they often believe their PhD degree and academic training wouldn’t hold any value in the life science industry. The reality is that PhD graduates are highly sought after in the life science industry due to their knowledge and comprehensive understanding of how to conduct good quality research. Moreover, upon graduation PhD students end up possessing a range of desirable skills, including:

1) Persistence: To earn a PhD, all graduate students need to work through a project from start to finish, making them very persistent and focused on the end goal.

2) Versatility: In the life science industry it is important for team members to be flexible. Often a novel approach or a change in strategy is needed, requiring you to let go your old ideas and come up with a new plan of attack. It is all about resilience, being able to recover from a setback, something every PhD student has to learn during their graduate research project.

3) Problem solving/Analytical capabilities: If a PhD could be summarised in two lines, they may well be: ‘the ability to identify the problem and find the best possible solution, while analysing all the available data’. The life sciences industry needs people trained in identifying potential roadblocks and providing innovative solutions.

4) Effective communication: During their graduate studies, PhD students have to develop a range of communication skills. From scientific writing for peer-reviewed journals, to presenting their complex experiments in a concise manner at international conferences and group meetings, these different tasks all helps them hone their ability to communicate, which is a key component of success in a business environment.

Setting yourself up for a smooth transition

PhD graduates who want to transition to a job in the life science industry need to be proactive. To initiate such a move, they need to first make an informed decision about the right direction for them, personally. Some steps I would suggest you consider, before taking the plunge, include:

1) Do your homework: University career services and job fairs are great places to understand the skill sets required for different job opportunities and to think about your likes and dislikes before trying to identify what’s a good fit for you.

2) Network: Identify professionals in different fields and contact them to understand about their work. You can find people easily through either your personal network or LinkedIn, but it is important to bear in mind that you are only approaching them to learn about their work (not for an actual position or job). This is useful for learning first-hand about a person’s views on industry, especially if they have also transitioned from academia to industry, and to check whether it might be appealing to you. It can also provide you with information as to which required skills and experience you might be lacking.

3) Take a course: Taking online courses, eg. on websites such as Coursera, can be a great way to learn more about the life science industry while simultaneously improving your professional skills and learning about different subjects such as finance, economics or communications.

4) Complete an internship: Internships are great opportunities to break into a field and learn about it at an accelerated pace. You can do multiple internships in different fields to help you make an informed decision about your professional future.

5) Participate in rotational programs: Many companies such as Merck, Novartis etc. provide PhD graduates with the opportunity to enrol in two-year rotational programs. Throughout the programs, participants work in different departments and get to learn how a pharmaceutical company functions, as a whole. This can be extremely useful for graduates who are still undecided about their career path.

For all PhD students and soon to be graduates, there are so many opportunities in the life sciences industry. Business development, equity research, consulting, venture capital, medical science liaison; the list goes on! So, get out of the lab and go exploring. Your next big adventure might just be on the light side, in the life sciences industry!

References

Evans TM, Bira L, Gastelum JB, Weiss LT, Vanderford NL. Evidence for a mental health crisis in graduate education. Nat Biotechnol. 2018 Mar 6;36(3):282-284 doi: 10.1038/nbt.4089. PubMed PMID: 29509732.

Larson RC, Ghaffarzadegan N, Xue Y. Too Many PhD Graduates or Too Few Academic Job Openings: The Basic Reproductive Number R(0) in Academia. Syst Res Behav Sci. 2014 Nov-Dec;31(6):745-750. PubMed PMID: 25642132

This article was authored by Ward Capoen from V-Bio Ventures.

November is classically the month where immunotherapy takes center stage, especially at the annual conference of the Society for Immunotherapy of Cancer (SITC, endearingly pronounced sitsie). Immunotherapy is a very active domain and given the recent activity in the field and the emergence of many novel targets, it should come as no surprise that some new targets are losing their luster. The bad news from IDO inhibitors together with poor activity with STING agonists, CSF1R antagonists and some cytokines, have deflated the field dramatically. It turns out that beating a standard chemotherapy-PD1 combination is not as easy as once was expected.

After this string of let-downs, is oncology still the hottest area in biotech? Are investments in the space still going strong? The answer seems to be a resounding yes. A recent paper in Nature Drug Discovery prompted the investment bank UBS to analyze the competitive landscape in oncology. UBS found that, out of the 4700 investigational drugs currently in the clinic worldwide, about 500 drugs will get approved in the coming 10 years (based on historical probabilities of success). A full 40% of these are cancer drugs, which is of course great news for cancer patients: of the 15 indications represented, 11 are oncology-based, with an estimated 47 new drugs just for breast cancer and 45 drugs for lung cancer alone over the next 10 years.

Competition is heating up

Although this high number of oncology drugs will benefit patients, the sheer number of new drugs has the downside that it will make it increasingly tougher for companies and investors to turn a profit. New oncology drugs will have a hard time making money in such a crowded environment and the life cycle of a drug will be significantly shorter than before, likely making patent expiration dates much less relevant than before.

Despite the above early stage investing in oncology is still strong. Biotech expert Linda Pullan, of Pullan Consulting, analyzed data on 5000 Venture Capital financing rounds from 2015 to 2018. She found that 25% of these rounds were focused on oncology, with 25% of those being specifically for immuno-oncology, representing a huge proportion of total investments.

In-house work at V-Bio Ventures focused on the recent investing behavior of top VC funds. For VCs with more than 5 Seed or Series A investments in life science companies in the period 2016-2018 – a proxy for the top VC funds currently most active in life sciences – the concentration of oncology investments is even more striking than in Pullan’s findings. Of 211 newly formed biotech companies, 40% were active in oncology, with 56% of these in immune-oncology. This shows that most of the recent ‘smart money’ investments are still heavily biased towards (immuno)oncology.

The landscape is constantly changing

What does this overwhelming trend towards oncology actually mean for the outlook of different cancer drugs? The answer to that seems to depend on each specific indication: tumor indications that are quite large, and can be divided into subsets, will naturally fare better than small, homogenous cancer populations. Lung cancer can be grouped by stage, driver mutation and line of treatment, so individual drugs addressing very specific mutations or mechanisms of resistance may find niches that are large enough to be commercially viable.

However, UBS found that for drugs approved for small indications, like acute lymphoblastic leukemia or multiple myeloma, there are only about 500 to 1000 patients per year, per drug. Even with astronomical pricing, these numbers would still not present a viable scenario for sustainable drug development.

It will be interesting to see how the drug development and investment landscape evolves over time beyond the oncology field. Looking at V-Bio Ventures’ top VC dataset, it is interesting to note that drugs for the central nervous system (CNS) are having a renaissance moment, with already 14% of the early stage investments being in this area. Five years ago, nobody would have thought that CNS would become a significant playground of small biotechs again, so there is hope that indications other than oncology will start to make a comeback.